The automotive industry is undergoing a seismic shift as traditional automakers seek new avenues to drive growth beyond merely building and selling gas-powered cars. At the center of this transformation stands Mary Barra, the longtime CEO and chair of General Motors, who has steered the company through a period of rapid technological change and strategic recalibration. Barra is pushing to double GM’s revenues by the end of the decade, while positioning the company to lead in electric vehicle sales, expand software-based services, and commercialize autonomous driving technology through its Cruise subsidiary. The journey to achieve these ambitious goals has been uneven, marked by setbacks and recalibrations, yet Barra remains steadfast in steering GM toward a broader, software- and technology-driven future. This broader context helps frame why GM’s leadership is repeatedly placed at the nexus of conversations about how legacy carmakers can reinvent themselves in a software-defined era.

GM’s Transformation Under Mary Barra

Mary Barra’s tenure at GM has become a defining thread in the company’s strategic arc as it seeks to redefine what it means to be a modern, technology-enabled automaker. Since assuming the top leadership role a decade ago, Barra has pursued a comprehensive overhaul of GM’s business model, aiming to diversify revenue streams beyond the traditional model of selling internal combustion engine vehicles and related hardware. This transformation encompasses not only product development but also organizational culture, investment strategies, and an accelerated push into software, services, and mobility platforms. The overarching objective is to reimagine GM as a company whose value derives from a portfolio of mobility solutions, data-driven services, and scalable technology platforms in addition to vehicle sales.

In setting audacious revenue targets, Barra has framed GM’s trajectory around three interlocking pillars: first, to lead the market in electric vehicle adoption and sales, thereby reshaping consumer perception and demand; second, to develop and monetize software-based services that connect vehicles, customers, and ecosystems in ways that generate recurring revenue; and third, to advance autonomous driving technology, leveraging Cruise as the strategic vehicle for testing, refining, and ultimately commercializing autonomous capabilities. These pillars reflect a nuanced strategy: GM seeks to move from being primarily a hardware manufacturer to becoming a software-enabled, data-centric platform company that can generate value across multiple touchpoints in a customer’s lifecycle. The emphasis on Cruise as a subsidiary underscores the importance GM attaches to controlled development paths for autonomy, enabling tighter integration with GM’s manufacturing, support, and customer networks while also providing a shield against the unpredictability of external partnerships.

The path to these goals has not been without obstacles. Barra has acknowledged that the road to transformation is “bumpy,” signaling that the company has faced, and will continue to face, technical, financial, and regulatory hurdles as it shifts capital toward new capabilities. This realism is central to her leadership style: a willingness to chart ambitious objectives while recognizing the complexity of executing them within a legacy corporate structure. The balance between sustaining traditional operations and investing in next-generation technology requires careful capital allocation, risk management, and organizational alignment. Barra’s approach to governance—ensuring clear accountability, disciplined execution, and a strong focus on long-term value creation—remains a core driver of GM’s ongoing effort to reinvent itself. At its essence, the transformation seeks to maintain GM’s competitive viability in a period when consumer preferences are increasingly shaped by electric drivetrains, connected software, and autonomous mobility options.

The leadership narrative around Barra also emphasizes talent acquisition and the cultivation of internal capabilities as critical components of GM’s reinvention. The company’s strategy hinges on attracting and retaining engineers, software developers, data scientists, and product professionals who can help GM develop, integrate, and scale new technologies. The challenge, of course, is to build these capabilities at scale across a global manufacturing and distribution network, while maintaining quality, safety, and regulatory compliance. Barra’s emphasis on talent underscores a broader industry trend: the most significant competitive differentiator in the modern auto industry is the ability to innovate quickly, adopt new software architectures, and deliver seamless customer experiences. In this context, GM’s culture and workforce strategy become as important as physical plant capacity and traditional supply chain metrics. The leadership narrative thus intertwines vision with execution, aspiration with discipline, and technology with human capital.

In summary, Barra’s stewardship signals a deliberate shift from a historic emphasis on volume and manufacturing efficiency toward a more diversified, technology- and software-driven business model. The arc of GM’s transformation—built around leadership, strategic focus on EVs, software services, and autonomous vehicle development via Cruise—reflects a broader ambition to redefine what a traditional automaker can be in a digital economy. The ongoing effort places Barra at the center of a debate about how legacy carmakers can modernize their operations, cultivate new revenue streams, and sustain long-term growth in a rapidly changing market landscape.

Strategic Pillars: EVs, Software, and Autonomous Vehicles via Cruise

GM’s strategic blueprint rests on three interlocking pillars intended to reshape the company’s revenue streams and market position: leadership in electric vehicles, the monetization of software-driven services, and the commercialization of autonomous driving technology through Cruise. Each pillar is designed to reinforce the others, creating a cohesive ecosystem in which vehicles serve as platforms for software, data, and mobility services rather than standalone hardware products. The following sections unpack these pillars and the rationale behind them, illustrating how GM intends to align its investments, partnerships, and internal capabilities to achieve sustained growth.

First, leadership in electric vehicles is a central priority for GM. The company views EV leadership not only as a means to capture share in a rapidly expanding segment but also as a pathway to build a scalable, software-enabled operating model. By prioritizing the development of electric drivetrains, battery technology, charging infrastructure partnerships, and consumer-focused EV experiences, GM aims to create differentiation through efficiency, range, affordability, and reliability. The vision extends beyond model range and charging speed to encompass lifecycle considerations such as vehicle longevity, over-the-air software updates, and integrated energy solutions. This multi-faceted approach is designed to position GM at the forefront of the transition away from fossil-fuel-powered mobility, capitalizing on the anticipated growth in demand for clean, electric transportation across global markets. It also reflects an understanding that EVs are a gateway to broader software-enabled capabilities that can be monetized over the vehicle’s lifecycle.

Second, GM’s strategy emphasizes software-based services as a major catalyst for recurring revenue and customer engagement. The shift toward software services encompasses connected-car features, data-driven services, subscription offerings, and value-added experiences that extend far beyond the initial vehicle sale. By creating a software-defined vehicle experience, GM can continuously evolve its products, deliver new functionalities, and build a database of customer interactions and vehicle telemetry. This, in turn, opens opportunities for monetization through subscriptions, premium features, and partnerships with content, navigation, and mobility providers. The software focus also facilitates tighter integration with GM’s autonomous initiatives, enabling features and updates that improve performance, safety, and user experience. In essence, software becomes the backbone of ongoing value creation, transforming GM from a one-time hardware seller into a long-term services platform.

Third, autonomous vehicle technology via Cruise represents a strategic bet on a future where automated mobility can be scaled in a controlled, safe, and commercially viable manner. Cruise, as GM’s autonomous-vehicle subsidiary, serves as the key engine for testing, refining, and deploying self-driving capabilities at scale. The company’s approach involves rigorous safety protocols, sophisticated perception and decision-making systems, and a business model that leverages autonomy to unlock new mobility services, logistics solutions, and potential service-based revenue streams. The Cruise initiative is positioned to integrate with GM’s broader ecosystem, leveraging GM’s manufacturing expertise, supply chain resilience, dealer network, and service infrastructure. The envisioned outcomes include not only passenger transport but also autonomous delivery and freight operations, expanding GM’s addressable market and creating new partnerships across industries that benefit from autonomous mobility solutions. This pillar underscores GM’s belief that autonomy will be a transformative capability, enabling safer roads, improved fleet efficiency, and new forms of customer value.

The synergy among these pillars is a critical element of GM’s strategy. Electric vehicles provide the platform for software integration and data generation, which in turn fuels the development of services and autonomous capabilities. The monetization of software and services supports the economics of EVs and automation by providing recurring revenue streams that complement traditional vehicle sales. Autonomous technology, instantiated through Cruise, offers the potential for scalable mobility and logistics solutions, further reinforcing the value proposition of an integrated GM ecosystem. Together, these pillars illustrate a deliberate, cohesive attempt to shift GM from a historical emphasis on manufacturing volume toward a broader, software-enabled business model that can adapt to changing consumer preferences and regulatory landscapes. Barra’s leadership is central to aligning cross-functional teams, allocating capital to the most strategic bets, and maintaining a long-term perspective amid market fluctuations. The ambition to double GM’s revenues by the end of the decade, reinforced by a relentless focus on EVs, software, and autonomy, reflects a vision of a modern automaker that transcends traditional industry boundaries while leveraging its scale, resources, and brand strength.

In operational terms, GM has pursued several tactics to advance these pillars. The company has accelerated investments in battery technology, built out charging infrastructure partnerships, and expanded its EV lineup to broaden appeal across market segments. On the software front, GM has emphasized the integration of over-the-air updates, data analytics capabilities, and a more robust software development culture within its product teams. The aim is to deliver feature-rich experiences that keep customers engaged and willing to subscribe to recurring services. For autonomy, Cruise has focused on rigorous safety testing, advanced sensor suites, and simulation-driven development to reduce real-world risk while expanding the scope of pilot programs and commercial prospects. The combined effect of these tactics is intended to create a virtuous cycle: more EV adoption increases data generation and software monetization opportunities, which in turn funds more advanced autonomous testing and scaling, ultimately driving higher revenue growth and market leadership.

In addition to these pillars, GM’s strategy includes strategic talent development and selective investments, including possible acquisitions where they align with core goals. The company’s approach to talent acquisition is designed to bring in top-tier engineers and software specialists who can accelerate product development, integration, and customer experience improvements. Investment activity is guided by a disciplined framework that weighs profitability, risk, and strategic fit, with Cruise representing a core capability that can be scaled and integrated across GM’s operational footprint. The broader implication is that GM aims to create a resilient, diversified revenue model that leverages the strengths of its manufacturing heritage while embracing the software-driven dynamics of modern mobility ecosystems. The strategic architecture is therefore not a single initiative but an integrated program that seeks to harmonize product development, customer value, and capital allocation in service of a long-term growth trajectory.

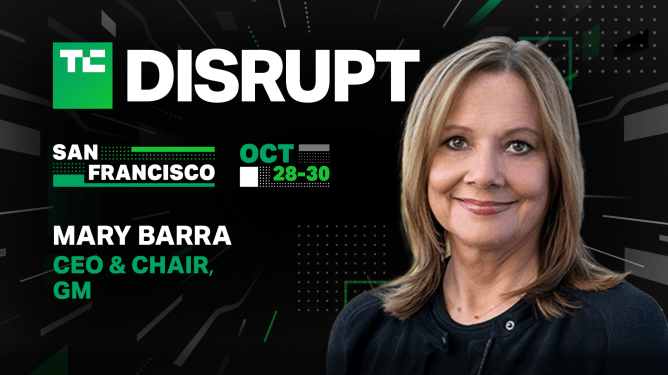

TechCrunch Disrupt 2024: A Platform to Spotlight GM’s Strategy

TechCrunch Disrupt 2024 presents a public-facing stage for GM’s strategic transformation, offering a platform to discuss how a legacy automaker navigates disruptive technologies and evolving market expectations. The event, hosted in San Francisco’s Moscone Center from late October, functions as a convergence point for the startup ecosystem and the broader technology community — a focal point where investors, founders, engineers, and designers exchange ideas, forge partnerships, and potentially launch new products. Against this backdrop, GM’s leadership and strategy take on a refreshed public profile as Barra participates in discussions that illuminate how GM intends to attract talent, structure investments, and pursue strategic opportunities in a landscape defined by electric propulsion, software-defined vehicles, and autonomous mobility.

Barra’s onstage role at Disrupt is framed as a real-world examination of the highs and lows of transforming a legacy automaker into a software- and technology-driven enterprise. The dialogue is positioned to cover a spectrum of themes: the organizational changes necessary to move from traditional manufacturing to a data- and software-centric model, the pathways through which GM plans to become a leader in EVs and software services, and the company’s approach to accelerating autonomous vehicle development through Cruise. The event is described as an ideal setting to unpack how GM seeks out talent and what the company’s approach to investing and potential acquisitions looks like in practice, including ongoing work with Cruise. This framing highlights the broader narrative of GM’s evolution, illustrating how a traditional carmaker is reimagining its core value proposition and exploring new growth mechanics in a rapidly changing industry.

The Disrupt platform functions as a lens through which observers can assess the practicality and ambition of GM’s strategy. It offers a rare opportunity to hear directly from leaders who oversee the company’s major strategic bets, including how GM plans to scale EV adoption, monetize software-enabled features, and deploy autonomous capabilities at enterprise scale. The event’s ecosystem fosters dialogue about talent strategies, corporate venture activity, and the potential for startup partnerships or acquisitions that complement GM’s core objectives. By providing a venue for this exchange, Disrupt contributes to a broader conversation about how legacy automakers align with the expectations of tech-driven stakeholders, including investors seeking durable growth, engineers pursuing cutting-edge challenges, and business leaders evaluating long-term profitability in a market that is increasingly defined by software and autonomy rather than conventional hardware alone.

In this sense, the GM narrative at TechCrunch Disrupt 2024 does more than celebrate a company’s ambition; it demonstrates how a traditional automaker is attempting to translate a software- and data-oriented strategy into tangible outcomes. The event context reinforces the message that GM’s leadership sees talent acquisition, disciplined investment, and strategic partnerships as essential levers for progress. It reinforces the idea that the company’s future will be shaped by its capacity to integrate EVs, software services, and autonomous technology into a cohesive ecosystem that delivers consistent value to customers and stakeholders. The Disrupt platform thus functions as both a showcase and a test bed for GM’s approach to reinventing a legacy business in an era where the pace of innovation demands continual reinvention and a willingness to adopt new paradigms in product development, go-to-market strategies, and operational execution.

Industry observers will watch not only for the specifics of GM’s strategic plans but also for the signals about the company’s willingness to engage beyond traditional automotive boundaries. The discussion around talent, investment, and startup partnerships — including those related to Cruise and other mobility initiatives — is likely to shape perceptions of GM’s long-term readiness to compete in a software- and data-rich mobility economy. The Disrupt setting underscores the importance of a holistic approach that integrates engineering excellence, customer-centric product design, and a strategic capital allocation framework capable of supporting ambitious growth objectives. By positioning Barra as a key voice in this dialogue, GM signals that it intends to play a central role in shaping the next era of transportation, one in which vehicles are increasingly connected, software-defined, and capable of delivering new and recurring value to consumers and enterprise customers alike.

The broader takeaway from the Disrupt context is that GM’s transformation is not merely a product strategy but a company-wide evolution that requires alignment across engineering, manufacturing, software, data analytics, and strategic partnerships. The event highlights how a legacy automaker seeks to redefine its identity while navigating a landscape shaped by electrification mandates, regulatory considerations, and the rise of autonomous technologies. For stakeholders, Disrupt offers a window into how GM is thinking about the future of mobility, how it plans to scale its core pillars, and how it intends to sustain growth by integrating the hardware strengths of traditional automotive manufacturing with the software and services capabilities demanded by a changing market. The conversation about talent, investment approach, and potential acquisitions such as Cruise codifies a practical, forward-looking blueprint for why steering GM toward a software-first, platform-centric model matters in the broader quest to remain competitive in a volatile, innovation-driven era.

Industry Context: The Broader EV and Autonomy Landscape

The strategic ambitions around EV leadership, software monetization, and autonomous mobility sit within a larger industrial context defined by rapid technological progress, evolving consumer expectations, and an increasingly complex regulatory environment. The shift toward electric propulsion is accelerating as governments worldwide implement policy measures to decarbonize transportation, spur infrastructure investments, and create consumer incentives for cleaner mobility options. This macro trend provides a fertile backdrop for GM’s EV strategy, offering potential market expansion opportunities while presenting supply chain and cost challenges that require careful navigation. The competitive landscape in electric mobility is intensifying as traditional automakers and new entrants alike push to capture early advantages, harness scale economies, and differentiate through software-enabled experiences that resonate with a modern customer base.

Autonomous mobility adds another layer of complexity and potential disruption. Cruise’s role in GM’s autonomy strategy is central to this narrative, as the company aims to demonstrate the safety, reliability, and commercial viability of self-driving systems at scale. The pursuit of autonomy intersects with regulatory approvals, public-perception considerations, safety standards, and the establishment of viable business models for autonomous mobility and logistics services. The interplay between Cruise’s technical development and GM’s manufacturing, service, and support ecosystems is critical for translating autonomous capabilities into tangible customer value and profitable operations. The broader industry context also includes partnerships, joint ventures, and collaborations with technology providers, suppliers, and municipal partners that collectively shape deployment strategies, safety practices, and the pace at which autonomous services can be scaled.

From a consumer perspective, the EV and autonomy transition is tied to quality, reliability, price parity, charging accessibility, and the perceived value of software-driven features. The success of GM’s strategy depends on delivering compelling total ownership experiences that reduce friction for customers and create ongoing engagement through software updates, services, and new mobility solutions. Additionally, the automotive sector faces supply chain pressures, including raw materials for batteries, semiconductors, and critical components, which influence production calendars, pricing, and availability. Executing a multi-faceted strategy of this kind requires not only technological prowess but also robust operational excellence, disciplined capital management, and a clear narrative to communicate value to investors, customers, and partners.

In this broader milieu, GM’s ambition to double revenue by the end of the decade through leadership in EVs, software-enabled services, and autonomous mobility reflects a recognition that the future of the automotive industry hinges on the ability to monetize software, data, and scalable services as much as on the ability to produce compelling hardware. The company’s plan integrates product development with platform thinking, seeking to establish a holistic ecosystem in which vehicles are the anchor but not the sole source of value. The future of transportation, in GM’s vision, involves a seamless blend of electrification, digitization, and automation, driven by data-driven insights, a robust charging and service network, and the capacity to offer customers new ways to interact with and benefit from their vehicles and mobility solutions. This context helps illuminate why GM is investing in Cruise, in software capabilities, and in a broad EV strategy that extends beyond traditional vehicle sales into a recurring-revenue model built around software, services, and autonomous mobility.

Challenges, Risks, and Path Forward

While GM’s strategic direction is ambitious and well aligned with evolving market dynamics, the path ahead is lined with significant challenges that require careful navigation. The company must contend with intensifying competition across EVs, software services, and autonomous mobility, including pressures from established rivals and new entrants that bring nimble software development practices and aggressive go-to-market strategies. Achieving leadership in electric vehicle sales requires not only advancing battery technology and supply chain resilience but also delivering affordable, highly reliable products that appeal to a broad spectrum of customers. The economics of EV production depend on continued improvements in battery chemistry, manufacturing efficiency, and scale, all of which are affected by market volatility and supplier constraints. For GM, sustaining an advantage will hinge on its ability to manage costs while expanding its EV lineup to meet evolving consumer needs and regulatory requirements in diverse regions.

In the software and services domain, monetization remains a complex endeavor. The recurring revenue model depends on customer willingness to engage with subscriptions, value-added features, and continuous software updates that justify ongoing expenditure. GM must deliver clear, measurable value through connected services, navigation, entertainment, safety features, and fleet-management capabilities, while ensuring data privacy, security, and compliance. The integration of software into hardware requires robust software engineering discipline, reliable delivery pipelines, and a culture that values iterative improvement. Additionally, the revenue impact of software services may be influenced by competition from tech-enabled mobility platforms and potential price sensitivities among consumers and fleets. The ability to demonstrate a compelling total cost of ownership and compelling return on investment for customers will be critical to realizing the monetization potential of software-based offerings.

Autonomous mobility presents perhaps the most complex challenge. Cruise’s success depends on achieving and sustaining high safety standards, earning regulatory approvals, minimizing operational risks, and proving the economics of autonomous services at scale. The regulatory landscape for autonomous vehicles varies across markets and can be highly dynamic, requiring ongoing engagement with policymakers, standards bodies, and safety regulators. Market acceptance of autonomous services by customers is also a critical variable; public trust in automated systems is essential for broad adoption. Moreover, the economics of autonomous mobility must compete with other mobility solutions and transportation models, such as ride-hailing, car-sharing, and traditional vehicle operations. The timing and pace of scaling Cruise’s capabilities will be influenced by these multifaceted considerations, as well as by the effectiveness of integration with GM’s existing manufacturing and service networks.

Beyond these core risks, GM must navigate the broader macroeconomic environment, including supply chain disruptions, inflationary pressures, currency volatility, and potential shifts in consumer demand. The capital-intensive nature of EV and autonomy initiatives requires disciplined financial management and a clear pathway to profitability. Any misalignment between capital allocation and strategic priorities could slow progress or erode investor confidence. Additionally, the transition to a software-centric model requires a cultural shift within GM—fostering cross-functional collaboration, accelerating decision-making cycles, and sustaining a pipeline of innovative product ideas. The company must also manage the transition for its workforce, ensuring retraining programs, upskilling opportunities, and alignment with new business imperatives to avoid talent gaps that could impede execution.

Despite these challenges, a path forward exists through a combination of disciplined execution, stakeholder alignment, and adaptive strategy. GM can strengthen its position by continuing to invest in battery technology, manufacturing scale, and infrastructure partnerships that support EV adoption. Concurrently, it can advance its software strategy by expanding connected services, refining data-driven offerings, and delivering measurable value to customers through ongoing updates and new features. For autonomy, progress will require continued safety leadership, transparent collaboration with regulators, and a clear, customer-centric business case for autonomous mobility and logistics services. The ultimate measure of success will be GM’s ability to translate ambition into tangible outcomes: higher revenue, improved margins, enhanced customer loyalty, and the creation of durable value across multiple business lines that align with the changing expectations of a software-defined mobility era.

In the concluding assessment, Mary Barra’s leadership and GM’s strategic emphasis on EVs, software, and Cruise represent a deliberate response to the demands of a transformation-driven market. The company’s participation in high-profile platforms like TechCrunch Disrupt 2024 underscores a willingness to engage with the broader technology and startup ecosystem, signaling a readiness to learn, adapt, and partner in ways that accelerate progress. The combination of ambitious revenue goals, a diversified strategic portfolio, and a commitment to talent and investment discipline positions GM to navigate the complexities of electrification, software-enabled mobility, and autonomous driving. While challenges persist, the integrated approach offers a coherent framework for delivering long-term value, aligning GM’s legacy strengths with the innovations that define the next generation of transportation.

Conclusion

In summary, GM’s strategic arc under Mary Barra reflects a carefully calibrated effort to redefine what a modern automaker can be in a technology-driven era. The company is pursuing a multi-faceted plan that seeks to double revenues by the end of the decade through leadership in electric vehicles, software-driven services, and autonomous mobility enabled by Cruise. Barra’s leadership and vision emphasize not only product development but also organizational transformation, talent cultivation, and disciplined investment in core capabilities that can sustain growth across changing market conditions. The TechCrunch Disrupt 2024 platform provides a timely stage to discuss these ambitions, offering insights into how GM intends to attract talent, structure investments, and pursue potential acquisitions in an ecosystem that values speed, innovation, and strategic partnerships. As GM continues to navigate the road ahead, its ability to execute on these interlinked pillars—EV leadership, software monetization, and autonomous mobility—will be critical to achieving long-term success and establishing a durable leadership position in the evolving mobility landscape.