The following analysis revisits decades of monetary policy, the signals the Fed has sent about future tightening, and how those moves interact with the broader economy through the lens of inflation, growth, debt, and market dynamics. It also explores the enduring role of technology, especially artificial intelligence, in shaping modern trading decisions and risk management, while examining the structural tensions that permeate financial markets in a highly leveraged, policy-dependent environment.

The Fed’s History and the Central Planning Paradigm

From its inception, the Federal Reserve has been seen by many observers as a central authority responsible for steering macroeconomic outcomes through a blend of liquidity management, interest rate discipline, and credit allocation. In this view, the Fed operates as a technical planner with knowledge and control over the levers that determine employment, inflation, and growth. The author of this analysis does not claim mastery or perfect foresight; rather, the piece challenges the prevailing notion that centralized planning by the Fed yields optimal results across all cycles. The aim is not to demean the Fed’s expertise but to interrogate the fundamental paradigm that underpins its operating framework: that tried-and-true tools—primarily interest rate adjustments and monetary expansion—can reliably direct the economy toward desired outcomes.

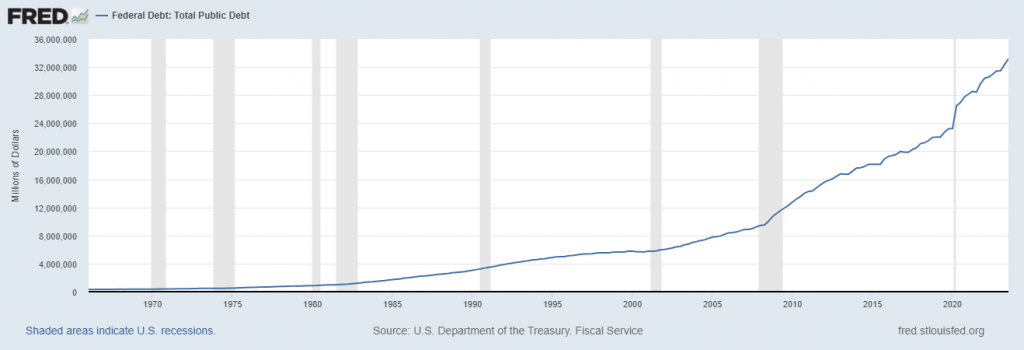

Over the last three decades, the Fed has repeatedly pursued a policy stance characterized by near-zero interest rates, followed by quantitative easing and an extended period of monetary stimulus. The justification offered for this approach has been the belief that cheaper money would spur economic activity, create jobs, and lift productivity. The narrative has often framed policy as a mechanism to lower the cost of capital, encouraging investment and hiring, while dampening the friction that can hinder growth. Yet, the experience of this period has been ambiguous. On one hand, unemployment has often shown relatively favorable readings, and certain sectors have benefited from cheap credit. On the other hand, debt levels have climbed, and inflationary pressures have re-emerged or persisted, even as GDP growth has slowed and the structural dynamics of the economy have evolved.

The central question remains: does the sustained glide path toward cheaper money and expanded balance sheets deliver the broad, durable gains that policymakers envision? The analysis presented here contends that this is not a trivial yes-or-no proposition. It argues that the pattern of policy over the last 30 years has produced certain macroeconomic outcomes—high debt loads, slower real growth in some episodes, and a different inflation regime—that complicate any straightforward claim about the long-run efficacy of central planning through monetary policy. This section sets the stage for a broader examination of how the Fed’s approach interacts with the complex fabric of the economy, and why skeptics argue that the paradigm of centralized control may not always yield the intended benefits.

The interplay between policy design and real-world outcomes is inherently intricate. Policy decisions reverberate through financial markets, the housing sector, consumer credit, and corporate financing. The Fed’s judgments about the path of interest rates, the pace of asset purchases, and the timing of balance-sheet adjustments all influence expectations, risk appetites, and the cost of capital for households and businesses. Because monetary policy is implemented through channels that affect many adverse and beneficial sides of the economy at once, the consequences are rarely linear or perfectly aligned with policymakers’ intentions. This complexity invites careful scrutiny of what policy has achieved, what it has failed to address, and what risks it might pose in the future. The central argument of this section is not a binary critique of the Fed but a call for a nuanced assessment of how the central planning paradigm operates in practice, and what that implies for households, investors, and the broader economy.

As the decades have advanced, the Fed has faced evolving macroeconomic landscapes—technological change, globalization, demographic shifts, financial innovation, and episodic shocks. Each cycle has required recalibration of the policy framework, often within the constraints of political pressure, financial stability considerations, and the evolving structure of the economy. The tension between crisis-management tools and long-run sustainability has therefore intensified. This section outlines the historical arc of that tension, highlighting how the central planning approach has shaped, and in some cases constrained, economic outcomes. It also emphasizes the importance of examining policy with a view toward unintended consequences, trade-offs, and the possibility that sustained stimulus can alter the behavior of borrowers and lenders in ways that persist even after policy normalization.

In sum, this section provides a comprehensive look at the historical ethos and practical realities of Fed policy as a central organizing force in the economy. It frames the ensuing discussion about signals of tightening, recession risk, and market dynamics, while maintaining a critical perspective on the long-run implications of a policy environment dominated by central planning through monetary tools. The goal is to illuminate how the past informs the present, and how present policy choices may shape the next phase of the economic cycle.

The Fed’s Interest Rate Policy Over Three Decades

Monetary policy in recent decades has revolved around the pursuit of stable prices and maximum employment, but the means and timing of policy actions have continuously evolved. The policy toolkit has included adjustments to the policy rate, asset purchases, and signals about the future stance of monetary policy. This section analyzes how the Fed has navigated this terrain over the last thirty years, focusing on the recurring theme: the use of low interest rates and expansive balance sheets to stimulate demand, followed by periods in which policymakers have contemplated tightening to address inflationary pressures or financial stability concerns.

The narrative of “cheaper money to spur growth” has framed policy in a way that treats credit availability as a primary driver of economic activity. When the policy rate sits near zero, the cost of capital for households and firms is reduced, incentivizing borrowing, investment in equipment and infrastructure, and hiring. The hope has been that these channels would translate into higher productivity, stronger GDP growth, and ultimately sustained employment gains. Yet the outcomes have been mixed across different episodes and sectors. While unemployment may have fallen during periods of easy policy, debt levels have risen, asset prices have surged, and inflation has reasserted itself in various forms, calling into question whether monetary stimulus alone can deliver a stable, long-run equilibrium.

The Fed’s balance sheet expansion has also been a defining feature of this era. Quantitative easing and other non-traditional policy tools broadened the Fed’s role in financial markets, absorbing risk, supporting liquidity, and influencing the pricing of risk assets. Advocates argue that such interventions prevented deeper recessions and stabilized markets during tumultuous times. Critics counter that prolonged balance-sheet growth can distort incentives, encourage risk-taking, and create moral hazard—encouraging leverage or behavior that relies on the continuation of supportive policy. This section canvasses both sides of the debate, describing how the policy stance has evolved in response to shifting macroeconomic conditions and how market participants have learned to interpret policy signals as they navigate risk and opportunity.

A key theme in this analysis is the tension between policy actions and real-economy outcomes. The interplay of inflation dynamics, wage growth, productivity gains, and demand components has complicated the simple equation of “low rates equal high growth.” There have been episodes where the policy stance appeared to align well with the economy’s needs—supporting employment during downturns or providing liquidity during stress. There have been other episodes where the longer-term consequences, such as asset-price inflation, rising debt burdens, and potential misallocation of capital, raised questions about whether policy was over- or under-estimating the true state of the economy. This section examines those episodes, highlighting the lessons learned and the uncertainties that remain as policymakers prepare to respond to evolving conditions in a forward-looking manner.

The discussion also touches on how market expectations have evolved in response to policy communications. Forward guidance, dot plots, and other policy communication tools have become increasingly important in shaping investor behavior. The ability to anticipate the Fed’s moves—whether it will tighten gradually, accelerate the pace of rate increases, or pause to assess incoming data—has become a central determinant of risk pricing and asset allocation. Traders, analysts, and financial institutions invest substantial effort in interpreting these signals, but misreads and timing errors are common. This section emphasizes the importance of understanding policy timing, the limits of predictability, and the role of data formakings in shaping the expected trajectory of policy. It also considers how the policy framework interacts with financial stability considerations, given the elevated levels of debt and the vulnerabilities that may arise if policy shifts occur abruptly or if credibility is challenged by misalignment between expectations and reality.

Ultimately, the past three decades illustrate that monetary policy can be a powerful tool, but it operates within a broader system of economic forces. The effectiveness of the Fed’s policy actions depends on how households and businesses respond, how credit markets price risk, and how the global economy interacts with domestic conditions. This analysis thus seeks to present a nuanced understanding of the long-run implications of the rate policy and the balance-sheet approach, while acknowledging that the policy environment continues to evolve in response to shifting structural conditions, political pressures, and financial-market dynamics.

Signals from the Fed and Market Expectations for Rate Hikes

In the financial press and among market participants, there has been a recurring theme: moments of signaling about stopping asset purchases and beginning an ascent in interest rates. The narrative often frames these signals as near-certain policy moves, drawing attention to supposed schedules of rate increases for the coming years. The reality, however, is more nuanced. The Fed’s communications are subject to interpretation, data dependence, and the ever-changing context of inflation pressure, labor markets, and financial conditions. This section unpacks what has been communicated, how it has been received, and what it may mean for the feasibility and timing of a sustained tightening path.

Over recent months, messages attributed to the Fed’s leadership and the Federal Open Market Committee (FOMC) have suggested a plan to halt bond purchases and to raise policy rates incrementally. Media commentary has frequently treated these statements as gospel, projecting a cadence of four rate hikes in 2022 and three more in 2023. Those projections, while influential, rest on assumptions about a stable macro picture: a straightforward path for inflation to ease, for growth to stay on a robust trajectory, and for the economy to withstand tighter financial conditions without experiencing stress that would derail expansion. The article argues that such projections require careful scrutiny, as they depend on the millions of moving pieces that comprise the economy, plus the market’s own expectations about policy.

From a theoretical standpoint, the feasibility of the projected rate hikes hinges on several interlocking conditions. First, inflation dynamics must respond to tightening without triggering disproportionate harm to demand, households, and the broader credit environment. Second, growth must remain resilient enough to absorb higher borrowing costs without tipping into recession. Third, financial conditions must not deteriorate too rapidly, ensuring that credit continues to flow to households and firms. Fourth, the labor market must exhibit persistence in strength, avoiding a scenario in which rate hikes erode employment gains or wage growth, thereby undermining consumer demand and the engine of growth. Each of these conditions is interdependent, and policymakers must weigh trade-offs when deciding how to proceed.

The broader market response to policy signaling is equally critical. Asset prices, yield curves, and credit spreads react to perceived changes in the path of policy. When investors interpret a forthcoming tightening cycle as imminent, they may reprice risk, adjust durations, and rebalance portfolios. Conversely, if data surprise to the downside, markets may push back on anticipated tightening and assign greater probability to a more gradual path or to delays in normalization. The tension between the policy’s intended stimulus effects and the potential destabilizing effects of higher rates is a central feature of this discussion.

Another layer to consider is the role of the banking system as a conduit for policy transmission. While the Fed sets the policy stance, the consequences for lending standards, liquidity conditions, and credit risk are mediated by banks and other financial institutions. If the banking system remains robust and willing to extend credit at reasonable terms, a tightening path may be absorbed with less drag on growth. If, on the other hand, credit channels show signs of stress, even modest rate increases could weigh on investment and consumption through higher borrowing costs and tighter liquidity.

The section also explores the risk of misalignment between communication and market reality. The notion that policy can be perfectly pre-emptive or that forecasts always materialize exactly as predicted is optimistic at best. Financial cycles, geopolitical developments, and sudden shocks can disrupt the intended path, producing scenarios in which the expected tightening either accelerates or stalls unexpectedly. The possibility of policy miscalibration—where the signs of inflation and growth diverge from what policymakers anticipate—poses a potential risk to both macro stability and market confidence.

In sum, the signals and the anticipated path of rate hikes depend on a multitude of data points and judgments about how those data will evolve. The potential for deviation from the projected sequence is real, and the consequences of such deviations can be wide-ranging. This section underscores the importance of maintaining a flexible framework, grounded in a careful assessment of inflation, growth, employment, financial conditions, and the broader macro landscape. The market’s interpretation of Fed communications will continue to shape asset prices, risk sentiment, and investment strategies, even as the underlying economic dynamics evolve in unexpected ways.

Recession: Individual vs Aggregate, Four Scenarios

The term recession is commonly understood in everyday language as a contraction in one’s personal economic circumstances. If someone faces a wage cut or loses hours, they may describe their experience as a personal recession. Yet, when economists analyze the economy as a whole, the term takes on a much more nuanced meaning. Aggregate economic analysis focuses on combinations of gross domestic product (GDP) growth and inflation, and how these two macro measures interact to shape economic trajectories. There are four primary configurations to consider: inflation rising or falling, and GDP growth rising or decelerating. Each combination carries distinct implications for policy, markets, and households.

The four configurations can be summarized as follows:

- Inflation falling, GDP growth accelerating

- Inflation rising, GDP growth accelerating

- Inflation falling, GDP growth decelerating

- Inflation rising, GDP growth decelerating

This framework helps to classify the economy’s current position and to anticipate policy responses. Before engaging with Fed edicts and pronouncements, it is essential to place the economy within this four-quadrant map, recognizing that the current dynamic may not fit neatly into a single quadrant for any prolonged period. A robust analysis considers the trajectory of both inflation and growth, and how policymakers might respond to evolving data in each scenario.

In the present context, the observation is that inflation is increasing while GDP growth is decelerating. This particular quadrant—rising inflation coupled with slowing growth—represents a challenging condition for policy. It creates what many describe as a stagflationary pressure, complicating the Fed’s task of maintaining price stability without undermining economic momentum. In a scenario like this, the central bank faces a delicate balancing act: tighten too aggressively and risk pushing a fragile economy into a downturn; ease policy to support growth and risk allowing inflation to become more entrenched. The article emphasizes that this combination is among the most troublesome for policymakers because it suggests that traditional stabilization tools may deliver incomplete relief or unintended consequences.

Recognizing the current position on inflation and growth, the analysis then considers the likelihood and consequences of policy actions designed to normalize monetary policy in a climate characterized by slower growth and rising prices. It asks: what is the appropriate pace and magnitude of tightening when the economy shows signs of deceleration at the same time that price pressures persist? What are the risks that rate increases could push the economy deeper into a slowdown or trigger a new wave of financial instability? These questions require careful assessment of the broader macro structure, including the acceleration of debt service burdens, the resilience of consumer demand, the health of credit markets, and the sensitivity of investment to higher financing costs.

A critical aspect of this discussion concerns the interpretation of data and the role of expectations. If households and businesses anticipate continued inflation, they may adjust behavior in ways that sustain higher price levels, thereby complicating the path to disinflation. If, conversely, expectations become anchored toward a more accommodative stance, the central bank may find it easier to navigate a tempered tightening cycle that avoids dramatic shocks. The four-scenario framework helps to avoid oversimplified conclusions and encourages a disciplined exploration of how inflation and growth interact over time, as well as how policy might respond in a way that supports sustainable expansion without stoking instability.

In summary, the four-scenario lens provides a structured way to analyze the macro landscape beyond single-point forecasts. It invites policymakers, investors, and researchers to consider how the economy might evolve under different combinations of inflation and growth, and to prepare for policy responses that are neither abrupt nor brittle. This approach highlights the complexity of macroeconomic management in real time and reinforces the importance of data-driven, flexible policymaking in the face of uncertain outcomes.

Inflation vs GDP Growth: The Four Scenarios and the Current Position

A keen understanding of macroeconomic dynamics requires distinguishing the nuanced interactions between inflation and GDP growth. The four-quadrant framework described earlier helps illuminate how the economy can evolve under different combinations of these two pivotal indicators. The current position, with inflation trending upward and GDP growth showing signs of deceleration, places the economy in a particularly precarious corner. This intersection has significant implications for policy, markets, and households, and it underscores why the path of monetary policy remains a central question for observers and participants across the financial spectrum.

To grasp the present regime, one must examine how price pressures arise and how they respond to demand and supply conditions. Inflation can accelerate due to demand-driven factors, supply constraints, wage dynamics, commodity price shocks, or a mixture of these elements. The persistence or transience of inflation depends on how quickly price signals are transmitted through the economy, how long it takes to adjust expectations, and how effectively policy responds to shifting conditions. In a climate where inflation is rising, the central bank’s primary concern is to avoid a self-reinforcing cycle in which higher prices feed into higher wages and further price increases. When inflation is strong but growth is slowing, policy faces a tightrope: tightening too much could stall activity, while loosening could let inflation get out of control.

GDP growth decelerating points to subdued economic momentum. A decelerating growth path can be caused by weaker investment, lower consumer spending growth, productivity constraints, or external headwinds such as trade frictions or geopolitical tensions. The combination of rising inflation and slower growth implies a shrinking margin for error. Policy normalization must be calibrated to avoid overtightening while still addressing inflationary risks. For households, this dynamic translates into higher costs of living, potential pressures on wages, and a changing landscape for employment opportunities. For firms, it means assessing the cost of capital, the viability of expansion plans, and the resilience of supply chains under a tighter monetary regime.

From an investment perspective, this current configuration emphasizes the sensitivity of asset valuations to changes in discount rates and expectations about future earnings. Higher inflation raises nominal discount rates, which can compress the present value of future cash flows. Slower growth reduces the pace at which earnings can expand, creating a double whammy for equities in the absence of offsetting drivers such as productivity improvements or structural demand. Fixed-income markets, in turn, respond to the real yield environment, with the inflation premium and the expectation of future policy moves shaping the slope and level of the yield curve. The four-quadrant framework thus provides a robust lens to interpret market behavior and to anticipate plausible policy choices as conditions evolve.

The analysis also considers the role of external factors in shaping inflation and growth trajectories. Global supply chains, commodity markets, currency dynamics, and geopolitical tensions all influence domestic inflation through import prices and capital flows. Delays or accelerations in these external channels can tilt the inflation-growth balance in unexpected directions. The slow pace of growth can reflect structural factors such as aging demographics, sectoral shifts, or productivity challenges, which policy must address beyond mere demand-side stimuli. In this sense, macroeconomic management becomes a more complex enterprise than a straightforward stabilization exercise, requiring attention to structural reforms, efficiency gains, and resilience-building across industries.

In summary, the current position—rising inflation paired with decelerating GDP growth—demands careful policy consideration and a measured approach to normalization. The four-quadrant framework remains a valuable tool for evaluating future scenarios and the associated risks. It reminds readers that the economy cannot be reduced to a single narrative; instead, it warrants a multidimensional analysis that accounts for data, expectations, and the subtle feedback loops that characterize modern monetary policy and its consequences for households and markets.

The Yield Curve as a Recession Indicator

Across financial markets, the yield curve stands as a primary barometer for recession risk. The standard signal—an inverted yield curve, where shorter-term rates exceed longer-term ones—has historically foreshadowed economic contraction with a meaningful lag. The conceptual logic is that when investors demand higher yields for short maturities relative to long-term bonds, it signals concerns about near-term growth and a preference for the safety of longer maturities. The widely observed pattern is that yield-curve inversions have often preceded recessions, making the curve a focal point for traders, policymakers, and analysts seeking to understand the trajectory of the economy.

In this analysis, the yield-curve spread between the 2-year Treasury note and the 10-year Treasury note has been a central metric. The observed spread has narrowed significantly in the recent period, moving to a level around 41 basis points, with fluctuations into the upper 30s in prior days. The narrowing spread has drawn particular attention because it coincides with the period during which the Federal Reserve has signaled or considered policy tightening through rising interest rates. The critical question is whether the spread will continue to contract to the point of inversion, at which time a recession is historically anticipated within a six-month horizon, or whether policy adjustments or market dynamics might arrest a further decline in the spread.

A fundamental premise of this discussion is the limitation the Fed faces in raising rates further without tipping the economy into a recession. Each incremental increase in the policy rate tends to widen the difference between short- and long-term yields in practice, but the relationship is not monotonic or guaranteed. The spread’s current level—around 41 basis points—reflects both the market’s assessment of the Fed’s capacity to tighten and the market’s expectations about growth, inflation, and the overall risk environment. If the Fed were to move ahead with additional rate increases, the potential for the spread to compress further remains a key concern. At the same time, if the Fed signals patience or a slower rate path, the yield curve could stabilize or even steepen as expectations for longer-term growth and inflation remain anchored in a way that reduces the urgency of near-term tightening.

The article’s central argument is that the yield curve is an essential, time-sensitive gauge of monetary policy’s room to maneuver. Observing the spread provides an empirical read on how much policy tightening the economy can absorb before triggering a negative feedback loop in growth and credit conditions. The reasoning is that the more the curve flattens—or in the worst case inverts—the greater the likelihood that the economy will experience a recession within a relatively short horizon. This logic rests on historical patterns, statistical regularities, and the observation that the yield curve’s behavior tends to reflect the market’s collective assessment of the risks and the policy path.

From a practical trading perspective, yield-curve dynamics significantly influence asset allocation, durations, and hedging strategies. Traders increasingly use these signals to calibrate risk exposure, adjust leverage, and manage the timing of entry and exit points for positions across equities, fixed income, and derivatives. The current environment, characterized by a relatively tight spread but ongoing inflation concerns, creates a nuanced landscape wherein the yield curve’s trajectory—whether it continues to compress, stabilizes, or steepens—will shape short- and medium-term market expectations. In this sense, the yield curve is not merely a static predictor but a dynamic barometer that reflects evolving policy expectations, inflation pressures, and the economy’s momentum.

The examination also considers what occurs when policy incentives interact with the yield curve’s trajectory. If policy moves push the curve toward inverting, the historical pattern of recession risk would be reinforced, potentially prompting investors to reprice risk and adjust portfolios to guard against downside scenarios. Conversely, if the curve avoids inversion due to a more accommodative policy stance or stronger growth signals, investors may pursue risk assets with greater confidence, albeit under the continuing shadow of debt sustainability challenges and inflation risks. The yield curve thus serves as a critical, constantly evolving reference point that integrates economic fundamentals with policy expectations, market sentiment, and the broader macro environment.

In summary, the yield curve’s current configuration is a focal point for assessing the feasibility and timing of policy normalization. The 2-year vs 10-year spread, hovering in the low-to-mid-40 basis-points range, functions as a barometer of policy leeway and recession risk. The possibility of additional rate hikes must be weighed against the risk that the curve could invert, signaling a potential downturn. This section highlights the delicate balance policymakers must strike and underscores the market’s ongoing vigilance as it interprets policy signals through the prism of anticipated macro outcomes.

The Limits of Monetary Policy: Debt, Zombie Firms, and Policy Dilemmas

One of the enduring features of the monetary policy era is a rising level of corporate and household indebtedness. The combination of prolonged low-rate regimes and expansive asset purchases has shaped a financing environment in which many entities—ranging from households to large corporations—have borrowed aggressively. This section delves into the consequences of a policy regime that encourages borrowing, the emergence of “zombie” companies that survive on cheap credit rather than productive profits, and the broader implications for the economy and labor market.

A striking observation is the growth in the balance sheet and the expansion of credit to the corporate sector, including instruments that carry elevated risk. An extended period of low rates has lowered the hurdle for refinancing, enabling firms to rollover debt and maintain operations even when earnings are challenged. This dynamic has contributed to a landscape in which a sizeable portion of publicly traded companies relies on debt service coverage that may be challenged if financing conditions tighten or if earnings deteriorate. In this environment, the concept of “zombie” firms—companies that should fail or shrink under normal market conditions but persist due to ongoing access to funds—appears less fictional and more operational. The existence of these entities raises questions about productivity, resource allocation, and the efficiency of markets in allocating capital to the most productive uses.

Several recognizable companies and sectors have been identified as examples of zombie dynamics, including major retailers and several large corporate players across different industries. The common thread is that these enterprises carry significant debt burdens, rely heavily on external financing, and operate in a competitive landscape where weaker business models could be sustained longer than historically typical due to the policy environment. The consequences for the broader economy include constraints on employment growth, slower productivity gains, and potential misallocation of capital toward businesses that might not survive in a more austere financing regime. As debt service costs rise with any interest-rate normalization, the risk of restructurings, restructurings of debt, or even bankruptcy considerations increases—especially for those sectors where earnings have been thin for an extended period.

The policy dilemma arises from the tension between preventing a disorderly disruption of markets and avoiding the perpetuation of fragile business models. On the one hand, allowing zombie firms to collapse could unleash a wave of inefficiencies, reallocate capital toward more productive uses, and reduce system-wide risk by clearing excess debt. On the other hand, precipitous or disorderly failure could destabilize credit markets, threaten employment, and provoke a broader economic downturn. The Fed’s mandate is not to rescue every struggling enterprise, but to maintain financial stability and confidence while promoting sustainable growth. The lasting concern is whether a prolonged period of easy policy has made the economy more vulnerable to destabilizing corrections when conditions tighten, and whether the policy response would be adequate to prevent a cascading sequence of bankruptcies, credit strains, and a loss of confidence that could amplify a downturn.

This section also addresses the political economy of monetary policy in a high-debt environment. The incentives to delay tightening, especially in an election year or amid a politically charged climate, can influence the rate path and the credibility of policy actions. If authorities worry about the social and political costs of a recession, they may fear that aggressive tightening could erode support or trigger unintended consequences in the labor market. The central tension is whether policy can preserve continuity and market faith without perpetuating a debt-fueled structure that makes the economy more fragile in the face of shocks. The analysis highlights the need for structural reforms and prudent risk management, ensuring that policy actions do not simply paper over deeper issues but instead create a more resilient macroeconomic framework.

In sum, the limits of monetary policy become most evident when debt levels, zombie firms, and fragile balance sheets interact with rate normalization. The policy dilemma is not simply about the mechanics of interest rates; it is about balancing financial stability, growth, and productivity within a framework that acknowledges the potential distortions created by prolonged stimulus. The economy’s capacity to absorb higher rates without tipping into a more severe downturn depends on a complex mosaic of financial health, earnings quality, and structural adaptability. This section emphasizes the importance of recognizing those limits and approaching policy with a view toward reform and resilience, rather than relying solely on the mechanics of monetary accommodation.

The Fed, Politics, and the Election Year Dynamic

Monetary policy does not operate in a vacuum. The surrounding political landscape, including election-year considerations, can influence how policymakers perceive and respond to risk, inflation, and growth. This section explores the ways in which politics interact with the central bank’s decisions, the incentives that shape this interface, and the consequences for markets and the broader economy.

Over time, there is a recurrent argument that the Fed—though designed to be technocratic and insulated—must contend with political expectations about economic performance and stability. In times of political sensitivity, policymakers may weigh the societal costs of recessionary outcomes against the benefits of credible inflation control. The political calculus can affect the pace of policy normalization, the willingness to tighten, and the messaging that accompanies policy actions. The expectation that the Fed should avoid triggering a downturn in an election year can shape the tempo of rate hikes, the communication of policy intentions, and the perceived independence of the central bank. This dynamic contributes to a broader narrative about the autonomy of monetary policy and the degree to which it can execute a neutral, data-driven path or whether it is inevitably influenced by political considerations.

The analysis also examines the structure of the debt landscape and the role of government policy in shaping market expectations. The cumulative increase in the monetary base and the balance sheet over the last decade has created a framework in which the Fed’s actions have wide-ranging implications for asset prices, financial stability, and the allocation of capital. The political economy dimension includes considerations about how fiscal policy and regulatory changes affect the economy’s resilience, the distributional impacts of policy choices, and the trade-offs between supporting employment and curbing inflation. In this context, the Fed’s capacity to maneuver is seen not only as a technical constraint but as a strategic choice embedded within a complex policy ecosystem.

Additionally, the section confronts the broader market sentiment around the Fed’s credibility and the public’s expectations about policy outcomes. When markets interpret communications as commitments to a tight or lenient path, they adjust pricing, risk premiums, and investment strategies accordingly. A credible, predictable policy framework reduces uncertainty and supports more efficient capital allocation, whereas frequent surprises or perceived inconsistency can destabilize confidence and create volatility. Understanding this dynamic is essential for investors and policymakers, as expectations can become self-fulfilling to a degree, influencing both macro outcomes and the functioning of financial markets.

The political dimension also intersects with the social and economic implications of policy. Policy choices that affect employment, wages, and living costs reverberate through households and communities, shaping political attitudes and civic engagement. In times of economic stress or uncertainty, the public’s perception of the central bank’s independence and effectiveness can have broad consequences for democratic processes and public trust in institutions. This section emphasizes that monetary policy does not exist in isolation from the political environment, and that forecasting policy trajectories requires attention to both macroeconomic data and the political-context signals that accompany them.

In conclusion, the interaction between monetary policy and the political calendar is a critical feature of the current environment. The election-year dynamic adds a layer of complexity to decisions about inflation, growth, and the pace of policy normalization. The Fed’s actions will continue to be interpreted through the lens of political accountability, market expectations, and the evolving macroeconomic backdrop, with consequence for asset prices, risk management, and the stability of financial markets.

The Investor’s Reality: Debasement, Markets, and AI’s Emergence

As money is created and liquidity remains abundant, many observers note a gradual debasement of the currency and a corresponding rise in the prices of financial assets. This section examines the mechanisms behind this phenomenon, the resulting implications for investors, and the evolving role of technology—especially artificial intelligence—in guiding trading decisions in an environment characterized by policy dependence and macro uncertainty.

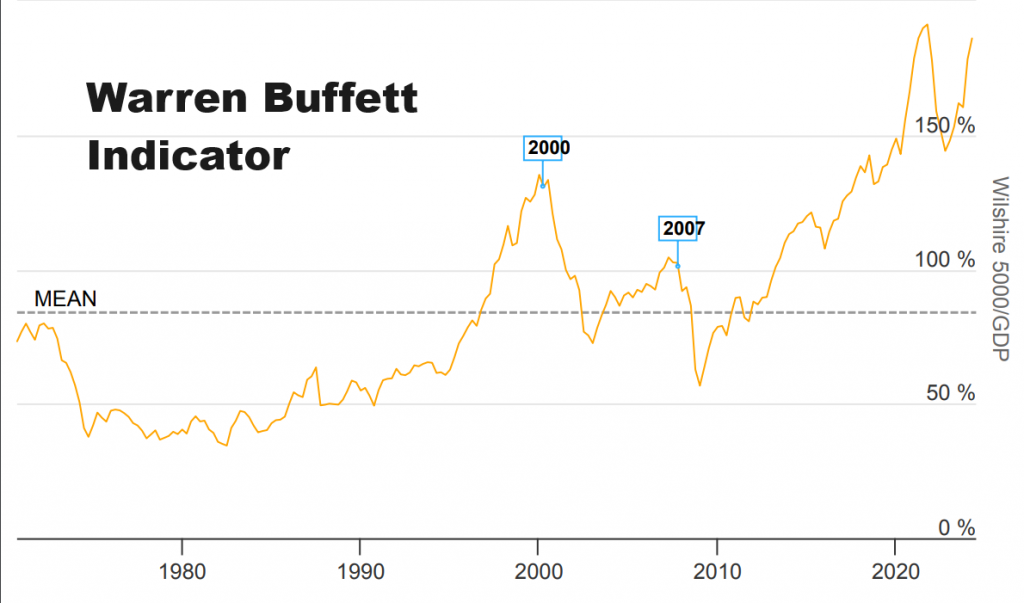

The interplay between monetary expansion and asset prices has been a defining feature of the current era. When central banks supply liquidity to financial markets, the prices of financial assets often move higher as investors seek returns in a climate of comparatively low yields on traditional instruments. This dynamic can lead to a disconnection between asset prices and underlying economic fundamentals, raising concerns about the sustainability of gains and the potential for sharp adjustments if policy conditions or risk appetites change. The analysis underscores that the macro environment—centered on ongoing policy support and the prevalence of debt—creates a landscape in which asset prices may rise even when real economy growth does not keep pace with expectations.

The piece also explores how money printing and policy-driven liquidity influence investor psychology and decision-making. The abundance of liquidity can encourage risk-taking, leverage, and the proactive pursuit of returns in diverse asset classes. In such a setting, investors may become more sensitive to central-bank signals and monetary policy surprises, as these can trigger rapid re-pricing across markets. The resulting volatility can pose particular challenges for risk management and portfolio construction, necessitating robust strategies to monitor exposure, hedging, and concentration risks.

Amid these dynamics, the role of technology in trading has grown substantially. Advanced analytics and machine-learning systems process vast amounts of market data to identify patterns that may precede price movements. The concept of a continuous feedback loop—where models learn from outcomes, refine their predictions, and adjust strategies—has become central to modern trading practice. The analysis emphasizes that AI’s strength lies in its capacity to recognize patterns, test hypotheses, and reduce the certainty gaps that humans often experience due to cognitive biases, emotional influences, and information overload. While AI does not guarantee profits, it offers a framework for more data-driven decision-making, systematic risk controls, and disciplined strategy execution.

The discussion acknowledges that the investment landscape is not solely driven by macro forecasts or policy signals. Microeconomic fundamentals, sector-specific dynamics, corporate earnings quality, and competitive positioning remain critical. The macro narrative sets the broad stage, but the specifics of individual assets, risk premia, and timing must be assessed with careful due diligence and methodical analysis. The convergence of macro policy, market psychology, and AI-powered analytics represents a new paradigm in which information processing, pattern recognition, and machine-learned risk controls coexist with traditional financial analysis and human judgment.

Within this framework, investors are urged to focus not only on whether policy will tighten or ease, but also on how that policy environment influences the risk-reward calculus across different asset classes. The possibility of currency debasement, yield-curve dynamics, and debt sustainability considerations interacts with corporate earnings, capital expenditures, and valuation multiples. This complex mix requires a comprehensive approach to portfolio design, combining macro awareness with rigorous security-level analysis and robust risk management practices.

The section also recognizes that not all investors will experience uniform outcomes. The effectiveness of AI-driven strategies depends on data quality, model assumptions, computational resources, and the ability to adapt to changing market regimes. It is essential to distinguish between metrices of historical performance and the real-world constraints that affect execution, liquidity, and slippage. A responsible approach to AI-enabled trading includes ongoing validation, risk controls, and an appreciation of the limits of predictive accuracy under different market conditions. The emphasis remains on leveraging data, technology, and disciplined processes to support informed decision-making rather than substituting for prudent judgment.

In sum, the macro environment of monetary policy, debt dynamics, and asset-price behavior creates a capacity for investors to navigate a fragile, policy-dependent landscape with greater clarity and discipline when augmented by AI tools. While the policy backdrop may produce uncertainty and volatility, technology can empower traders to identify patterns, manage risk, and adapt strategies in a structured, repeatable way. The broader takeaway is that success in this era depends on integrating macro insights with reliable data-driven techniques, and on avoiding overreliance on any single indicator or narrative.

AI, Machine Learning, and Trading: From Pattern Recognition to Risk Management

Artificial intelligence, neural networks, and machine learning have become increasingly central to the way professional traders approach markets. The core advantage of these technologies lies in their capacity to recognize patterns, learn from outcomes, and refine decision-making processes in ways that humans cannot replicate with the same speed or scale. This section delves into how AI is shaping trading strategies, risk management, and the interpretation of complex market signals in an environment dominated by policy shifts, debt considerations, and volatile sentiment.

A key concept in AI-driven trading is the feedback loop. Algorithms process historical and real-time data to detect recurring patterns, test alternative scenarios, and adjust their forecasts accordingly. Over time, the system refines its understanding of which patterns tend to precede price moves and which environments produce false signals. This dynamic learning process helps reduce the cognitive biases that can affect human traders, such as overconfidence, loss aversion, or the misinterpretation of noise as meaningful trend. By continuously updating its predictive framework, an AI-driven approach can adapt to new market regimes and incorporate a wider array of data sources, including macro indicators, micro-level financial data, and alternative data streams.

The potential advantages of AI in trading include improved pattern recognition, faster processing of market signals, and more systematic risk control. Machines can execute complex analyses that would be impractical for a single human to perform in real time, allowing for more disciplined entry and exit decisions, precise risk budgeting, and dynamic hedging strategies. However, AI-based approaches also face challenges. Data quality, model risk, overfitting, and the risk of crowding effects—where many participants rely on similar signals—can reduce the effectiveness of AI-driven strategies in certain conditions. The article emphasizes that success in this field requires rigorous validation, transparent methodologies, and an ongoing discipline to monitor and adjust models as conditions change.

The narrative around AI in trading also addresses the limits of forecasting. Even the most sophisticated systems cannot guarantee profits, particularly in markets characterized by structural changes, policy surprises, or black-swan-type events. The emphasis is on using AI to augment judgment, to systematically test hypotheses, and to implement robust risk management practices. The human trader remains central to decision-making, with AI serving as a powerful tool for information synthesis, scenario analysis, and execution efficiency.

A notable advantage of AI is its potential to reduce the repetition of avoidable errors. The principle of mistake prevention—learning from what does not work, and then steering away from those pathways—can help traders avoid returning to unsuccessful strategies. This approach aligns with how neural networks are designed to operate: through exposure to large data sets, pattern recognition, and iterative refinement. The result is a mechanism for improving decision quality over time, particularly when combined with experienced risk controls and a well-planned portfolio approach.

The section then turns to practical implications for professional traders. The use of AI can enhance the ability to identify movement opportunities in the market, including potential price movements that may arise from macroeconomic shifts, policy changes, or shifts in investor sentiment. The technology provides a framework for exploring multiple hypotheses simultaneously, assessing their probabilities, and selecting strategies with favorable risk-reward profiles. However, it also demands careful governance, clear performance metrics, and a robust compliance framework to ensure that the strategies align with risk tolerance and regulatory requirements.

Finally, the discussion considers how AI and human judgment can coexist in a way that improves outcomes for investors. Human traders contribute domain knowledge, context, and strategic thinking, while AI contributes speed, breadth of analysis, and disciplined execution. The synergy between these elements can produce a more resilient trading approach, one that remains adaptable in the face of evolving macro conditions and policy signals. In a landscape where policy uncertainty and debt dynamics continue to shape asset prices, leveraging AI as part of a comprehensive risk-management framework offers the potential to improve decision quality, rather than replacing the essential human roles in analysis and strategy design.

Conclusion

The careful examination of monetary policy, recession dynamics, yield-curve signals, debt structures, political influences, and the advent of AI-driven trading reveals a complex, interwoven system whose outcomes depend on many moving parts. The Fed’s approach to maintaining stability through near-zero rates in the past, the inflationary pressures that have emerged, the evolving debt landscape with zombie-like corporate financing, and the market’s ongoing interpretation of policy signals together shape the environment in which households, firms, and investors operate. The yield curve remains a pivotal gauge of recession risk and central-bank maneuvering space, while the presence of debt and policy-dependent incentives raises questions about long-run growth and productivity. Artificial intelligence offers a new dimension to risk management and decision-making, complementing human judgment and reducing the likelihood of repeating costly mistakes.

As readers consider how to navigate this landscape, several themes emerge. First, the macro environment remains highly sensitive to policy signals, data surprises, and shifts in inflation expectations. Second, the alignment (or misalignment) between policy and the real economy will continue to influence financial conditions, credit availability, and the pace of expansion. Third, structural factors—such as debt sustainability, corporate earnings resilience, and productivity improvements—will determine whether the economy can absorb policy normalization without triggering a meaningful downturn. Fourth, technology, specifically AI and machine learning, is reshaping how decisions are made, how risks are measured, and how opportunities are identified, creating a new layer of sophistication for traders and investors.

Ultimately, readers should approach this landscape with a balanced perspective that recognizes both the opportunities and the risks embedded in a policy-driven, debt-laden economy. The interplay of inflation, growth, and policy normalization creates a dynamic environment in which disciplined risk management, diversified strategies, and evidence-based decision-making are essential. The integration of AI into trading adds a powerful tool for pattern recognition and risk control, but it must be employed thoughtfully, with awareness of its limitations and in concert with human judgment and robust governance.

This comprehensive view reinforces the importance of continuous learning, rigorous analysis, and prudent risk management in navigating the modern financial system. It invites investors to consider not only the immediate policy signals but also the longer-term structural forces that will shape asset prices, growth prospects, and capital allocation for years to come. The future of markets depends on a careful blend of macro insight, data-driven analysis, and disciplined execution—an approach that combines traditional wisdom with the transformative potential of technology.

Note: Readers should be aware that trading in stocks, futures, options, ETFs, and currencies carries substantial risk and is not suitable for everyone. Risk capital, informed decision-making, and professional guidance are essential for navigating these markets. This article presents analysis and opinions and does not constitute solicitation or investment advice. Past performance is not indicative of future results, and simulated performance results have limitations compared with actual trading outcomes.