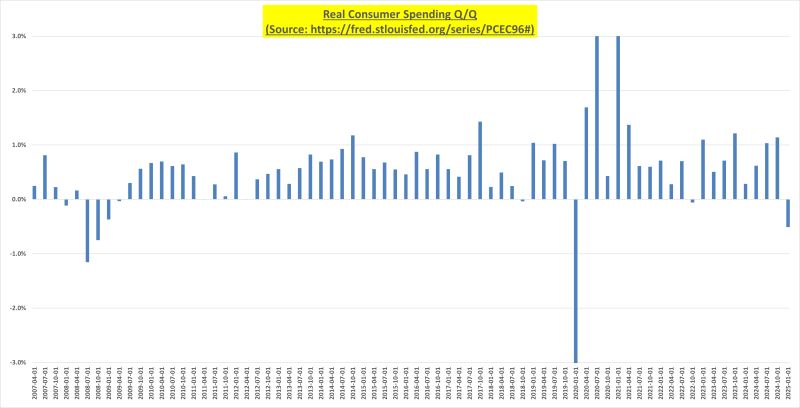

Real consumer spending in early 2025 is signaling a softer footing for the economy, even as broader sentiment gauges fluctuate. The latest receipts from consumer outlays show a more fragile pattern than some headline narratives suggest, underscoring how the behavior of spending can diverge from what people say they intend to do. January posted a meaningful drop, and February barely advanced, leaving the first quarter with a weak cadence. Viewed through a quarterly lens—consistent with how real GDP is calculated—the early 2025 period has registered a decline that warrants careful interpretation, given the potential for revisions and the noise inherent in early data. While it is prudent not to overreact to a single data point, the existence of a tangible pullback in actual spending is a data point that deserves attention and deeper analysis.

The Current Trajectory of Real Consumer Spending in 2025

Real consumer spending has moved through a difficult stretch at the start of 2025, with monthly results painting a picture of reticence in household outlays that runs counter to some positive narratives around consumer resilience. In January, the monthly read on real spending declined by 0.6 percent, a figure that marks the weakest performance in roughly four years. This sharp drop stands in stark contrast to any perception that households were accelerating their purchases in the early part of the year. It suggests that, after adjusting for price changes, households were deferring or limiting purchases across broad categories, rather than pulling forward demand in anticipation of future needs.

February’s outturn offered only a flicker of improvement, increasing by 0.1 percent on the month. That modest gain did not meaningfully alter the underlying trajectory or the broader interpretation of the data, which continues to point toward a cautious consumer environment. The combination of a pronounced January decline and a tepid February uptick results in a fragile early-year spending path. The arithmetic of these two months translates into a quarterly perspective that is notably weak, as discussed in more depth below. Importantly, the February reading, while slightly positive, did not erase the negative momentum carried from January; rather, it reinforced the sense that discretionary purchasing—especially in nonessential categories—remains restrained.

When these monthly figures are aggregated in a quarter-over-quarter framework—aligned with real GDP measurement conventions—the story becomes more revealing. The first quarter of 2025 to date registers a decline of -0.5 percent in real consumer spending. This quarterly decline is nontrivial and places Q1 in a rarefied club of periods characterized by significant contraction in household purchases. The implication is not merely a short-term softness in a single month but a broader pattern that manifests across the first three months of the year. The negative quarterly result is a signal that, even as other components of the economy struggle to maintain momentum, consumer outlays have not contributed positively to growth in the opening quarter.

To place this in a historical frame of reference, the only other times when real spending experienced a quarterly decline of this magnitude were the first quarter of 2020, during the onset of the COVID-19 shock, and the fourth quarter of 2008, at the height of the Global Financial Crisis. Those episodes were associated with severe economic strains and unique, exogenous disruptions. The present iteration cannot be classified in the same category as those events; however, the similarity in quarterly contraction underscores how unusual and consequential a sustained drop in real spending can be for the health of the economy. It also acts as a reminder that the macroeconomic landscape can pivot quickly when household purchasing power, credit conditions, or confidence swing in unexpected directions.

The broader interpretation of these patterns requires caution. Relying on a single data point—especially when that data point emerges amid seasonal fluctuations, measurement revisions, and temporary shocks—can lead to over-interpretation. Analysts emphasize the importance of looking at a range of indicators and recognizing that early data can be skewed or noisy. In the current environment, where inflation dynamics, wage trends, and interest rates interact with evolving consumer preferences, the early-year spending readings should be viewed as part of a larger mosaic rather than as definitive signals of future conditions. Nevertheless, the fact that a measurable pullback in real spending exists—distinct from sentiment alone—adds a meaningful layer to the ongoing assessment of demand-side momentum in the economy.

As investors, policymakers, and businesses absorb these readings, they will naturally scrutinize the potential drivers behind the spending softness. A combination of higher price levels, evolving wage trajectories, debt servicing burdens, and the availability of credit can all influence how much households choose to spend, even when sentiment surveys do not point to a similar degree of caution. The persistence of a spending pullback would be more convincingly interpreted if accompanied by corroborating signs in other consumption-related data, such as durable goods orders, services expenditure, or retail sales across key categories. In the meantime, the spending data for January and February sets a narrative of caution that complements, rather than contradicts, the broader macroeconomic picture.

The takeaway from this section is that real consumer spending in early 2025 has demonstrated a meaningful but nuanced weakness. The January drop of -0.6 percent, followed by a marginal February gain of +0.1 percent, has produced a quarterly contraction, reinforcing the sense that household demand is not currently contributing to a robust expansion in real terms. While a single month or quarter never dictates the entire trajectory, the aggregate signal is sufficiently pronounced to be incorporated into mid-term forecasts, with the understanding that data revisions could shift the precise magnitudes in subsequent releases.

Underlying Dynamics and Potential Channels

The spending pattern observed so far may reflect a combination of macro and micro forces shaping household behavior. Inflation relief or persistence interacts with wage growth, which in turn affects disposable income after essential expenses. If price pressures remain stubborn or if wages fail to outpace inflation, households may adjust their consumption mix toward essential items and away from discretionary goods and experiences. Additionally, sensitivity to borrowing costs could influence credit-based purchases, from big-ticket items to everyday services. The degree to which households draw on savings versus new credit will matter for the sustainability of any ongoing spending weakness or potential rebound.

Seasonal factors also play a crucial role in interpreting monthly data. The first quarter often exhibits volatility linked to weather, holidays, and fiscal timing, and seasonal adjustment processes can introduce shifts that are later revised. Analysts regularly expect revisions as more complete data becomes available and as seasonal factors are re-estimated with additional information. Given this, the current readings should be anticipated as provisional to some extent, with a strong emphasis on the direction and persistence of the trend rather than the precise monthly outturns. The month-to-month figures, while informative, gain greater significance when viewed in conjunction with the quarterly abstraction and with a broader set of consumption indicators.

The consumer spending narrative also intersects with the path of real GDP. Real GDP is the aggregate measure of economic activity adjusted for inflation, and consumer spending is typically the largest component of that aggregate. When real spending is contracting on a quarterly basis, it can weigh on the overall growth rate, potentially offsetting gains from other sectors. This dynamic is particularly relevant when the economy faces competing impulses—such as strong export activity, manufacturing resilience, or investment momentum—that may counterbalance weak household demand. The net effect on GDP will hinge on how these competing forces evolve, and it is precisely why the spending data deserve careful, ongoing attention in the months ahead.

In summary, the current trajectory of real consumer spending in 2025 shows a clear, though interpretable, soft spot. The January decline of -0.6 percent and the February increase of +0.1 percent, when viewed together, contribute to a quarterly drop of -0.5 percent. While historical parallels exist, they should be treated with appropriate caution given the different macroeconomic contexts. The data point confirms a pullback in actual consumer outlays, but it is one piece of a broader, evolving economic picture that remains subject to revisions, new information, and the interplay of multiple demand drivers.

Decoding January and February Spending: What the Data Tell Us

The monthly readings for real consumer spending in January and February 2025 reveal a pattern of back-and-forth movement that is not unusual in times of economic transition, yet carries specific implications for the near-term outlook. January’s -0.6 percent decline in real spending is a sizable contraction by any standard, and it signals that households significantly reduced outlays after adjusting for price effects. This net contraction in the first month of the year stands out relative to the preceding period and raises questions about the underlying momentum of consumer demand as the year began.

February’s data, by contrast, show a modest rebound with a +0.1 percent gain. Although any single-month uptick can be encouraging on the surface, the gain is small enough to leave the overall quarterly path unaltered in a meaningful way. The net effect of January’s sharp decline followed by February’s slight positive move is a quarterly sequence that leans toward negative territory, reinforcing the notion that the early portion of 2025 has not yet delivered a strong lift in consumer spending. The qualitative interpretation of this sequence is that households appeared to curb their spending pace in January and then paused short of a robust recovery in February. The magnitude of the February uptick suggests limited pent-up demand to be released within that month, or possibly a reallocation of spending toward essential goods and services rather than discretionary items.

When these monthly datapoints are stitched together into a quarter-over-quarter framework—consistent with how the economy’s strength is assessed—Q1 2025 records a -0.5 percent change in real consumer spending. This is a pivotal metric because it translates the month-to-month volatility into a single, policy-relevant indicator that captures the cumulative effect of spending decisions across the quarter. A -0.5 percent quarterly decline is not a minor wobble; it implies a meaningful drag on aggregate demand from households, at least over the period in question. Such a figure can influence expectations around the broader economic trajectory, including the pace of growth, the potential for inflationary pressures to ease, and the stance of macroeconomic policy.

Historical context provides a lens through which to assess the significance of this quarterly decline. The only times when real spending fell by a similar magnitude on a quarterly basis were during the first quarter of 2020, amid the onset of the COVID-19 pandemic, and in the fourth quarter of 2008, during the Global Financial Crisis. These episodes were marked by exceptional disruptions that affected confidence, employment, and access to goods and services. While the current situation does not replicate those shocks in their entirety, the presence of a comparable drop in real spending on a quarterly basis underscores the potential for a meaningful impact on the macroeconomic landscape if the trend persists or broadens.

From a methodological standpoint, the interpretation of January and February spending must account for several considerations. First, the data are subject to revisions as more complete information becomes available and seasonal and price-adjustment models are refined. Second, the timing of measurements can affect the appearance of momentum, especially around holiday-related spending shifts or end-of-period adjustments. Third, the distribution of spending across categories can influence the overall figure: durable goods purchases may reflect different dynamics than services or non-durable goods purchases. Each of these aspects contributes to the overall interpretation and highlights the importance of maintaining a cautious stance until a more complete data sequence emerges.

The takeaway from the January and February readings is that the spending path remains soft through the opening months of 2025. The -0.6 percent drop in January and the +0.1 percent rise in February, when arranged into a quarterly chronology, yield a -0.5 percent quarter-over-quarter decline for Q1. This combination of outcomes suggests a cautious consumer environment and raises the possibility that households could remain restrained in their outlays unless there is a shift in income growth, savings behavior, or credit conditions. In the absence of stronger momentum in spending, other components of demand, such as business investment or external demand, would need to compensate to keep the broader economy on a solid growth footing.

The Role of Revisions and Data Quality

An important aspect of interpreting these numbers is acknowledging that macro data evolve. Revisions can alter the magnitude and occasionally the direction of the initial readings. This is a standard feature of monthly and quarterly statistics, reflecting the ongoing incorporation of more comprehensive data sources and refined techniques. In practice, this means that the January and February figures might be adjusted in subsequent releases, potentially reducing or amplifying the initial impression of spending strength or weakness. Analysts closely monitor revision patterns to gauge whether the early-year numbers are likely to converge toward a more accurate representation of underlying demand.

The quality of the data also depends on how the price deflators are applied to convert nominal outlays into real terms. If inflation measures shift, or if the composition of spending changes in ways that affect the implicit price index for consumption, the real spending figures can move differently from nominal dollars. This nuance reinforces the need to interpret the early-year data within the broader context of inflation dynamics and consumer income trends. Taken together, revisions and methodology considerations can influence the perceived strength of the consumer sector, even when initial reports suggest a particular direction.

In addition to revisions, the composition of spending matters for interpretation. A decline in real spending could arise from a shift in consumer preferences—toward more savings or toward essential goods with less discretionary purchase power—rather than a dramatic downturn in overall demand. The data do not immediately reveal category-level details in the summaries referenced here, but the broader interpretation remains that real spending has faced headwinds in the early part of 2025, consistent with a cautious consumer posture, even amid potential pockets of resilience in certain sectors or categories.

Overall, the January and February readings suggest a fragile, eventful early-year period for consumer outlays. The sharp January decline, combined with a tepid February gain, culminates in a quarterly contraction that raises questions about the pace of consumption growth for the remainder of 2025. Yet, the data also highlight the importance of capturing a full sequence of indicators before drawing definitive conclusions about a durable shift in consumer behavior. The next data release will be instrumental in either confirming a sustained weakness or signaling a stabilizing trend in real spending as the year progresses.

The Quarter-over-Quarter Picture and Historical Context

The quarterly framing of spending data provides a lens that helps to normalize month-to-month volatility and reveals underlying demand dynamics that may not be visible from a single month’s figure. In the current environment, the Q1 -0.5 percent reading on real consumer spending places the period in a historically notable position, one that invites comparison with past episodes when demand slowed and the economy faced heightened uncertainty.

Within this framework, the most directly comparable historical benchmarks are Q1 2020, which captured the onset of the COVID-19 shock, and Q4 2008, marking the depths of the Global Financial Crisis. Each of these periods represented a time when household demand was under substantial pressure due to external disruptions and the broader shock to the economy. The presence of a similar quarterly decline underscores the potential for meaningful ripples through the production chain, labor markets, and overall economic sentiment, should such a pattern persist beyond a single quarter.

However, there are important caveats to keep in mind when leveraging these historical analogs. The structural characteristics of the economy in 2025 differ from those of 2020 and 2008 in several dimensions, including the policy responses that followed the shocks, the health of labor markets, the level of household savings, and the evolving pace of technological and productivity improvements. While the sharp declines in the comparison periods reflect acute disruptions, the present-day context includes a mix of factors that could either amplify or dampen the impact of a similar quarterly contraction on growth and inflation outcomes.

From a practical perspective, a -0.5 percent quarterly drop in real consumer spending translates into softer demand for goods and services, with potential knock-on effects across manufacturing, retail, and service sectors. It also interacts with other components of GDP, such as investment and net exports, which collectively determine the trajectory of overall economic expansion. In analyzing this signal, economists and policymakers weigh the degree to which spending softness is temporary—perhaps tied to transitory factors such as post-holiday inventory adjustments or weather-related weak activity—and the extent to which it signals a more persistent moderation in household demand.

The historical lens also informs expectations for revisions. In the wake of revisions, the magnitude of the quarterly decline could be revised either up or down as more information becomes available and as seasonal adjustments are refined. The potential for revisions is a reminder that the present interpretation is provisional, even as the direction of travel—weakening consumption—remains a critical piece of the macroeconomic puzzle. The past pattern suggests that initial data often capture the headline movement while subsequent revisions reveal the underlying resilience or fragility of demand, depending on how the data are reconciled and how subsequent months unfold.

From a policy and forecasting standpoint, a -0.5 percent Q1 drop raises the bar for the subsequent quarters in terms of how growth engines are expected to perform. If consumer spending continues to pull back or remains subdued, forecasters may look for compensating forces to sustain aggregate demand. These forces could include stronger business investment, improvements in net exports, or a more favorable financing environment that supports household spending through credit channels. The balance of risk will hinge on how quickly confidence strengthens, how inflation trends evolve, and how households respond to any shift in policy settings that impacts real purchasing power.

In sum, the quarterly perspective on real consumer spending situates the first quarter of 2025 in a context that warrants careful analysis. The -0.5 percent contraction aligns with heads-up signals about demand, while the historical references provide a framework for evaluating the potential durability of the trend. It remains essential to monitor upcoming data and revisions to determine whether this weakness is a temporary alignment of factors or the early stage of a broader, multi-quarter adjustment in household spending.

Historical Comparisons and What They Do—and Do Not—Tell Us

Looking back at how quarterly spending patterns have evolved in prior episodes of economic stress helps to calibrate expectations for the next several months. The COVID-era shock in early 2020 created a highly unusual demand environment characterized by abrupt changes in household behavior, government interventions, and a rapid reallocation of resources across the economy. The Global Financial Crisis period in late 2008 likewise featured a pronounced contraction in real spending as financial conditions tightened and economic confidence deteriorated. In both cases, the subsequent recovery required a combination of policy support, labor market stabilization, and shifts in consumer behavior as the economy found its footing again.

That said, it is essential to distinguish the current environment from those historical episodes. The policy responses available today, the structure of the financial system, and the ongoing dynamics of inflation and wage growth create a different set of headwinds and tailwinds. A direct extrapolation from the past to the present would be inappropriate; instead, analysts use these references to understand possible trajectories and to assess the probability of various scenarios. The differences in macroeconomic conditions imply that while a -0.5 percent quarterly decline is meaningful, its persistence or reversal will depend on how the underlying drivers evolve in the months ahead.

From a forecasting perspective, the Q1 -0.5 percent figure informs baseline expectations for the trajectory of consumer demand across the first half of the year. If the decline is followed by improvement in subsequent quarters, it could indicate a temporary adjustment phase rather than a structural shift in consumer spending. Conversely, if weakness broadens or deepens, it could presage a more pronounced slowdown with implications for labor markets, business investment, and monetary policy. The challenge for analysts lies in parsing the near-term signals from the longer-term structural forces, a task that requires weighing a range of indicators beyond a single quarterly measure.

Ultimately, the quarterly spending data provide a snapshot of demand conditions that influence the broader economy. The current -0.5 percent reading for Q1, in conjunction with January’s -0.6 percent monthly decline and February’s +0.1 percent gain, paints a nuanced picture of a consumer sector that is not fully participating in a robust expansion. The interpretation rests on the balance of evidence and the willingness to revise expectations as more information becomes available, including the next set of releases and any revisions to prior months.

Interpreting a Single Data Point: Methods, Limitations, and Noise

In macroeconomic analysis, the temptation to draw sweeping conclusions from a single data point is strong but risky. The case of early-2025 real consumer spending illustrates why analysts emphasize a cautious, multi-metric approach. The initial reading for January shows a sizable contraction, and February offers only a marginal rebound, prompting questions about the durability of the momentum. Yet, anchoring expectations to one month or one quarter can overstate the strength or fragility of the underlying demand, given the inherent volatility and the presence of measurement and revision dynamics.

One fundamental principle is that measurements are not static. Initial estimates are often revised as more comprehensive data become available and as seasonal adjustments, price deflators, and survey inputs are refined. In real terms, the revisions can shift the perceived strength of spending, sometimes modestly, sometimes meaningfully. The prospect of revisions means that policymakers and market participants should treat the current figures as provisional, with a recognition that the eventual publication could alter the narrative. This is not to diminish the value of timely data, but rather to set expectations for the evolution of the numbers over time.

Seasonal adjustment and methodological choices are also central to interpretation. Real spending figures are sensitive to how price changes are accounted for, how seasonal patterns are modeled, and how categories of goods and services are weighted in the aggregate. If these methodologies experience shifts, the resulting real spending estimates can move in ways that do not necessarily reflect a fundamental change in consumer behavior. Consequently, analysts often triangulate with other measures of consumption, such as retail sales, services activity, and durable goods orders, to develop a more comprehensive understanding of the demand environment.

The possibility of data noise should not be overlooked. Short-run fluctuations can emerge from idiosyncratic factors such as weather, holiday timing, or supply chain disruptions affecting inventory accumulation. While these factors do not nullify the signal, they can obscure it in the near term. For example, a harsh winter might suppress outdoor or seasonal spending in one month but may be offset by delayed purchases in a subsequent month. Similarly, policy announcements or financial conditions can influence consumer behavior in the near term without implying a permanent change in long-run spending patterns.

Revision risk is another critical component of interpretation. The initial indications of spending strength or weakness frequently evolve as late-imputed data are integrated. This phenomenon is not an anomaly but a recognized feature of macro data: the more complete the data series, the more stable and reliable the assessment of the underlying trend becomes. In practice, this means that a cautious interpretation of the current readings is warranted, and the door remains open to revisions that could either bolster or soften the observed trend. The prudent course is to monitor subsequent releases and to place greater emphasis on sustained movements in multiple indicators rather than on any single number.

From a practical standpoint, the key is to balance immediacy with reliability. Real-time data offer timely insights that can inform policy and market expectations, but they must be tempered by an awareness that the full story unfolds over time. The current readings provide valuable information about the direction of travel, even as they invite scrutiny regarding the strength and durability of the trend. Analysts, policymakers, and investors will likely assess the next wave of data with an eye toward whether the early-year softness persists, improves, or stabilizes, and they will adjust their expectations accordingly.

To operationalize this cautious approach, it can be helpful to track a broader suite of consumption indicators, including household spending on services, durable goods, and nondurable goods, along with related measures such as personal income, savings rates, and debt service burdens. A comprehensive view can reveal whether weakness is concentrated in particular categories or whether it reflects a more general retrenchment in spending. It is precisely this kind of cross-check that strengthens the reliability of the macro narrative and reduces the risk of overreacting to a single data point.

In summary, interpreting the January and February spending data requires a disciplined, multi-faceted approach. While the numbers reveal a notable step back in January and a modest rebound in February, the broader significance hinges on the persistence of these patterns across subsequent releases. The methodological realities of revisions, seasonal adjustments, and potential noise mean that conclusions should be provisional, with a bias toward watching the trend over several quarters rather than fixating on any one reading. This approach helps ensure that economic forecasts and policy discussions are grounded in a robust understanding of underlying demand dynamics.

The Upcoming Data Release: What to Watch and Why It Matters

With the next wave of consumer spending data on the horizon, market participants and policymakers are looking for new information that could either reinforce the current interpretation or prompt a reassessment. The timing of the upcoming release matters because it will provide a more complete view of the early-year period, including any revisions to the January and February figures and potentially new monthly data that can illuminate the trajectory of real spending across the first quarter.

One of the central questions for observers is whether the forthcoming data will confirm the observed weakness or reveal resilience that was not captured in the initial estimates. Revisions could either lower the perceived severity of the decline or, conversely, magnify the weakness if the data are revised downward. In either case, revisions add a layer of complexity to the interpretation, reinforcing the notion that macro data are a moving target that require ongoing assessment.

Beyond revisions, the upcoming release has the potential to reveal shifts in the composition of spending. If households continue to channel more outlays into essential goods and services, the aggregate real spending figure could remain soft even as certain segments show strength. Similarly, if consumer confidence improves and households begin to spend more freely, even modest increases could lead to a more favorable quarterly performance than currently anticipated. The data will also reflect any changes in inflation trajectories, which influence the real purchasing power of households and, by extension, their spending propensity.

The timing of the release is also relevant in a broader market context. When new data arrive, investors and analysts adjust their expectations for growth, inflation, and the trajectory of interest rates. These adjustments can influence financial markets, nonfinancial markets, and policy debates, especially if the data align with or challenge the prevailing consensus. The upcoming release thus serves as a critical inflection point for calibrating the near-term outlook and for guiding the balance of risks in the forecast landscape.

From a methodological standpoint, the upcoming numbers will be scrutinized for revisions, seasonality adjustments, and the integrity of the underlying components. Analysts will look to see whether any adjustments point to a more supportive or more restrictive demand environment than the initial readings suggested. The degree to which revisions and the new data align with other contemporaneous indicators—such as payroll data, consumer confidence surveys, and business sentiment indices—will be important for validating the consistency of the macro narrative. If the new data cohere with other indicators, it would strengthen the case for the current interpretation; if not, it could prompt a reevaluation of the expected pace of consumption growth.

The forward-looking takeaway from the upcoming data is that any sustained improvement in real spending would be a constructive sign for the economy, potentially signaling a reacceleration of consumer demand and a better balance of growth drivers. Conversely, persistent softness in spending could indicate that headwinds such as inflation, financing costs, or weaker wage growth are continuing to constrain households. In either scenario, the data will contribute to the evolving understanding of how households are navigating the economy and how their behavior is likely to shape the pace of growth in the quarters ahead.

As the data horizon approaches, it is prudent for readers to maintain a balanced perspective. The narrative about consumer spending should be anchored in a constellation of indicators rather than a single release. The next data point may confirm the fragile start to the year or reveal a more resilient path, but either outcome will feed into a broader discussion about macroeconomic momentum, policy implications, and the outlook for the consumer sector in 2025.

The Relationship Between Spending, GDP, and Economic Sentiment

Understanding how real consumer spending interacts with the broader economy requires a framework that connects household outlays to the measurement of gross domestic product (GDP) and to the sentiment that markets and households hold about economic conditions. Real spending is a central component of GDP, and changes in consumption have a substantial impact on the overall growth rate. When real spending declines, GDP growth can weaken unless offset by gains in other components of demand, such as business investment, government spending, or net exports.

The distinction between sentiment and action is a persistent feature of macroeconomics. Sentiment indexes—such as consumer confidence surveys—capture perceptions, expectations, and attitudes about future conditions. While sentiment can influence future spending decisions, it is not a direct proxy for actual outlays. People may report pessimism or optimism about the economy that diverges from what they end up spending, whether due to credit availability, planned purchases, or delayed response to price changes. The data show that spending decisions are influenced by a complex set of factors, including income growth, price levels, debt service burdens, wealth effects, and expectations about future income and prices.

The current data highlight a potential divergence between sentiment and spending, a phenomenon that is not unprecedented but requires careful interpretation. If sentiment improves yet spending remains soft, policymakers might focus on whether the improvement in confidence will translate into higher consumption over time, or whether other constraints—such as rising interest costs or tighter credit conditions—continue to hamper outlays. Conversely, if sentiment remains negative but spending begins to pick up, it could indicate a lag between perceived conditions and the actual spending response, perhaps driven by delayed purchases or pent-up demand catching up with revised income prospects.

The interplay between spending and GDP is not one-way; the composition of growth matters as well. Even when consumption is tepid, other demand components—like business investment or export demand—can contribute to a positive GDP trajectory. The challenge for forecasters is to assess how robust those other engines are relative to the strength or weakness of household demand. In the current environment, if consumer spending remains subdued, the economy would rely more heavily on investment, innovation, and external demand to maintain growth momentum. This balance has implications for policy decisions, including how central banks calibrate interest rates and how fiscal authorities design measures to support households without undermining incentives for saving and investment.

From a market perspective, the relationship between spending, GDP, and sentiment shapes asset prices, inflation expectations, and risk assessments. When spending data suggest weakness, it can feed into expectations of slower growth and cooler inflation, potentially influencing bond yields and equity valuations. If sentiment improves but spending does not, traders must weigh whether the optimism is sustainable or whether it will fade if real demand remains muted. The confluence of these signals makes the macro environment more nuanced and underscores the need for a multi-dimensional approach to forecasting and risk management.

The current readings thus serve as a reminder that economic health is the sum of many parts. Real consumer spending, as a major component of GDP, provides critical insight into household demand and living standards. Yet, it is not the sole determinant of growth, and it must be considered in concert with the trajectory of wages, inflation, credit conditions, business investment, and external factors that influence trade and productivity. The evolving relationship among these variables will shape the near-term outlook for the economy and inform policy and investment decisions as 2025 progresses.

How Markets and Policymakers Could Respond

With spending showing signs of a pullback, policymakers might scrutinize whether the pace of consumer demand necessitates adjustments to monetary policy, fiscal programs, or targeted supply-side measures. If higher-frequency indicators converge toward softer growth, some policymakers could favor data-dependent stances that emphasize price stability and the containment of inflation without unduly constraining growth. Conversely, if a broader suite of indicators suggests resilience and a more stable trajectory for spending, policymakers could maintain or even consider pathways that support sustained expansion while monitoring inflation dynamics.

Investors, in particular, may adapt their strategies to align with the evolving consumption landscape. A softening in real spending could prompt a reallocation toward sectors with more favorable exposure to slower, but steadier, growth. This might include areas tied to services that remain in demand, or industries benefiting from a resilient labor market, even if overall household outlays are constrained. On the other hand, if the data indicate a positive turn in spending alongside improving inflation dynamics, markets could respond by pricing in a more robust growth path and adjusting rate expectations accordingly.

In the broader context, the spending signal interacts with the outlook for interest rates, inflation, and the sustainability of household financial conditions. If spending weakness persists, central banks may face heightened concerns about the risk of demand-driven disinflation or delayed inflation normalization. This could influence policy communications and the calibration of rate paths, as well as the anticipated pace of balance sheet normalization or potential macroprudential measures aimed at ensuring financial stability and affordable credit access for households.

The policy implications of spending data thus extend beyond quarterly headlines. They touch on the sufficiency of demand to support a balanced expansion, the resilience of labor markets, and the durability of wage growth in a high-price environment. Policymakers and analysts use these signals to refine their projections, assess the risk of a protracted slowdown, and determine the most appropriate policy mix to maintain economic stability and sustainable growth.

Behavioral Insights: Spending vs. Sentiment

A nuanced layer of interpretation emerges when examining the relationship between what people say and what they do. Sentiment gauges—capturing consumer confidence, expectations about income growth, and perceptions of economic conditions—are valuable for forecasting potential shifts in spending. However, the translation of sentiment into actual purchases involves an additional set of constraints and choices. Household decisions are influenced by real income after taxes and inflation, access to credit, liquidity preferences, and anticipated future conditions. Even when sentiment signals caution, households might still spend on necessary items or essential services, while delaying or reducing discretionary purchases.

The divergence between sentiment and action is not inherently contradictory; it reflects the complexity of consumer behavior in real-world decision-making. For instance, an economy experiencing modest inflation or improving wage growth can sustain a degree of consumer spending even if sentiment remains tepid. Conversely, if confidence improves but households face tight credit conditions or elevated debt service burdens, the uptick in sentiment may fail to fully translate into higher outlays. The current readings align with this dynamic: the January drop in real spending suggests cautious immediate behavior, while February’s slight rebound could reflect timing and reallocation rather than a convincing, sustained pickup in discretionary demand.

These behavioral dynamics also interact with saving and wealth effects. If households respond to recent price stability and wage gains by saving more as a precaution, the immediate effect could be a slower pace of spending even in the presence of improving sentiment. If, on the other hand, financial conditions loosen or wealth effects improve—such as rising asset prices that bolster perceived household wealth—spending could accelerate as confidence translates into durable purchases. The net effect on the economy will depend on which of these forces dominate and how quickly they adjust to evolving macro conditions.

From a practical viewpoint, businesses and policymakers should consider both sentiment and behavior in their planning and forecasting. Sales strategies, inventory management, and capital expenditure plans can benefit from understanding the lag between confidence shifts and actual purchase patterns. For policymakers, a broader view that includes sentiment signals alongside observed spending, income growth, and inflation will yield a more robust assessment of the economy’s health and its trajectory.

The current data landscape reinforces the importance of a holistic approach to assessing the consumer sector. While the narrative of sentiment remains a critical piece of the puzzle, the actual spending outlays provide concrete evidence about demand conditions. The combination of these insights—behavioral traces and confidence indicators—offers a more complete picture of how households are navigating price pressures, income dynamics, and credit conditions as the year unfolds.

Implications for the Economy, Markets, and Policy

The early-2025 pattern in real consumer spending has meaningful implications for the broader economy, financial markets, and policy settings. A weaker consumer spending profile can dampen overall growth, requiring a more supportive stance from other demand components to maintain a balanced expansion. If spending remains subdued, policymakers might consider whether monetary policy should continue to prioritize price stability and inflation containment, while looking for policy measures that preserve household purchasing power and prevent a fragile growth trajectory from deteriorating further.

For markets, the spending signal can influence expectations about the pace of growth, inflation, and the trajectory of interest rates. Weaker consumer demand could lead to tempered expectations for earnings growth across consumer-facing sectors, potentially pushing valuations lower for companies with heavy reliance on discretionary spending. Investors may also focus on sectors that demonstrate resilience to slower consumer demand or those benefiting from a still-healthy labor market and favorable financial conditions. The response will depend on how the broader data landscape evolves, including inflation trajectories, labor market fundamentals, and the pace at which other demand engines contribute to growth.

From a policy perspective, the spending data contribute to a nuanced debate about the appropriate balance between stabilizing inflation and supporting real activity. If the economy shows signs of a protracted slowdown, policymakers might lean toward measures that sustain household income and consumption, such as targeted relief for high-burden households, or financial policies designed to support credit availability while maintaining prudent risk management. Conversely, if spending shows signs of stabilizing and inflation remains on a predictable path, policymakers could maintain a cautious stance or adjust toward a more flexible approach that supports growth without compromising price stability.

The net effect of these interpretations is to emphasize that the consumer sector remains a central barometer for the economy’s health. The interplay between spending, inflation, and wages will continue to shape the policy and market narratives in the months ahead. The early-2025 readings should be interpreted as part of a broader, evolving framework that incorporates revisions, additional data, and cross-checks with other indicators to produce a balanced and credible forecast.

Implications for Forecasts and Economic Planning

Forecasting the economy requires integrating real spending data with a spectrum of related indicators. The observed weak start to 2025 could lead forecasters to modestly lower near-term growth projections if weakness persists, while still allowing for a catch-up if momentum returns. The exact path will depend on subsequent readings, especially whether the next set of consumer spending data confirms a turning point or reinforces a slower pace of expansion.

Businesses may adjust planning horizons in response to the spending signal. A softer consumer backdrop could prompt more conservative inventory management, delayed capital investments, and a careful reassessment of demand projections for the coming quarters. Conversely, if signs of stabilization emerge, firms might resume more ambitious expansion plans, particularly in sectors aligned with resilient consumer demand or where productivity gains enable greater output without fueling inflation.

In the policy domain, the spending read is a critical input for central banks and fiscal authorities as they calibrate policy stances in response to evolving macroeconomic conditions. A persistent undershoot in spending could reinforce the case for a measured easing stance if inflation pressures remain contained, while a stronger-than-expected rebound in spending could influence concerns about overheating and push policy back toward a more restrictive posture. The balance of risks will require constant reevaluation as new data arrive and the economy’s dynamics continue to unfold.

Methodology, Revisions, and Data Quality

A robust understanding of spending data requires awareness of the methodological backbone behind the numbers. Real consumer spending is derived by adjusting nominal outlays for changes in price levels, typically using a chain-type price index or other deflators to capture the true volume of goods and services purchased. Data collection processes, survey methodologies, and seasonal adjustment techniques all contribute to the final figures, and each step introduces potential sources of revision. The precision of the current readings is intrinsically linked to the quality of the source data, the frequency of updates, and the consistency of measurement across months and quarters.

Revisions are a standard feature of macroeconomic data series as more complete information becomes available and as estimation models are refined. The January and February numbers may be revised in subsequent releases, which can change the magnitude of the observed changes and the overall quarterly assessment. This reality reinforces the need to treat early readings as indicative of direction rather than as definitive statements about the economy’s state. The reliance on revisions to converge to a more accurate representation is a routine part of macroeconomic analysis, and it underscores the importance of following a sequence of data rather than anchoring decisions on a single release.

Another critical methodological consideration is the avoidance of over-interpretation from a single data point. The presence of one dramatic monthly decline followed by a small uptick does not, by itself, imply a structural shift in consumer behavior. Analysts therefore emphasize looking at the trend across several months and across related indicators to obtain a more reliable signal. This approach reduces the risk of misreading the data, helps identify genuine shifts in demand, and improves the quality of the economic forecast.

Additionally, data quality hinges on consistent definitions and classifications. If there are changes in how categories of spending are defined or in the weighting of components within the real spending aggregate, the resulting figures could reflect these methodological changes rather than pure economic dynamics. The ongoing attention to consistency, transparent revisions, and alignment with international standards is essential for preserving the integrity of macroeconomic analysis and for enabling meaningful cross-country or cross-period comparisons.

In practice, the best way to interpret spending data is to view it as part of a dynamic, evolving dataset that enhances understanding when combined with other macro indicators. The current readings offer valuable insight into the direction of household demand, but their true significance rests on the alignment of these numbers with ongoing trends across wages, prices, credit conditions, and business investment. The data’s reliability improves as the series expands over time and as revision processes are completed, providing a clearer, more stable picture of the consumer sector’s role in the economy.

Outlook: Risks, Scenarios, and Strategic Considerations

The mid-year outlook for 2025 hinges on how the consumer spending pattern evolves in the face of evolving macro conditions. A key risk is that the early-year softness in real spending might persist into the next few quarters, potentially amplifying downside risks to overall growth if other demand components fail to compensate. In such a scenario, policy considerations would need to balance inflation containment with measures designed to maintain household purchasing power and support a gradual reacceleration of consumption.

An alternative scenario envisions a stabilization and eventual rebound in real spending as inflation cools, wage growth remains steady, and credit conditions normalize. If households regain confidence and the underlying drivers of spending improve, consumption could contribute more positively to GDP in the subsequent quarters, mitigating some of the drag observed in Q1. Such an outcome would rely on a constructive alignment of price stability, income growth, and accessible financing, creating a more favorable environment for discretionary purchases and durable goods investments.

A third possibility involves a broader economic deceleration with uneven effects across sectors. In this case, some industries could experience continued strength due to structural shifts or demographic trends, while others may face persistent headwinds from higher borrowing costs or lower consumer confidence. The net impact on policy and markets would depend on the relative resilience of internal demand versus external demand, inflation dynamics, and the pace at which the labor market absorbs any shocks.

From a strategic standpoint, policymakers and market participants should maintain a flexible approach. Scenarios can shift rapidly in response to new information, including labor market data, inflation relief, and global developments that influence demand and prices. Maintaining a diversified risk framework and updating forecasts as data accumulate will help stakeholders navigate the uncertain path ahead, ensuring that decisions remain grounded in the evolving economic narrative.

For businesses that rely on consumer demand, the current sequence signals the importance of prudent planning and agility. Clear visibility into the pace and composition of spending can inform production schedules, inventory levels, and pricing strategies. By aligning operations with the likely demand environment and by preparing for both downside and upside scenarios, firms can better manage risk and capitalize on opportunities as the economy evolves.

The consumer spending narrative for 2025 remains a focal point for economic analysis. The early-year readings—January’s -0.6 percent decline, February’s +0.1 percent uptick, and the resulting -0.5 percent quarterly change—collectively highlight a cautious consumer dynamic that will shape the coming months. Whether this softness proves temporary or signals a more persistent trend will depend on the trajectory of incomes, inflation, credit access, and the broader balance of demand across the economy. As data continue to emerge, analysts will refine forecasts and policymakers will calibrate responses to ensure the economy stays on a steady, sustainable path.

Conclusion

The opening months of 2025 have delivered a clear signal: real consumer spending has weakened in the first quarter, with January posting a sharp drop, February offering only a modest improvement, and the quarter rendering a -0.5 percent contraction. This pattern underscores that the consumer—despite any concurrent optimism in sentiment surveys—has not yet resumed robust outlays. While the data point is meaningful, it is also transitional, subject to revisions and evolving conditions as more information becomes available. The narrative around consumption remains a central piece of the macroeconomic mosaic, and its evolution will continue to influence the outlook for growth, inflation, and policy in the months ahead. The next data releases will be crucial for confirming whether this early-year softness is a temporary phase or the beginning of a more sustained adjustment in household spending.