A risk-on tone re-emerged in the overnight session in the United States, energized by statements from senior government officials suggesting a de-escalatory path in the U.S.-China trade standoff. Major U.S. equity indices recovered from Monday’s declines, with the S&P 500, Nasdaq 100, Dow Jones Industrial Average, and Russell 2000 all posting gains of more than 2% on the session, though they still traded below their 20-day moving averages. In parallel, the U.S. dollar retraced some earlier gains but remained notably firm against traditional safe-haven currencies, with the USD/CHF rising by about 1.2% and the USD/JPY up roughly 0.5%. In Asia this morning, the S&P 500 and Nasdaq 100 E-mini futures extended intraday gains to around 1.6% and 1.8%, supported by reports that President Trump had stepped back from an earlier threat to remove Federal Reserve Chair Powell and that he signaled tariff reductions on Chinese imports would eventually come down substantially. The mood across major Asian benchmarks improved as well, with Japan’s Nikkei 225 rising by approximately 2% and Hong Kong’s Hang Seng Index advancing about 2.4% as traders priced in the prospect of easing tensions between the world’s two largest economies.

The rally in risk appetite also manifested in the commodities and currency markets, as investors reassessed the safety posture that had dominated trading in the prior session. Gold surrendered gains and moved sharply lower, closing yesterday’s U.S. session down about 1.3% at around $3,381 per ounce, a retreat from an earlier intraday high near $3,500, which had marked another round of upside pressure during the prior run. The move lower in gold came despite the broader psychological backdrop of elevated geopolitical and macro uncertainties, signaling that the renewed appetite for risk was broad-based rather than a flight-to-safety event. Even with the pullback, gold remained perched above its 20-day moving average, a level that technical traders watch closely as it tends to provide support near the $3,170 area. The overnight bid for risk assets appears to reflect a shift in narrative from pure hedging against trade tensions to a cautiously optimistic expectation that policymakers may steer towards de-escalation and stability in the underpinning growth environment.

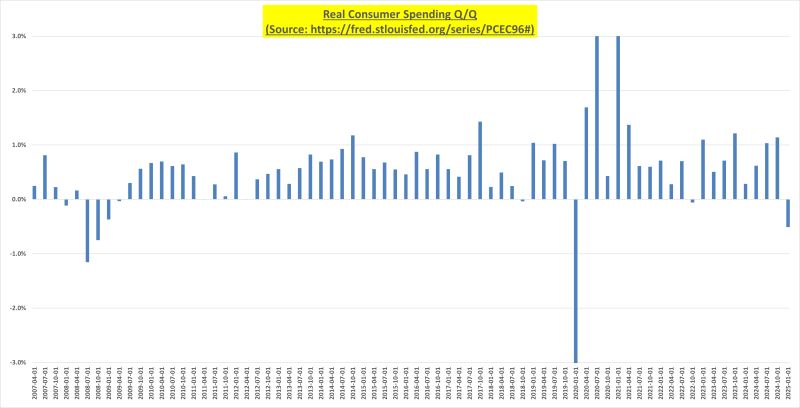

Against this backdrop, global growth projections and policy narratives continued to influence market sentiment. In its latest World Economic Outlook, the IMF reduced growth forecasts for a broad swath of economies, citing the drag from U.S. trade tariffs and intensifying trade tensions. The global growth forecast for 2025 was lowered to 2.8% from 3.3% projected in January, underscoring the fragility of the post-pandemic recovery in many regions and the sensitivity of growth trajectories to tariff developments, exchange rate regimes, and investment sentiment. These revisions reinforce the sense among market participants that even modest shifts in trade policy or tariff regimes can meaningfully alter capital allocation, corporate earnings expectations, and the risk premia embedded in equity valuations. In this context, investors are weighing the balance between the potential for policy-driven de-escalation and the possibility that headlines could reintroduce volatility if expectations centered on a breakthrough fail to materialize.

Section 1 — Overnight Risk Appetite Rebound and Market Tone

The overnight market environment showcased a notable swing in risk appetite as investors absorbed both political and economic signals pointing toward a potential easing of U.S.-China tensions. The U.S. Treasury Secretary’s comments, framed within a closed-door investor session, framed a path toward de-escalation rather than a confrontation-laden approach to the ongoing trade dispute. This framing appeared to color traders’ risk preferences, pushing broad-based gains in U.S. equity indices and a re-rating of risk assets as a plausible path to more predictable trade outcomes. The S&P 500, Nasdaq 100, Dow Jones Industrial Average, and Russell 2000 each registered gains in excess of 2% on the session, a meaningful reversal from the prior period’s weakness. This broad-based improvement, however, did not erase all technical risk: all four indices traded below their 20-day moving averages, signaling that the market remained cautious and attentive to short- to medium-term trend dynamics rather than fully committing to a sustained breakout. The 20-day moving average is a critical technical benchmark used by traders to gauge the durability of near-term momentum; a move above this average can reinforce confidence in a continued advance, while failure to clear it can keep the market in a range-bound or corrective stance.

In parallel, currency markets reflected a mixed risk posture. The dollar’s initial strength had cooled somewhat, though it remained a central driver of flows in the currency complex. The USD/CHF and USD/JPY registers showed notable gains for the dollar against traditionally safe-haven counterparts, climbing around 1.2% and 0.5% respectively. Such moves are consistent with a scenario in which investors are reassessing the hedging premium that often accompanies heightened geopolitical risk, favoring a more balanced approach in which risk assets are pursued but with an awareness of potential policy-driven volatility. The net effect of these moves was a more nuanced risk environment: while equities moved decisively higher, the currency backdrop suggested that some participants were still evaluating the durability of the improvement, particularly if any new trade headlines emerged.

In the broader market narrative, investors watched closely for further clarity on policy direction and trade policy. The combination of improved risk sentiment and tentative technical footing created a setup that could sustain short-term gains if de-escalation pathways persist, or yield a retracement if headlines pivot toward more aggressive tariff rhetoric or unexpected policy shifts. The balance between optimism about a potential thaw in trade tensions and vigilance regarding the possibility of renewed conflict was central to the day’s price action. Market participants also noted that a number of underlying drivers—such as corporate earnings momentum, domestic monetary policy expectations, and global growth trajectory—could interact with evolving trade dynamics to shape the tempo and scope of subsequent risk-on episodes.

Section 2 — US-China Trade De-escalation Signals and Impacts on Equities

The market’s early pulse seemed to align with the prospect of reduced trade frictions between the United States and China. The narrative favored the expectation that the U.S. might pursue a more conciliatory stance on tariffs and leverage in negotiations, consistent with a broader strategy of seeking stability to support domestic growth and investment. In this frame, equities began to extend gains as investors recalibrated the risk-reward calculus associated with the trade dispute. The movements in major U.S. indices reflected a re-rating that acknowledged a potentially less punitive tariff environment, a factor that would contribute positively to corporate earnings and global supply chains.

The conversation around tariffs and trade policy took on a more nuanced tone as market participants weighed various statements and signals from policymakers. On one hand, there was a sense that tariffs could eventually come down substantially, easing the path for imported goods and raw materials and reducing the fiscal drag on businesses operating in global supply chains. On the other hand, the market remained sensitive to the possibility that any adverse policy shifts could reintroduce volatility and alter the pricing of equities, currencies, and commodities. The tension between optimism about de-escalation and caution about policy risks underlined the importance of monitoring the evolving policy dialogue for further clarifications, timetables, and specific tariff actions.

From a technical standpoint, U.S. equity futures and cash indices were positioned to respond to new information with flexibility. The S&P 500 and Nasdaq 100 futures pointed toward continued upside potential in the near term, provided the de-escalation narrative persisted and was reinforced by policy commitments and credible communications. However, the negative risks remained tangible: if headlines failed to deliver on de-escalation promises or if new constraints emerged—whether from negotiations or domestic policy debates—investors could reassess risk appetite quickly. This dynamic underlined the importance of an adaptive trading approach that weighs macro signals against hard data, including inflation trends, growth indicators, and corporate earnings trajectories in the sectors most exposed to international trade and supply chain disruptions.

Historically, the relationship between U.S.-China policy developments and equity market performance has been pronounced. When risk sentiment improves on de-escalation signals, equity markets tend to rally across broad indices, with leadership often seen from cyclicals and technologically oriented equities that are sensitive to global demand and supply chain health. Conversely, if the trade dialogue stalls or regresses, investors tend to reprice risk, with higher volatility and a tendency for rotation into more defensive assets. The present environment, characterized by cautious optimism, suggests that market participants are calibrating exposures to reflect a more balanced risk-reward profile. This dynamic could favor assets that historically perform well in the context of orderly progress in negotiations, such as large-cap growth and technology shares with global reach, while also maintaining a broad-based exposure to economically sensitive sectors that would benefit from a more favorable trade regime.

Section 3 — Asia-Pacific Equity Response and Safe-Haven Movements

In the Asia-Pacific session, major benchmarks responded positively to the improved mood on U.S.-China relations and the prospect of de-escalation. Japan’s Nikkei 225 registered a solid rally, rising around 2%, as investors priced in more favorable global growth prospects and a potential stabilization of export-driven demand. Hong Kong’s Hang Seng Index advanced by roughly 2.4%, reflecting the net positive influence of improved risk sentiment on regional equities. The broader regional reaction suggested that investors were pricing in a scenario where trade tensions abate and global trade activity could gradually regain momentum, a development that would support regional earnings and export-oriented economies.

Safe-haven assets, which had previously surged amid higher risk during the negotiation phase, showed a shift in strength. In particular, the gold market exhibited a marked reversal, with XAU/USD falling about 1.3% by the close of the U.S. session. This retreat followed a brief surge that had brought gold within striking distance of intraday highs near $3,500, illustrating how quickly price action can pivot when risk appetite improves. The pullback in gold prices did not erase the asset’s longer-term role as a hedge against inflation and policy uncertainty, yet it did indicate that traders were prioritizing appetite for risk and the potential for more stable macro conditions in the near term. The intraday price dynamics underscored the delicate balance between risk-on flows and the ongoing need for safe-haven hedges in times of uncertainty.

The currency response in Asia mirrored the nuanced risk environment. With risk sentiment turning more positive, domestic currencies in the region found themselves navigating a landscape of divergent forces: some currencies benefited from a more stable external backdrop, while others faced downward pressure if the dollar remained firm or if external risk premia declined. In this environment, traders watched for signs of confirmatory data—such as regional trade figures, capital flows, and central bank communications—that could either reinforce the risk-on bias or prompt a re-pricing of risk assets in the event of new developments in the U.S.-China dialogue.

Section 4 — Gold, Safe-Haven Demand, and the Dollar Dynamics

The gold market’s intraday journey in this environment provides a useful case study in the interplay between risk sentiment and hedging behavior. After trading near record or near-record levels in prior sessions, gold experienced a sharp reversal as risk appetite improved and traders sought to reduce hedges built during the peak tension period. The move lower, by about 1.3%, to around $3,381 per ounce, reflected a combination of profit-taking by some investors and a diminished need for a robust hedge against immediate geopolitical risk if trade tensions appeared to be moving toward de-escalation. The intraday high near $3,500 had represented a psychological and technical milestone, underscoring how price action can reflect the mood swings around trade policy expectations.

Despite the near-term pullback, gold remained comfortably above its 20‑day moving average, a sign that the market still recognized its role as a longer-term hedge amid uncertain macro conditions. The 20-day moving average usually acts as a dynamic support level, and in this case, it provided a cushion around the $3,170 area. The enduring proximity to this level suggested that while the immediate risk premium had softened, the structural case for gold as a risk-off asset remained intact for investors seeking diversification or inflation hedging in their portfolios. The price path of gold, therefore, indicated a split-market dynamic: short-run risk-on sentiment prevailed but did not erase the underlying concerns about growth stability, policy trajectories, and the potential for volatility if trade negotiations were to derail again.

On the currency front, the dollar’s relative strength versus safe-haven currencies remained a key barometer of risk sentiment. The USD/CHF and USD/JPY movements highlighted that, even within a broader risk-on backdrop, the greenback retained a strategic position in portfolios that require liquidity and risk management. The relative strength of the dollar can influence commodity prices, cross-border investment decisions, and carry trade dynamics, which in turn can shape the behavior of other asset classes over varied time horizons. Market participants continued to monitor whether the dollar’s strength would persist as de-escalation signals translate into real policy actions and tangible improvements in trade relations, or whether risk-on flows would eventually push the dollar into a consolidation phase as investors reassess hedging and funding dynamics in a more balanced global environment.

Section 5 — IMF World Economic Outlook Update and Global Growth Outlook

The IMF’s latest World Economic Outlook update added a new layer of realism to the market narrative by revising down growth prospects for a broad set of economies amid ongoing U.S. trade tariffs and broader trade tensions. The global growth forecast for 2025 was reduced from 3.3% to 2.8%, signaling a meaningful downgrade that underscores how tariff regimes and trade policy uncertainty can blunt investment, disrupt supply chains, and weigh on productivity gains. This downgrade reflected the IMF’s assessment that the drag from trade policy actions would remain an important determinant of macroeconomic performance across multiple regions, including advanced economies and emerging markets. The global downgrade underlined the sensitivity of growth projections to policy decisions, tariff regimes, and the evolving balance between demand-side and supply-side factors in the global economy.

Within this framework, the IMF’s assessment updates could influence central bank policy expectations, particularly in economies with exposure to trade-sensitive sectors and export-oriented industries. Markets anticipant that slower global growth could translate into more accommodative or patient central bank stances in some jurisdictions, even as inflation dynamics and domestic demand conditions remain uneven across countries. The IMF’s outlook highlights the risk to investment and employment in sectors most closely tied to international trade flows, and it underscores the possibility that persistent trade tensions could constrain the global recovery trajectory. Investors may respond by recalibrating portfolio allocations toward assets that historically perform better in a lower-growth, policy-dovish environment, while maintaining diversification to manage idiosyncratic risks associated with regional policy mix, currency volatility, and sector-specific exposures.

Overall, the IMF’s revisions amplify the importance of watching trade negotiations and policy signals that could either ease or intensify the global growth headwinds. The market’s reaction to these macro updates—tending to favor risk-on assets when de-escalation appears credible and more cautious positioning when policy ambiguity remains high—signals that investors are prioritizing resilience and flexibility in their portfolios. The challenge for investors is to balance exposure to cyclical equities and growth-oriented assets with hedges against potential downside risks arising from policy missteps, tariff spikes, or abrupt changes in risk sentiment.

Section 6 — Technical Setup: Japan 225 CFD Index and Key Price Levels

The price action of the Japan 225 CFD Index, serving as a proxy for the Nikkei 225 futures, showed a bullish gap-up relative to its 20-day moving average, accompanied by a positive momentum reading in the hourly RSI indicator. This configuration suggested that the index might extend its mean-reversion rebound that had been in progress since its swing low on 7 April at 30,343. The technical setup provided a framework for trading decisions over the near term, with clearly defined critical levels to monitor: support at 34,315 and resistance at 35,730 and 36,450, the latter two levels aligning with the 50-day moving average, which often acts as a longer-term barometer for price trends. If the index manages to hold above 34,315, the bullish tone could persist, paving the way for further upside as momentum remains supportive. A break below 34,315, however, would invalidate the immediate bullish tone and shift attention toward more intermediate support levels at 33,680 and 32,425 in the initial downside scenario.

These levels offer a structured approach for traders to assess continuation versus reversal risks in the near term. The bullish gap-up and positive RSI momentum readings indicate a favorable setup for a continued mean-reversion rebound, but the price action remains contingent on broader market dynamics, including the pace of de-escalation in U.S.-China tensions, global growth signals, and domestic policy developments. Traders should remain mindful of potential volatility spikes around economic data releases and policy announcements that could disrupt the short-term technical ordering or trigger swift price re-pricings in the index. The interplay between technical indicators and macro news will likely shape the amount and direction of exposures in futures and related exchange-traded products tied to the Japan 225.

Section 7 — Investor Outlook: Valuations, Portfolios, and Opportunities

With valuations having surged in 2024, many investors have grown wary about allocating additional capital to equities, particularly in segments that appear richly priced relative to historical norms. The market narrative centers on whether the pace of gains can be sustained in an environment characterized by high valuations, ongoing macro uncertainty, and potential policy shifts. Investors are weighing the risk-reward dynamics of adding exposure to the broad equity market versus seeking opportunities in pockets of the market where fundamentals remain supportive and risk-adjusted returns appear more compelling.

A key area of focus for investors is the diversification of portfolios to balance growth potential with downside protection. Strategies that emphasize a mix of income-generating assets, defensively positioned equities, and select cyclicals with resilient earnings streams can help manage macro risk while preserving the potential for appreciation if de-escalation milestones materialize. In the current climate, investors may also consider evaluating sectors whose performance is closely tied to global trade and supply chain dynamics, given that any improvement in U.S.-China relations could translate into higher demand, more stable production pipelines, and improved earnings visibility in export-oriented economies. At the same time, risk management remains essential: the market’s sensitivity to policy communications, tariff decisions, and geopolitical developments suggests that positions should be structured with clear risk controls, including defined stop levels, hedges against currency movements, and an assessment of liquidity to weather potential volatility bursts.

Moreover, investors should consider the role of technology and growth equities in the portfolio as potential beneficiaries of a more stable and predictable policy environment, especially if trade tensions recede and global capital expenditure begins to pick up. However, this should be balanced with a critical appraisal of earnings momentum, valuation multiples, and the degree of concentration risk within any single sector or stock. A disciplined approach to rebalancing, combined with a robust framework for monitoring macro indicators, earnings quality, and policy cues, can help investors navigate the evolving risk-reward landscape and position themselves to capture potential upside while mitigating downside risk.

Section 8 — Market Implications, Risks, and Forward-Looking Scenarios

Looking ahead, the market rests on a delicate balance between the improving risk appetite implied by de-escalation signals and the persistent risks embedded in global trade policy, inflation dynamics, and geopolitical tensions. A credible and sustained de-escalation trajectory could help lift equity valuations further, particularly in sectors tied to international trade and global supply chains, and could support a more benign risk premium environment. Conversely, a failure to translate political rhetoric into tangible policy steps could reintroduce volatility and reprice risk assets downward, particularly if tariff expectations shift again or if economic data show signs of deterioration. The near-term path will thus depend on both the momentum of policy communications and the interpretation of macro data points, including growth indicators and inflation readings that influence central bank policy expectations. Traders will also watch for shifts in currency dynamics, as a persistent or renewed dollar strength can weigh on commodity prices and cross-border earnings, potentially offsetting some of the gains seen in equities.

In this context, diversification, active risk management, and a clear understanding of policy risk are essential for investors seeking to navigate a market environment characterized by evolving dialogue on trade and growth. The potential for volatility remains a timely consideration, as markets are likely to respond rapidly to new developments in the U.S.-China relationship, as well as to any changes in IMF assessments or major central bank communications. Investors should prepare for a range of scenarios, from incremental improvements in trade relations to more abrupt policy shifts, and consider hedging strategies to manage cross-asset risk while remaining adaptable to shifting market dynamics. The emphasis should be on maintaining a resilient portfolio framework that can weather a broad spectrum of potential outcomes, while remaining receptive to opportunities that may arise from a constructive and credible de-escalation path.

Section 9 — Conclusion

In summary, the overnight and early-session market dynamics reflected a renewed risk-on posture driven by signals of potential de-escalation in the U.S.-China trade dispute. U.S. equity indices posted meaningful intraday gains, even as they traded below their 20-day moving averages, underscoring a cautious optimism about the path forward and the possibility that policy actions could reduce tail risks associated with trade tensions. The U.S. dollar broadly strengthened against safe-haven currencies, though the overall currency environment revealed a nuanced mix of hedging behavior and risk appetite shifts. Asian equity benchmarks followed suit with notable gains, as reflectivity of de-escalation optimism lifted regional markets, while safe-haven demand in gold receded from intraday highs as risk appetite improved. The IMF’s global growth downgrade reinforced the view that trade policy remains a crucial determinant of macro momentum, a theme that is likely to influence market behavior in the near term.

Technically, the Japan 225 CFD Index showed signs of strength with a bullish gap above its 20-day moving average, supported by a positive momentum reading, suggesting the potential for continued upside if the de-escalation narrative holds. However, clear levels of support and resistance emerged: 34,315 as a critical near-term support, with 35,730 and 36,450 acting as the primary resistance and a reference to the 50-day moving average. A break below 34,315 could revive bearish momentum and bring intermediate supports at 33,680 and 32,425 into focus. The broader market narrative centered on balancing the improved risk sentiment with ongoing policy risks, and the path forward would likely hinge on the credibility and durability of de-escalation signals, the evolution of the IMF’s global-growth outlook, and the data points that drive central bank policy expectations. Investors are advised to remain vigilant for continued volatility, maintain well-diversified portfolios, and prepare for a range of outcomes as negotiations and policy developments unfold.

Conclusion

This evolving market backdrop indicates that risk appetite remains sensitive to the trajectory of U.S.-China trade talks, with a potential de-escalation path providing a catalyst for continued gains in equities and a moderation in safe-haven flows. The IMF’s growth downgrade emphasizes the importance of policy coordination and structural reforms to support a more resilient global expansion, even as headline risk remains a constant companion for investors. Technical readings across major indices—particularly the Japan 225 CFD Index—highlight the value of monitoring critical support and resistance levels in conjunction with momentum indicators to inform near-term trading decisions. As the market navigates this complex mix of policy signals, economic data, and geopolitical developments, a disciplined, diversified approach—emphasizing risk management, long-term fundamentals, and tactical exposure adjustments—remains the prudent path for investors seeking to capitalize on potential upside while guarding against unexpected reversals.