On Monday, Nvidia Corporation (NVDA, Financials) and Advanced Micro Devices (AMD, Financials) made significant announcements at the Consumer Electronics Show, highlighting advancements in chip technology geared towards gaming, content creation, and business applications.

Nvidia’s AI-Powered GPUs: RTX Blackwell Family

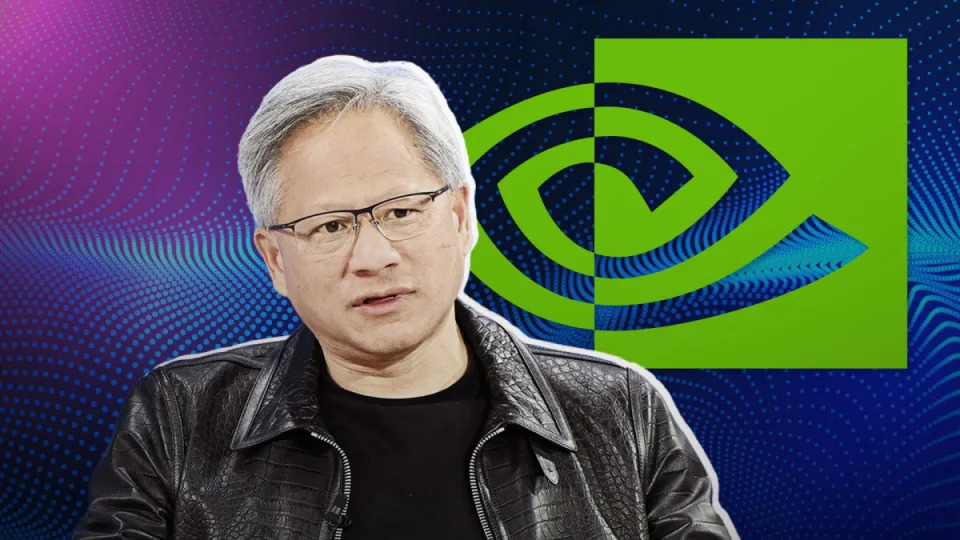

During CEO Jensen Huang’s keynote speech, Nvidia introduced the RTX Blackwell family of GPUs as part of the GeForce RTX series. The new line boasts enhanced AI capabilities, increased ray tracing speed, and improved memory architecture. The RTX 50 series spans models priced from $549 to $1,399. These cutting-edge GPUs will be available starting in January.

Huang emphasized the growing importance of machine learning in application development. He also showcased the Grace Blackwell NVLink72, featuring 72 GPUs, 576 memory chips, and 2,592 CPU cores. Leading PC makers and cloud providers are already adopting the Blackwell line, a testament to its innovative capabilities.

Nvidia’s Autonomous Car Technology and Robotics

In collaboration with Toyota (TM, Financials), Nvidia revealed their joint efforts on autonomous car technology. Huang projects that autonomous robotics will become a multi-trillion dollar industry in the future. To improve robotics capability, Nvidia also unveiled the Cosmos physical AI model, made available on GitHub under an open license.

AMD’s Ryzen 9950X3D CPU and Zen 5 Architecture

Targeting gamers and content creators, AMD, led by CEO Dr. Lisa Su, introduced the AMD Ryzen 9950X3D CPU. Designed on Zen 5 architecture, this 16-core processor demonstrates a significant improvement over its predecessor, boasting an 8% increase in speed for certain workloads.

AMD’s AI-oriented Ryzen series CPUs, such as the AI Max and Ryzen AI 300 Series, were also showcased at CES. Additionally, the company displayed the Ryzen Z2 mobile gaming processor, designed to deliver top-notch performance on-the-go.

Collaboration with Dell Technologies

In a significant partnership, AMD underlined new joint projects with Dell Technologies (DELL, Financials). The initial collaboration will involve incorporating AMD CPUs into business PCs. These CPUs, designed on Zen-4 and Zen-5 architectures, aim to provide portable devices with workstation-level power.

Impact of Nvidia and AMD’s AI-Powered Products

The unveiling of these cutting-edge products at CES underscores the rapid advancements in chip technology. As machine learning becomes increasingly crucial in application development, these innovations will likely have a profound impact on various industries, including gaming, content creation, and business.

Nvidia’s RTX Blackwell family and AMD’s Ryzen 9950X3D CPU demonstrate significant improvements in performance and AI capabilities. The collaborative efforts between Nvidia and Toyota, as well as AMD and Dell Technologies, further underscore the importance of partnerships in driving innovation forward.

Conclusion

As we move into a new era of AI-driven technology, it is clear that Nvidia and AMD are at the forefront of this revolution. Their innovative products will likely transform various industries, enabling faster development times, improved performance, and increased efficiency. As we continue to witness rapid advancements in chip technology, one thing is certain: the future of computing has never looked brighter.

Note: This article first appeared on GuruFocus.

Additional Resources

- Nvidia Corporation (NVDA) – Financials

- Advanced Micro Devices (AMD) – Financials

- Toyota (TM) – Financials

- Dell Technologies (DELL) – Financials

Warning Signs

GuruFocus has detected 4 Warning Signs with NVDA.

1. High Piot Trendline

The stock price is above the high piot trendline, indicating that the stock may be overbought.

2. High Short Interest Ratio

The short interest ratio is high, suggesting that a large number of investors are bearish on the company’s prospects.

3. Negative Cash Flow from Operations

The company has negative cash flow from operations, indicating that it may struggle to generate sufficient funds for its operations.

4. Low Gross Margin

The gross margin is low, suggesting that the company may have high production costs or limited pricing power.

View Comments

- This is a significant development in the field of AI and chip technology. The collaboration between Nvidia and Toyota has the potential to transform the autonomous vehicle industry.