I’m watching the economy and markets with a careful eye as we begin a new year, recognizing that history provides useful context for understanding current trends and anticipating how they might unfold in financial markets. The most critical themes today revolve around the scale of the federal debt, how debt levels interact with growth and inflation, and the split between what markets are discounting and what the broader economy is actually delivering. The following analysis revisits those macro forces, unpacking how debt dynamics, tax receipts, and interest payments shape the investment landscape, and how political events and global shifts influence the currency regime we live in. The goal is to build a narrative that helps explain the gap between stock-market performance and the lived reality of many businesses and households, while outlining the implications for asset allocation and risk management in the near to medium term.

The Debt Landscape and Its Macro Implications

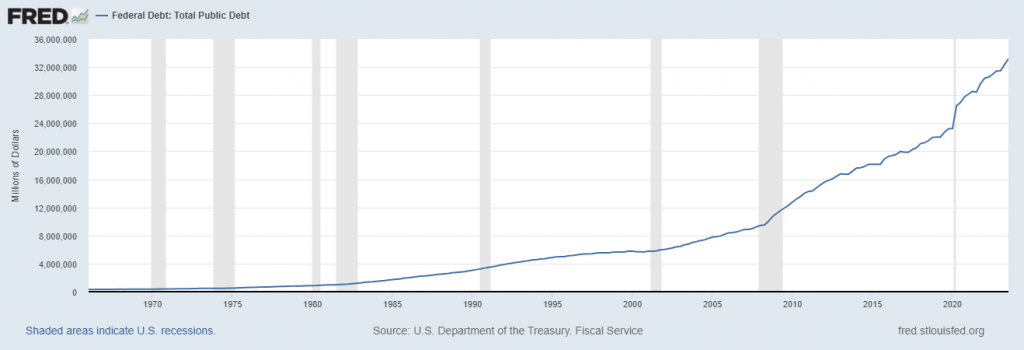

Federal debt recently surpassed the extraordinary milestone of 34 trillion dollars, a level that stands as the highest in U.S. history and, by any measure, not a cause for celebration. The size of the debt is more than an amount; it is a structural influence on every corner of policy, economy, and markets. In the last five years alone, federal debt has grown by roughly 55 percent. That pace of expansion is nearly inconceivable in absolute terms and presents a set of questions about sustainability, long-run growth, and the price of capital. When we frame debt relative to the country’s output, the situation becomes even more stark: the debt-to-GDP ratio has risen sharply since the mid-2000s, and since the 2008 financial crisis, the United States has operated in a mode that resembles an ongoing experiment with money creation being used to support fiscal objectives. The implication is not merely a numerical uptick in liability figures; it is the emergence of a structural condition in which the economy is increasingly financed by debt that must be serviced with future tax and revenue streams.

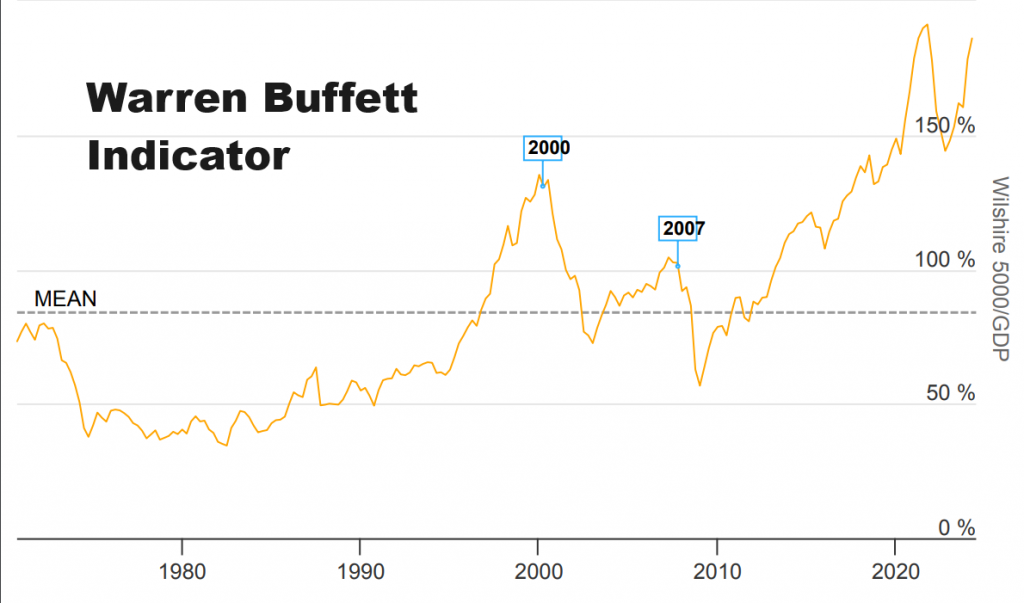

The broader narrative around debt has taken on a tone of complacency from some political and policy circles, who frequently characterize the economy as “strong and resilient” and insist that “debt does not matter.” Those slogans, while perhaps comforting to some audiences, struggle to reconcile with observable economic mechanics and market behavior. A core discrepancy underpins this debate: the stock market can show impressive gains even when the underlying economy operates with less buoyant momentum—especially when favorable liquidity conditions and low real-interest rates support asset prices. In 2023, the major stock indices posted notable gains, but that performance did not uniformly reflect broad strength across the real economy or corporate earnings trajectories for most firms.

To put the numbers in perspective, the leading 2023 stock performers posted double- and triple-digit returns. NVIDIA surged by about 239 percent, Apple rose roughly 48 percent, Microsoft about 57 percent, Alphabet (Google) around 59 percent, Amazon about 81 percent, Tesla near 102 percent, and Meta Platforms roughly 194 percent. These figures are undeniably impressive and indicative of powerful momentum in select segments of the market, particularly in technology platforms and semiconductors. Yet, a more grounded view—based on conversations with a wide swath of business owners across sectors—suggests that many firms experienced revenue pressures, earnings compression, and margins that did not reflect the exuberance seen in certain high-flyer tech equities. This divergence between a few standout performers and a broader economic reality underscores the core theme: there is a meaningful disconnect between what is driving equity markets and what is unfolding on Main Street.

A focal point of this disconnect becomes more pronounced when examining the confluence of several critical indicators: the national debt, the debt-to-GDP ratio, federal tax receipts, and the interest payments on the debt. Taken together, these variables point toward a sustained pattern of currency debasement and fiscal risk that could intensify over the medium term. The debt burden translates directly into annual interest obligations, which absorb an increasing share of fiscal resources and crowd out other forms of spending. Meanwhile, tax receipts—rooted in transactional activity—tend to move in tandem with the level of economic exchanges. When transactions slow or stall, tax inflows diminish, which compounds the challenge of financing deficits and servicing debt. The resulting dynamic creates a feedback loop that can erode fiscal space and raise concerns about long-run flexibility in economic policy.

In this context, the case for currency risk grows clearer. If debt continues to rise relative to GDP and tax receipts trend lower, the government may rely more on borrowing or monetizing deficits, which can contribute to depreciation pressures on the currency. The structural implication is that a nation’s monetary stance, fiscal posture, and the pace of debt accumulation become intertwined with inflation dynamics and the purchasing power of the currency. The narrative many observers are watching centers on whether debt dynamics will continue to force a broader shift in policy, or whether policy responses will dampen the negative implications and keep financial conditions relatively stable. The reality is nuanced: policy makers face competing pressures between sustaining demand, avoiding a sharp shock to markets, and maintaining confidence in long-run solvency. All of this matters for investors who must evaluate the odds of continued currency debasement versus the potential for policy tightening to restore balance to the macro economy.

Looking ahead, it is worth noting how the outlook for debt interacts with the political calendar and the broader economic environment. The 2024 election year adds a layer of complexity to fiscal decisions, as spending commitments and revenue projections come under greater scrutiny and political negotiation. Historical patterns suggest that elected governments may expand spending to support growth or voter sentiment, sometimes without fully offsetting revenue or credible long-range consolidation measures. Even where policy rhetoric emphasizes restraint, the practical reality of balancing competing priorities—military aid, domestic programs, subsidies, and social spending—can tilt the trajectory of deficits higher in an environment where growth expectations and revenue streams are uncertain. The stakes are high: if the trajectory remains unabated, the combination of rising debt service costs and constrained revenue could intensify concerns about fiscal sustainability and the stability of the financial system. In short, debt dynamics are a central, overarching driver of economic expectations and market sentiment, shaping the risk landscape for a broad range of asset classes.

As the year unfolds, the answering questions revolve around what can be done to navigate a system where traditional levers—tax hikes or spending reductions—face political friction and practical constraints. The core challenges are not merely about the size of the deficit; they are about the interplay between debt service, the ability to raise revenue through taxes or growth, and the effect of those dynamics on inflation, interest rates, and market valuations. In this sense, the 34 trillion-dollar debt figure is not just a statistic but a lens through which to view policy tradeoffs and the risk environment for investors who must decide where to place capital in a world where currency debasement remains a plausible long-run trend.

Market Performance vs Economic Reality: The Disconnect

The relationship between the stock market’s performance and the underlying health of the economy has grown increasingly complex. In 2023, the S&P 500 delivered a strong return, underscoring the market’s capacity to price in favorable conditions and supportive monetary conditions. Yet beneath the headline performance lies a more nuanced story about divergence. The robust equity gains do not necessarily reflect a broad-based uplift in corporate revenues or the economic activity of the broader business landscape. Instead, they highlight the extent to which select sectors—most prominently technology, software, and related platforms—were able to benefit from favorable liquidity, investor appetite for growth, and strategic corporate positioning. This disconnect is not merely academic; it translates into practical implications for portfolio construction, risk assessment, and expectations for future returns.

To illustrate the point, the performance of the top stock contributors in 2023, while impressive, should be read in context. The gains achieved by NVIDIA, Apple, Microsoft, Alphabet, Amazon, Tesla, and Meta reflect a concentration of market leadership within a subset of high-growth, high-visibility tech and AI-enabled businesses. These firms benefited from ongoing demand for computing power, cloud services, and digital ecosystems, along with strategic positioning in AI, semiconductors, and platform-enabled business models. However, the broader economy did not uniformly experience an acceleration in demand or a universal uplift in earnings across all industries. The result is a market that rose on expectations for continued resilience in certain segments while many smaller and mid-sized firms faced revenue pressures, margin compression, or slower growth trajectories. The tension between stock-market resilience and real-economy weakness creates an environment in which investors must sift signal from noise and consider trajectories that diverge from headline indices.

From a macro perspective, that divergence can be traced to several structural forces at work. First, there is the effect of ultra-eaccommodative monetary policy and the role it plays in sustaining asset prices when growth is uneven. Second, there is the behavior of global capital seeking safe or liquid assets even amid domestic uncertainties, which can inflate valuations disconnected from underlying cash flows. Third, there is the resilience of certain business models that are better positioned to benefit from sweeping changes in technology, digitalization, and efficiency gains, even if many other sectors do not mirror that success. Taken together, these forces produce a market environment in which a relatively small number of names contribute outsized gains while much of the economy encounters more modest growth or contraction.

This pattern prompts a closer look at the key data points that feed into the macro outlook. The national debt level and the debt-to-GDP ratio provide a gauge of the fiscal scale that policy makers must manage and the potential constraints on future policy. Federal tax receipts offer a barometer of the currency’s health—how transactional activity in the economy translates into government revenue. Interest payments on the debt trace the ongoing cost of servicing past deficits and the sensitivity of the fiscal account to rising rates or larger debt loads. The combination of these indicators helps illuminate the risk of a persistent pattern of currency debasement and the possible need for structural adjustments to the economy, including taxation, spending, and monetary policy. In the absence of meaningful reform or credible consolidation measures, the risk environment for investors may shift toward a longer horizon of higher inflation expectations and greater currency risk, with implications for diversified portfolios and hedging strategies.

In sum, while a brisk equity rally in 2023 demonstrated the market’s capacity to price in optimism and policy support, it did not erase concerns about the economy’s underlying trajectory. The debt trajectory, tax-revenue dynamics, and the rising burden of interest payments paint a cautionary picture in which the risk of currency debasement and macro instability remains a central consideration for investors. The stock market’s performance should not be interpreted as an unambiguous signal of robust economic health; rather, it reflects a more complex interplay of policy, liquidity, sectoral leadership, and investor psychology. Those who attempt to read the economy solely through the lens of one metric or one asset class risk misunderstanding the broader risk environment and may underestimate vulnerabilities that could emerge as debt servicing costs rise and growth moderates.

Tax Revenue, Interest Payments, and the Cost of Debt

Taxes are fundamentally transactional in nature, tied to the occurrence of economic exchanges. They are the fiscal bridge that converts individual and business transactions into revenue for the state. This principle highlights a core vulnerability: when transactions slow due to downturns, weak demand, or market stagnation, tax revenue tends to dry up. The health of public finances, then, hinges on the vitality of the economy’s trading activity—the frequency and scale of purchases, sales, and other taxable transactions that generate revenue for government operations. In periods when economic activity slows or becomes less dynamic, the resulting decline in tax inflows can coincidentally amplify deficits, creating a challenging feedback loop that complicates stabilization efforts. This linkage underscores why policymakers emphasize the need for a robust, dynamic economy to underpin the treasury’s revenue system.

Examining this relationship raises a basic but fundamental question: how can a robust, strong, and resilient economy coexist with a persistent decline in annual tax receipts? If the tax base is shrinking or not expanding in step with policy ambitions or debt servicing obligations, then the fiscal framework becomes increasingly fragile. The reality is that tax policy alone cannot fully compensate for a structural weakness in growth or a demand slowdown. The implication for asset markets is that tax receipts, as a proxy for economic activity, can serve as a leading indicator of fiscal space and the capacity to fund expenses without resorting to further borrowing or monetization.

Consider the trajectory of tax receipts alongside debt service costs. When tax receipts contract, as observed in a 13 percent decline year over year in some periods, it suggests that the pace of economic transactions is not sufficient to sustain broader fiscal aims without additional borrowing or policy accommodations. This contraction challenges the conventional notion of a “strong and resilient” economy and underscores the importance of examining underlying activity, not just headline growth rates or market performance. The tax channel is a reminder that the fiscal system relies on the pulse of the economy: when that pulse falters, government revenue suffers, potentially forcing adjustments that may come with their own set of market and macroeconomic consequences.

Next, turning to the chart of interest payments on the federal debt, a critical question emerges: what does it imply when debt service costs rise as tax revenues shrink? An environment in which interest on the national debt grows exponentially while tax receipts decline by double-digit percentages signals a fundamental mismatch between government obligations and its revenue-generating capacity. In such a scenario, the possibility of a fiscal crisis—sometimes described as a sovereign-debt crisis—gains plausibility. The drivers behind escalating interest costs can include refinancing risk, higher interest rates, or simply the growing base of outstanding debt that must be serviced. The consequence for the economy and financial markets is multifaceted: higher debt-service burdens can crowd out productive spending, increase sovereign risk premiums, and place pressure on the credibility and resilience of the fiscal framework.

Notably, in 2023, rating agencies removed some of their concerns by downgrading U.S. debt, with Moody’s and Fitch signaling credit rating adjustments. Such downgrades serve as a stark reminder that credit markets are attuned to the evolving debt landscape and understand that fiscal dynamics are a fundamental determinant of risk and returns. Turning to 2024, an election year, the political calculus surrounding debt and deficits becomes especially salient. While the relationship between debt levels and presidential elections is not deterministic, several general patterns can be observed: incumbent or governing parties tend to increase spending in various forms to stimulate growth or appeal to voters, which can widen deficits if revenue gains do not fully offset these outlays. The policy mix—whether it favors tax cuts, increased spending, or a combination of the two—can have meaningful implications for the debt trajectory, the path of interest rates, and investors’ expectations for inflation and currency value.

The macro implications of these dynamics extend beyond immediate policy concerns. If debt levels accelerate faster in the upcoming years, investors may seek assets that benefit from currency debasement or inflationary pressure, while avoiding assets that would be most vulnerable to a rising rate environment or a deteriorating fiscal outlook. This perspective reframes the investment calculus: rather than simply chasing traditional hard assets or cash equivalents, investors may gravitate toward assets with hedging characteristics or those that can perform in a high-debasement environment. If the U.S. dollar’s purchasing power continues its long-run decline, the relative attractiveness of different asset classes—such as equities across certain sectors, precious metals, or alternative assets like digital currencies—could shift in a way that reflects the perceived trajectory of the currency and the fiscal outlook.

A critical takeaway is that the health of federal finances has a direct bearing on the market’s risk premium, the yield on Treasuries, and the attractiveness of other sovereign or corporate funding instruments. As interest payments rise and tax receipts face headwinds, the market’s assessment of risk and return adjusts accordingly. This dynamic has real consequences for borrowers and lenders, for investors seeking diversification, and for policymakers who must balance the competing imperatives of growth, stability, and solvency. In this context, it becomes essential to scrutinize the debt service burden in relation to the broader fiscal framework, to monitor the policy mix and its implications for inflation and growth, and to consider how investors should structure exposures to navigate a potential environment of sustained currency risk and fiscal pressure.

Fiscal Politics, Debt Ceiling, and the 2024 Electoral Context

The state of the federal budget and the political battles over spending are central to understanding the near-term trajectory of markets and the economy. The looming debt-ceiling deadlines in January and February cast a long shadow across Capitol Hill as lawmakers wrestle with how to fund government operations through September. The task of reconciling competing priorities—reducing discretionary spending to comply with caps, while also addressing urgent needs such as emergency aid to foreign allies and domestic programs—forms the core of the current political drama. Fiscal hawks within the Republican ranks have pressed for spending reductions that would bring annual outlays below previously reached caps, and the negotiation dynamics are complicated by strategic considerations tied to the election cycle and the broader geopolitical context.

Beyond the debt ceiling, the policy debate touches on broader questions about long-term fiscal sustainability. The question of how to finance spending—whether through revenue enhancements, policy reforms, or a mix of approaches—remains central to both the political discourse and the market’s expectations for growth and inflation. In an election year, policy proposals and political signals can become a focal point for market participants who attempt to anticipate the likelihood of tax changes, spending packages, and regulatory shifts. These factors feed into asset valuations, risk appetite, and volatility, not merely through the direct fiscal impact, but through the broader confidence channel that governs investment decisions.

The debt-ceiling negotiation process intersects with other pressing issues on the congressional agenda. Lawmakers are considering emergency aid packages for Ukraine and Israel, geopolitical considerations that add a layer of complexity to the fiscal calculus. Additionally, discussions about unrelated U.S. border-security provisions may be proposed as part of broader spending packages or as riders on must-pass legislation. This confluence of domestic and foreign policy priorities has important implications for the economic outlook and the risk climate for financial markets. The way these issues are resolved—or delayed—will influence the liquidity environment, the cost and availability of credit, and investor expectations about future inflation and growth.

An important point for investors and analysts is that the recent performance of U.S. Treasuries has been tepid relative to expectations, with a tendency among buyers to cluster near the shorter end of the yield curve and to avoid longer-duration securities. This behavior signals a preference for lower-duration risk amidst uncertainty about the trajectory of deficits and interest-rate movements. The debt ceiling stalemate compounds these dynamics by injecting a political risk premium into the sovereign debt market. The net effect is a challenging environment for capital allocation, where the risk-return calculus must account for both macroeconomic fundamentals and political risk, including the possibility of policy inaction or last-minute negotiations that disrupt funding flows.

The stubborn reality remains that the aggregate federal debt figure—standing at historical highs—acts as a perpetual reminder of the structural fiscal challenges facing the United States. Without meaningful adjustments to the balance of tax receipts and government spending, the debt level and interest costs are likely to remain a dominant consideration in policy discussions and market pricing. The consequence for portfolios is clear: investors must consider strategies that can withstand scenarios in which currency value erodes, borrowing costs rise, and the fiscal framework experiences recurrent shocks as political processes unfold. The path forward rests on a combination of sober policy choices, disciplined risk management, and a clear understanding that fiscal dynamics will continue to shape the investment landscape in meaningful ways.

In this context, the key takeaway is that until the essential metrics—Federal Debt, Interest on the Debt, Debt-to-GDP, and Federal Tax Receipts—show sustained improvement, claims of a strong and resilient economy should be viewed with caution. The lack of visible improvement in these core indicators implies that the narrative of resilience may be more reflective of policy support and market liquidity than of foundational economic strength. Consequently, attention should turn toward strategies and markets that have demonstrated resilience to currency debasement and macro volatility, while also avoiding cash and cash equivalents—such as direct positions in U.S. Treasuries—that are vulnerable to the erosive effects of inflation and a depreciating currency. In this framework, the priority becomes identifying assets and markets that have historically shown durability in the face of currency debasement and fiscal stress, while maintaining a vigilant stance toward risk management and capital preservation.

Currency Debasement, De-Dollarization, and Global Shifts

A central theme shaping the investment landscape is currency debasement—the gradual erosion of a currency’s purchasing power through a combination of fiscal expansion, inflation, and monetary policy dynamics. As the debt burden grows and policy options evolve, the prospect of persistent currency debasement becomes more plausible. The alternatives available to policymakers—such as tax increases or other fiscal measures—may be constrained by the political cycle, particularly in a presidential election year. If those levers are limited or delayed, currency debasement may persist as a principal mechanism through which deficits are managed, or at least tolerated, in the near term. This has important implications for investors who must decide how to protect purchasing power and where to allocate capital to preserve real returns.

The currency narrative has grown more complex with the rise of de-dollarization—the gradual diversification of foreign reserves and trade settlement away from the U.S. dollar. Beginning to gain traction in 2023 among major economies, notably the BRICS coalition and aligned partners, de-dollarization reflects a strategic desire for greater financial autonomy and resilience against the pressures of dollar-denominated debt. BRICS, along with the inclusion of new participants and the shifting role of Saudi Arabia in global energy markets, signals a broader reconfiguration of the international monetary order. While the United States will remain a dominant economic actor for the foreseeable future, the trend toward multi-currency settlement and diversified reserve holdings contributes to a more complex and potentially more volatile international financial environment.

The shift away from the dollar does not inherently signal weakness in the United States; rather, it indicates that other nations are seeking a more balanced and resilient international monetary architecture. The implications for U.S. investors and policymakers are multifaceted. On one hand, de-dollarization could pressure the dollar’s reserve currency status over the long run, influencing capital flows, inflation dynamics, and the relative cost of foreign indebtedness. On the other hand, a more diversified global financial system could create new opportunities for hedging currency risk, accessing alternative markets, and integrating different inflation and growth dynamics into investment strategies. The crucial takeaway for market participants is to recognize that global shifts in currency regimes amplify uncertainty and require more sophisticated risk management approaches, including cross-asset diversification, currency hedging considerations, and a nuanced understanding of global macro forces.

Looking forward, the global financial narrative has crystallized around a clear division between traditional dollar-based mechanisms and a growing array of alternatives that seek to reduce exposure to U.S. monetary policy conditions. The alignment of geopolitical, economic, and monetary developments points to a future in which currency risk remains a salient factor for investors. The strategy for navigating this environment involves recognizing the structural forces at play—debt dynamics, inflation expectations, and the evolving currency regime—and translating that understanding into asset allocations that reflect long-run risk-adjusted prospects. Rather than assuming that the dollar will perpetually confer stability, market participants should prepare for scenarios in which diversification across currencies and assets protects against unexpected shifts in the balance of power within the global monetary system.

In this broader context, the investment opportunity set expands beyond traditional equities and bonds to include assets that historically demonstrate resilience to currency moves and inflationary pressures. Gold, diversified commodity exposures, and select digital assets may play a role in hedging against currency risk, while equities with strong pricing power, secular growth, and robust balance sheets may offer defensible upside in inflationary regimes. The precise mix will depend on evolving macro signals, policy trajectories, and the confidence investors place in central-bank credibility amid fiscal pressures. The bottom line is that currency debasement and de-dollarization are key structural themes that will influence the risk landscape, liquidity, and asset valuations in the years ahead, and investors should incorporate these dynamics into both tactical and strategic plans.

The Investment Outlook: AI-Driven Trends and Risk Management

The core of successful investing in this context hinges on understanding market movements, rather than chasing the latest headlines or conventional narratives. The market’s true signal often lies in price action and the rhythm of supply and demand, which can be captured and interpreted more effectively through advanced tools and models. Artificial intelligence and machine-learning-enabled trading software are evolving rapidly, offering the potential to parse vast datasets, detect subtle patterns, and adapt to changing conditions with greater speed and precision than human analysts alone. The central premise is simple: the most reliable barometer of market direction is the movement of prices themselves. Everything else—the narratives presented by financial media, the sentiments of investors, and even macro forecasts—are secondary or even distracting when the objective is to forecast price trajectories. In practice, this means centering decision-making on objective signals derived from data-driven models, rather than on episodic news flow or episodic policy announcements.

Historical experience across domains—whether in games like poker and chess or in complex strategic environments—shows that models capable of learning from errors, adapting to changing conditions, and generalizing beyond past outcomes can outperform humans who rely solely on intuition or static frameworks. Machine learning and AI have demonstrated their capacity to improve decision-making by learning from missteps and updating expectations in response to new information. In trading, this translates into models that refine their understanding of market regimes, volatility dynamics, and price-amplitude relationships as they accumulate more data and experience. While no system can guarantee success, the potential for AI-driven forecasting to enhance precision, reduce bias, and automate disciplined execution is an important frontier for traders and institutions.

One practical implication of this perspective is a shift away from attempting to anticipate the exact sequence of political or macro events and toward embracing a robust framework for trend identification, risk control, and position sizing. Traders must consider the three critical questions that govern performance: how large to trade (position sizing), how long to hold a position (duration or time horizon), and what to trade (asset class and instrument). In a regime characterized by currency risk, high debt service costs, and volatile policy dynamics, the calibration of these three dimensions becomes essential. A disciplined approach to risk management—anchored in stop-loss discipline, portfolio diversification, and a framework for ongoing evaluation of model performance—helps mitigate the downside when models encounter regime shifts or unexpected shocks.

Alongside AI-driven trend analysis, it remains important to evaluate inflation signals, the state of the bond market, and the relative attractiveness of different asset classes. Even when inflation appears persistent or the CPI indicates elevated price levels, price action and market-implied expectations about future policy and growth provide critical information that should inform allocation decisions. The bond market’s stability, for example, is a key barometer of fiscal and macro risk. A deteriorating bond market or rising yields can signal concerns about debt sustainability and the credibility of fiscal policy, which may have ripple effects across equities, currencies, and commodities. The interplay between AI-driven signals and fundamental macro indicators can offer a more holistic view of risk and opportunity, enabling traders to navigate complex regimes with greater clarity.

At the same time, it is essential to acknowledge the substantial risks involved in trading and to exercise caution and discipline. The market environment described here is characterized by high uncertainty, structural debt pressures, and evolving global dynamics that can lead to abrupt and large price movements. The use of leverage, rapid trading, and complex derivatives can magnify losses as well as gains. Therefore, it is important to recognize that trading stocks, futures, options, forex, and ETFs carries significant risk and is not suitable for everyone. Investors should only risk capital they can afford to lose and should carefully assess their own financial situation, objectives, and risk tolerance before engaging in any trading activity. The objective in adopting an AI-driven approach is not to promise profits, but to enhance decision-making through data-driven insights and rigorous risk controls.

The overarching theme is that the combination of currency risk, debt dynamics, and policy uncertainty creates a challenging but potentially navigable landscape for investors who are disciplined, data-driven, and willing to adapt to evolving regimes. AI-enabled forecasting and trend analysis can be valuable tools in this context, but they work best when integrated into a broader framework that emphasizes risk management, diversification, and a clear understanding of market structure. In practice, this means using AI to identify and confirm trends, manage risk, and optimize exposure across asset classes, rather than relying on any single signal or event to drive decisions. This approach helps to reduce reliance on headlines and sustains a focus on objective price behavior and robust risk controls.

Important note: There is a substantial risk of loss associated with trading. Only risk capital should be used to trade. Trading stocks, futures, options, forex, and ETFs is not suitable for everyone. DISCLAIMER: Stocks, futures, options, ETFs and currency trading all have large potential rewards, but they also carry large potential risks. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you cannot afford to lose. The information provided here is not a solicitation or an offer to buy or sell futures, options, stocks, or currencies. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed. The past performance of any trading system or methodology is not necessarily indicative of future results. Simulated performance results have limitations, including the possibility that they are not reflective of actual trading conditions, lack of liquidity, and the benefit of hindsight. No assurances are being made about the likelihood of profit or loss from any strategy.

The bottom line is clear: the path to navigating this environment hinges on a disciplined, data-driven approach that leverages AI-driven trend analysis while maintaining rigorous risk controls and a diversified exposure framework. The potential rewards exist, but they are balanced by meaningful risk, and success requires careful planning, ongoing evaluation, and a willingness to adapt as conditions evolve.

Conclusion

The year ahead is charged with the weight of accumulated debt, shifting currency dynamics, and evolving political decisions that together mold the risks and opportunities for investors. The 34 trillion-dollar federal debt is not merely a statistic; it is a strategic constraint that informs policy choices, interest costs, and the sustainability of government programs. The relationship between stock-market performance and the real economy remains nuanced, with notable leadership in a handful of high-growth sectors coexisting alongside broader economic pressures on many businesses. Tax receipts, as a proxy for transactional activity, alongside rising interest payments, illuminate a fiscal path that could trend toward currency debasement if deficits remain large and revenue growth stalls. The 2024 political landscape—debt-ceiling negotiations, spending debates, and geopolitical commitments—adds a layer of uncertainty that manifests in bond-market behavior and risk premiums across assets.

Global shifts toward de-dollarization complicate the outlook further, signaling a more diverse and potentially more volatile monetary system in the years ahead. While the dollar will likely remain dominant in the near term, the broader trend toward multi-currency financial arrangements and reserve diversification underscores the need for investors to reassess hedging strategies, currency exposures, and cross-border asset allocation. Against this backdrop, the investment approach that emphasizes objective price movement, disciplined risk management, and AI-assisted trend analysis offers a framework for navigating uncertainty. The emphasis on three pillars—position sizing, time horizon, and asset selection—remains central as traders seek to extract value while limiting downside risk in a world where currency debasement and fiscal risk are salient, ongoing features of the macro landscape. The ultimate aim is to prioritize markets and trends that demonstrate resilience in the face of currency erosion, while avoiding overreliance on cash and cash equivalents that are susceptible to inflationary pressure.

In closing, the fiscal, monetary, and geopolitical forces described here suggest a long-run context in which debt dynamics and currency shifts will continue to shape asset prices, policy responses, and investment opportunities. The prudent path combines a sober assessment of macro risk with a disciplined, AI-supported approach to trend identification, risk control, and portfolio diversification. The year ahead will test the resilience of investment theses, but a well-structured framework that integrates data-driven insights with prudent risk management can help navigate the uncertainties that lie ahead.