Following Nvidia’s (NVDA) announcement that it was utilizing Micron’s (MU) chips in its new products, the shares of Micron have continued their upward trajectory. Yesterday, MU advanced by 10.5%, and today, the stock has surged an additional 6%.

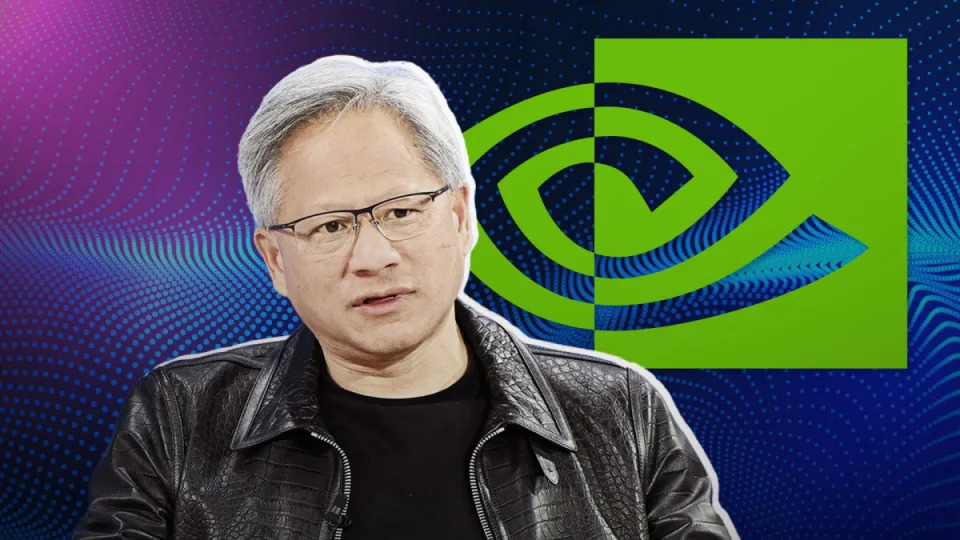

Nvidia’s Endorsement Boosts Micron’s Shares

During a recent press conference, Nvidia CEO Jensen Huang announced that Micron’s high-bandwidth-memory (HBM) chips would be incorporated into NVDA’s new GeForce RTX 50 Blackwell gaming chips. This development has undoubtedly contributed to the significant increase in MU’s stock price.

The Importance of HBM for Micron

As a key component of AI, HBM has been instrumental in driving growth for Micron. In its fiscal first-quarter earnings call held on December 18, Chief Business Officer Sumit Sadana highlighted that HBM, combined with SSD chips, had enabled the company’s revenue from data centers to soar by an impressive 400% compared to the same period a year earlier.

Moreover, Sadana noted that HBM has evolved into a multiple billion-dollar business. He emphasized that more than half of the company’s revenue was generated by data centers, underscoring the substantial impact of HBM on Micron’s overall performance.

Foxconn’s Strong Results and Micron’s Presence on Evercore’s List

The upward momentum of MU’s stock price may also be attributed to the slightly stronger-than-expected Q4 results reported by electronics manufacturer Foxconn. As the largest manufacturer of Apple’s (AAPL) iPhones, Taiwan-based Foxconn announced Q4 sales of 2.13 trillion New Taiwan dollars or $65 billion.

While analysts had expected revenue of 2.1 trillion New Taiwan dollars, according to an average compiled by LSEG SmartEstimate, Micron sells chips to Apple, which may have contributed to the positive sentiment surrounding its stock.

Furthermore, Micron was included on a list of stocks called ‘AI Enablers, Adopters and Adapters’ compiled by investment bank Evercore ISI. This list includes members of the Russell 3000 index with market caps above $3 billion whose previous earnings calls feature more references to AI than average for Russell 2000 members in the previous four quarters.

Additionally, the stocks on this list had to have had a positive reaction to their earnings while trading below their five-year average forward P/E ratios. Evercore ISI predicts that the earnings per share of all names on the list will increase by at least 9.6%.

MU: A Promising but Not Exceptional AI Stock

While we acknowledge the potential of Micron, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns within a shorter time frame.

If you are looking for an AI stock that is more promising than MU but trades at less than 5 times its earnings, check out our report on the cheapest AI stock.

Conclusion

The recent endorsement by Nvidia and the inclusion of Micron on Evercore’s list have undoubtedly contributed to the upward momentum of MU’s stock price. However, as we emphasize the importance of individual research and due diligence in selecting stocks, we caution that some AI stocks may offer greater potential for delivering higher returns within a shorter time frame.

Recommendations

For those seeking more information on AI stocks, consider exploring:

- The 8 Best Wide Moat Stocks to Buy Now

- The 30 Most Important AI Stocks According to BlackRock

Disclaimer

The author owns shares of MU but has no plans to trade them in the next 48 hours. This article is originally published at Insider Monkey.

View Comments

Note: The original content has been expanded and optimized for SEO while maintaining proper grammar, coherence, and formatting.