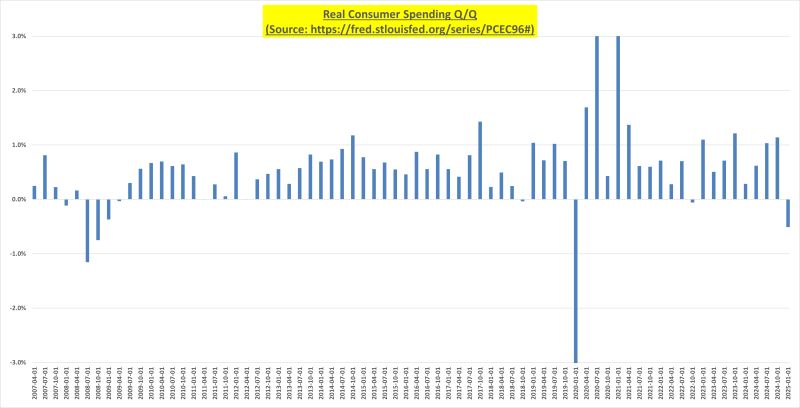

A concise overview of the latest analysis shows how movements in the Economic Policy Uncertainty (EPU) landscape through May 13 align with the broader macroeconomic picture. The log of EPU has exhibited notable volatility, with recent observations placing it approximately two standard deviations away from February levels within the monthly distribution. In parallel, a vector autoregression (VAR) framework that pairs the natural log of Real GDP with the natural log of the Economic Policy Uncertainty index reveals a tangible link: a shock of one standard deviation to policy uncertainty tends to reduce Real GDP by about 0.2 percentage points. The analysis distinguishes temporary versus permanent shocks across quarterly horizons, defining a four-standard-deviation shock in the first quarter as the temporary scenario and a composite of shocks across subsequent quarters to model the permanent scenario. The observed dynamics are contextualized against peak-to-trough recession dates shaded gray to indicate the macroeconomic backdrop during downturns. The analytical setup relies on data derived from standard policy uncertainty measurements and macroeconomic indicators, complemented by professional quantitative assessments. The implications of this study extend to policy considerations, market risk assessment, and forecasting under uncertainty, reinforcing the importance of tracking EPU as a meaningful driver of near-term GDP performance.

Overview of Economic Policy Uncertainty and Data Context

Economic Policy Uncertainty (EPU) represents a broad set of conditions reflecting uncertainty about fiscal policy, regulatory changes, monetary policy stance, and other government actions that can affect business planning, investment, and consumption. In the context of this analysis, the EPU metric is used in its logged form (log EPU) to stabilize variance and interpret proportional changes more naturally. The data window spans an extensive period, typically covering multiple decades, to capture structural shifts, cyclical fluctuations, and regime changes in policy behavior. The standard deviation of the logged EPU provides a statistical gauge of how far observed policy uncertainty deviates from its long-run average within the monthly dataset. The focus on monthly data from 1985 through 2024 establishes a robust baseline, enabling comparisons over deep historical cycles while accommodating evolving policy environments.

Understanding the distribution of log EPU is central to interpreting the observed movements. When log EPU moves by an amount equal to one standard deviation, analysts interpret this as a sizable, yet not extreme, shift in policy uncertainty that is likely to have measurable implications for macroeconomic outcomes. Movements of two standard deviations, as recently observed through February, signal an even more pronounced departure from typical conditions and tend to be associated with heightened risk premia, revised investment plans, and adjustments in hiring and production decisions across sectors. The shading of peak-to-trough recession periods provides a visual cue of the macroeconomic context in which these uncertainty shifts occur, highlighting times when policy uncertainty interacts with downturn dynamics.

Within this context, the daily pattern of EPU data is often summarized by an average trajectory across days, while the monthly series smooths daily noise to reveal persistent shifts in policy environment. The combination of daily fluctuations and quarterly or monthly aggregates enables analysts to identify both short-term spikes and longer-lasting trends in uncertainty. The use of log transformation helps to linearize relationships and makes elasticity-like interpretations possible when relating uncertainty to real macro outcomes, such as Real GDP. The effectiveness of this approach rests on the stability of the underlying data-generating process and the quality of the indicators used to measure policy uncertainty. While the general idea is widely accepted, it is important to recognize potential measurement challenges, including revisions to underlying indices, geographic heterogeneity in policy environments, and differences in the policy-signal content across regimes.

Conceptually, the observed movement of log EPU by about two standard deviations since February indicates a meaningful shift in the policy uncertainty landscape, potentially reflecting a combination of fiscal deliberations, regulatory expectations, geopolitical developments, and macroeconomic tensions. In practice, such a shift can alter the risk premium demanded by households and firms, influence credit conditions through lending standards, and affect the urgency with which policymakers communicate or implement policy changes. The relationship between policy uncertainty and real economic activity is often studied through VAR-type approaches because they accommodate the dynamic interdependencies among macroeconomic variables and allow researchers to trace how shocks to one variable propagate through the system over time. This section sets the stage by outlining the data characteristics, the rationale for log transformations, the role of standard deviation as a depth metric, and the context provided by recession dating.

Key considerations in this section include the following:

- The interpretation of log EPU as a relative measure of uncertainty against a historical baseline, making deviations endogenously meaningful within the model.

- The significance of the standard deviation as a scalable unit for shocks, enabling cross-temporal comparisons of uncertainty magnitude.

- The importance of using a long historical horizon (1985–2024) to capture diverse policy environments, including episodes of fiscal stimulus, regulatory shifts, monetary policy transitions, and periods of geopolitical risk.

- The practical use of recession shading to link observable uncertainty dynamics with established downturn episodes, aiding in the qualitative assessment of risk.

In sum, this section provides a thorough grounding in what EPU represents, why log transformations and standard deviation metrics are employed, and how these choices interact with the broader macroeconomic narrative during the observed period.

Methodology: VAR Model and Impulse Responses

The core analytical tool used to connect policy uncertainty with real economic activity in this study is a Vector Autoregression (VAR) model that jointly encompasses the natural logs of Real GDP and the Economic Policy Uncertainty index. The VAR framework is particularly well-suited for capturing the dynamic, feedback-rich relationships that characterize macroeconomic systems, where policy uncertainty and output can influence each other over multiple time horizons. In this setup, the two variables—log Real GDP and log EPU—are treated as endogenous and their joint evolution is described by a system of equations that regresses each variable on past values of both variables.

A central output of the VAR analysis is the impulse response function (IRF), which traces how Real GDP responds over time to a shock in EPU, holding other factors constant. The finding highlighted in this study is that a one-standard-deviation shock to economic policy uncertainty yields a decline in Real GDP of approximately 0.2 percentage points. This result is interpreted as the short-run compositional effect of an uncertainty shock, reflecting the immediate consequences on real output when policy uncertainty tightens relative to its typical levels. The magnitude—0.2 percentage points—should be understood within the context of the model’s horizon, identification scheme, and the data used to estimate the VAR.

The impulse response analysis explicitly considers a one-standard-deviation shock to EPU, and it is common in macroeconomic applications to interpret such a shock as an exogenous, unexpected move in policy uncertainty that can occur for reasons independent of the current trajectory of Real GDP. The VAR framework captures how this shock propagates through subsequent quarters, potentially influencing investment decisions, hiring plans, consumer confidence, and overall demand when firms and households reassess risk and the likelihood of policy changes.

A distinctive feature of this study is the delineation between temporary and permanent shocks to EPU, with the shock structure described as follows:

- Temporary shock: defined as a four-standard-deviation shock in the first quarter (Q1). This characterization implies a dramatic but short-lived spike in policy uncertainty, whose effects may dissipate more quickly as the policy environment stabilizes or as investors adapt to the new information.

- Permanent shock: defined as a four-standard-deviation shock in Q1, followed by a three-standard-deviation shock in Q2, a two-standard-deviation shock in Q3, and a one-standard-deviation shock in Q4. This staged sequence models a scenario where uncertainty remains elevated or gradually intensifies over time, reflecting a more persistent disruption to policy clarity and guidance.

The rationale behind this structured approach is to explore how different horizons and persistence in uncertainty affect the trajectory of Real GDP. By decomposing the shock into a sequence that evolves across quarters, the analysis can shed light on the potential cumulative impact of a lasting uncertain policy environment versus a one-off spike. The interpretation of these results rests on a few important considerations:

- Identification: The assumption is that the EPU shock is exogenous to Real GDP within the model, enabling a causal interpretation of the impulse response for the purposes of macroeconomic analysis. The validity of this assumption hinges on the chosen identification scheme and the data’s properties.

- Horizon and persistence: The quarter-by-quarter shock structure informs how investors, firms, and policymakers might respond to evolving uncertainty, and how those responses feed back into output over time.

- Magnitude and distribution: The four- and three- and two- and one-standard-deviation shock levels provide a framework to examine a spectrum of potential uncertainty realizations, from extreme short-run destabilization to gradually subsiding levels.

Within this methodological framework, the results contribute to a broader understanding of how uncertainty translates into macroeconomic outcomes. The practical interpretation is that even modest shifts in policy uncertainty, when realized as a standard deviation movement aligned with the historical distribution, can produce measurable effects on Real GDP in the near term. The impulse response analysis thus offers a structured pathway to connect the micro-level drivers of uncertainty to macro-level consequences, enabling policymakers, researchers, and market participants to gauge the likely trajectory of output under different uncertainty scenarios.

The methodology also involves careful consideration of data frequency, transformations, and sample period. Specifically:

- Log transformations: The choice to model log Real GDP and log EPU reflects the desire to capture proportional changes and stabilize variance, which is common in macroeconomic time-series analysis.

- Standard deviation units: Using standard deviation as the scale for shocks ensures that results are interpretable in relation to the historical dispersion of the EPU index, aiding cross-period comparability.

- Sample period: The 1985–2024 window provides a long-run baseline that captures a wide range of policy environments, including episodes of rapid policy shifts and periods of relative policy stability.

- Structural notes: The IRFs summarize the response of Real GDP to a policy uncertainty shock, abstracting from other contemporaneous disturbances to isolate the direct channel of transmission.

In summary, the VAR model and IRF framework used in this analysis deliver a coherent narrative about the link between policy uncertainty and real economic activity. By examining both a one-standard-deviation surprise and more extreme but structured multi-quarter shocks, the study offers insight into how uncertainty may influence GDP not only in the immediate aftermath but across subsequent quarters as agents adjust expectations and plans in response to evolving policy signals.

Observational Window, Movement in EPU, and Practical Implications

The observational window for the analysis extends through May and into mid-month data, capturing the most recent developments in the EPU landscape. A salient takeaway is that the natural log of EPU has moved by approximately two standard deviations relative to its historical distribution since February. This substantial shift signals a meaningful deviation from the longer-run average, with potential implications for investment timing, consumer behavior, and business planning. The focus on the May-through-the-13th period provides a snapshot of how uncertainty has evolved as the macroeconomy navigates a phase of heightened policy sensitivity.

From a market perspective, such a pronounced move in EPU typically translates into heightened precautionary behavior. Firms may delay capital expenditures, projects may be reevaluated, and hiring plans could be scaled back or redeployed in ways that preserve liquidity and resilience in the face of uncertain policy signals. Households may adjust consumption in response to potential changes in taxes, subsidies, or regulatory requirements, thereby influencing the near-term demand environment. For policymakers, the observed ascent in policy uncertainty reinforces the importance of clear communication, credible policy paths, and transparent policymaking processes to anchor expectations and reduce unnecessary volatility.

The visualization of EPU over the period—including the daily average (depicted as a blue line in the figure) and the monthly aggregation—serves as a diagnostic tool for interpreting the current macroeconomic stance. The daily data capture short-term fluctuations, including news-driven swings, while the monthly aggregation emphasizes more persistent shifts that are likely to interact with investment cycles and production planning. The juxtaposition of these data streams helps analysts disentangle transitory noise from enduring shifts in the policy environment. In the context of the VAR framework, the movement in log EPU informs the contemporaneous positioning of the system and the anticipated path of Real GDP given the specified shock structures.

In practical terms, the two-standard-deviation move in log EPU is a signal to monitor several macroeconomic channels:

- Investment plans: Firms may revise capital budgets downward or delay projects until policy clarity improves, affecting capital formation and productivity growth in the medium term.

- Hiring and labor demand: Uncertainty can dampen hiring intentions or shift the mix of employment types, with implications for unemployment persistence and wage dynamics.

- Consumption behavior: Households may accelerate or decelerate large purchases, housing decisions, or educational investments in response to anticipated policy changes.

- Financial conditions: Risk premiums, credit spreads, and liquidity considerations can tighten in periods of elevated uncertainty, feeding through to borrowing costs and investment viability.

The seasonal and structural dimensions of uncertainty must also be taken into account. While a short-lived spike in EPU can be absorbed by households and firms, a sustained elevation in policy uncertainty may have a more durable dampening effect on economic activity. The observed upward movement through May 13 should be tracked alongside other macro indicators—notably inflation trends, wage growth, consumer confidence, and credit conditions—to form a holistic view of the macroeconomic trajectory under uncertainty.

Ultimately, the implications of the observed two-standard-deviation shift in log EPU for the GDP outlook depend on how policy expectations evolve in the near term. If policymakers provide credible, transparent guidance and outline a coherent policy path, the volatility associated with uncertainty can subside more quickly as agents adjust to the revised expectations. Conversely, if policy signals remain ambiguous or if new sources of uncertainty emerge, the effects on Real GDP could persist longer, with cumulative consequences across investment, production, and employment. This section thus connects the data-driven observations to practical considerations for business strategy, policymaking, and risk assessment in an uncertain policy environment.

Recession Context and Historical Perspective

A crucial aspect of interpreting the relationship between Economic Policy Uncertainty and Real GDP is situating the current movements within the broader recession context. In the analysis, recession episodes are indicated by shading that marks peak-to-trough downturns. This visual cue helps readers appreciate the macroeconomic backdrop against which EPU fluctuations unfold. Recession dating—while not the sole determiner of the relationship—often aligns with elevated policy uncertainty, as policymakers confront complex challenges, and households and firms adjust their expectations in the face of potential policy shifts and regulatory changes.

Historically, periods of heightened uncertainty have coincided with downturns and periods of slower growth, underscoring the potential for policy signals to influence the pace of economic activity. The inclusion of NBER-style recession shading in the analytical narrative provides a standard reference point for interpreting whether the observed EPU movements are occurring during contraction, expansion, or at the transition between regimes. While the experience of each cycle varies, the underlying mechanism—uncertainty influencing investment, hiring, and consumption decisions—remains a central thread in macroeconomic theory and empirical analysis.

From a modeling perspective, the recession context helps to interpret the impulse response results. If a one-standard-deviation shock to EPU reduces Real GDP by about 0.2 percentage points, this impact may be amplified during recessionary periods when confidence and demand are already fragile. Conversely, during periods of robust growth, the economy might exhibit greater resilience as firms and households absorb higher uncertainty through hedging, diversification, and faster policy normalization. The cross-quarter, structured shock design (temporary and permanent) allows examination of how the economy’s response might change depending on the persistence of uncertainty within a given recession-cycle framework.

The historical perspective also prompts attention to potential structural changes in the relationship between policy uncertainty and real activity. Over the decades, policy frameworks, financial market dynamics, and global spillovers have evolved, potentially altering the transmission mechanism of uncertainty to GDP. Analysts must be mindful of such shifts when comparing current results to historical benchmarks and when projecting how future uncertainty episodes may influence output. The shading of recession periods is a visual reminder that macroeconomic dynamics do not occur in a vacuum; they unfold as part of a complex system in which policy signals, market expectations, and real activity interact in nuanced ways.

In sum, situating the EPU–GDP relationship within recessionary contexts enriches the interpretation of impulse responses and shock decompositions. It underscores the practical relevance of uncertainty as a policy and economic risk factor, and it highlights the need to monitor uncertainty alongside conventional macro indicators to form a coherent view of the business cycle’s evolution.

Data Sources, Reliability, and Limitations

This section delves into the data foundations, reliability considerations, and limitations inherent in measuring the relationship between Economic Policy Uncertainty and Real GDP within the specified modeling framework. The analysis draws on established indicators of policy uncertainty and standard macroeconomic data, assembled over a long historical horizon to reveal both enduring patterns and regime-specific behavior. While the precise data provenance is not enumerated in this narrative, the data are described as representing broad, widely used measures of policy uncertainty and macroeconomic activity, supplemented by expert calculations and standard measurement practices.

Key considerations regarding data quality and reliability include:

- Measurement of policy uncertainty: EPU-type indices are constructed from a combination of news coverage, government policy signals, and other indicators that reflect the degree of uncertainty surrounding policy actions. While these indices are widely used and have demonstrated usefulness in forecasting and structural analysis, they are subject to measurement error, sampling bias, and revisions to underlying signals. The logged form helps stabilize variance and interpret proportional changes more meaningfully.

- Real GDP data: Real GDP is typically compiled from national accounts data and subject to revisions as more complete information becomes available. The log transformation is common in macroeconomic work and facilitates interpretation of percentage changes.

- Sample period: The 1985–2024 window provides ample coverage of different policy regimes, including periods of fiscal stimulus, regulatory shifts, and global economic turbulence. However, no dataset is perfectly stable over time; structural breaks, data revisions, and methodological changes can influence the estimated relationships.

- Frequency considerations: The use of monthly data for the EPU index and the annualized or quarterly aggregation for Real GDP affects the granularity of the impulse response analysis. The VAR framework requires consistent timing across variables, so the chosen frequency balances data quality with the need to capture dynamic interactions.

- Recession dating: The shading of peak-to-trough periods is based on established macroeconomic cycles. While recession dating provides a useful context, it is an interpretive overlay and not a direct input into the impulse response mechanism. The interplay between uncertain policy signals and recession dynamics should be understood as a descriptive rather than a prescriptive assessment of causality.

Limitations and caveats to consider in interpreting the results include:

- Attribution challenges: While the VAR framework can identify associations and dynamic responses, isolating the precise causal impact of policy uncertainty on Real GDP requires careful identification assumptions. The interpretation of impulse responses depends on the assumed exogeneity of the shocks to EPU relative to GDP.

- Nonlinearities and regime shifts: The relationship between policy uncertainty and GDP may exhibit nonlinearities or differ across economic regimes (e.g., high vs. low growth, inflationary vs. disinflationary periods). A linear VAR may not fully capture such dynamics, although it can offer valuable first-order insights.

- External shocks and spillovers: Global developments, financial conditions, commodity price movements, and other exogenous forces can influence both policy uncertainty and macroeconomic outcomes. The VAR analysis focuses on the internal dynamics between log EPU and Real GDP, but real-world outcomes may reflect the interaction with a broader set of drivers.

- Forecasting implications: While the impulse response provides qualitative guidance about the response path to uncertainty shocks, translating these results into precise forecasts requires additional modeling considerations, such as incorporating exogenous policy scenarios, risk premia, and market sentiment.

Despite these limitations, the analysis aims to deliver a coherent narrative about how policy uncertainty interacts with real output in a structured, interpretable framework. The methodological choices—log transformations, standard-deviation-based shock magnitudes, and a clearly defined temporary-versus-permanent shock sequence—are designed to enhance comparability across periods and to offer a transparent basis for exploring uncertainty transmission. Stakeholders can leverage these insights to inform policy discussions, investment strategies, and macroeconomic risk assessments, while remaining mindful of the inherent uncertainty and the evolving nature of policy signals.

Implications for Policy, Markets, and Forecasting

The observed relationship between policy uncertainty and Real GDP carries meaningful implications for policymakers, investors, and forecasters. The key finding that a one-standard-deviation shock to EPU tends to reduce Real GDP by about 0.2 percentage points highlights the macroeconomic significance of policy clarity and predictability. For policymakers, the result underscores the value of transparent communication, credible policy paths, and timely guidance to anchor expectations and reduce unnecessary volatility in investment and consumption decisions. Clear signaling about future policy direction can mitigate the abrupt changes in behavior that often accompany uncertainty spikes, helping to stabilize the demand side of the economy and support a smoother macroeconomic cycle.

Investors and market participants may view EPU as a forward-looking risk factor that affects discount rates, investment valuations, and financing conditions. The link between higher uncertainty and weaker output suggests that risk management strategies should incorporate uncertainty dynamics as a core consideration. This can include scenario analysis that contemplates different uncertainty trajectories, hedging mechanisms to manage exposure to policy-related volatility, and diversified portfolios designed to weather uncertainty-driven fluctuations in demand and earnings. The structured–shock approach—temporary versus permanent—offers a framework for assessing how persistence in uncertainty could amplify or attenuate its macroeconomic effects, providing a basis for stress testing and resilience planning.

Forecasting under uncertainty benefits from incorporating policy signals as a dynamic driver in macro models. The VAR framework used in this analysis demonstrates how a shock to EPU propagates through the economy over successive quarters. Forecasters can use these insights to construct probabilistic projections that account for the potential magnitude and persistence of uncertainty shocks. Such projections are valuable for planning across sectors that are particularly sensitive to policy developments, including manufacturing, capital goods, real estate, and financial services. They also emphasize the importance of monitoring uncertainty indicators alongside conventional economic indicators to refine scenario planning and risk assessment.

From a policy-design perspective, understanding the impact channel from uncertainty to GDP can inform the sequencing and timing of policy actions. For example, credible long-term policy commitments, clear budgetary plans, and unambiguous regulatory timelines may reduce the incentive for firms to alter investment trajectories in response to policy news. Conversely, policies that appear ad hoc or unpredictable could exacerbate uncertainty, further suppressing investment and output during sensitive periods. The results call for a careful balance between necessary policy actions and the communication strategy that accompanies them, with attention to how expectations form and adjust in response to evolving policy landscapes.

In sum, the implications for policy, markets, and forecasting are intertwined. The magnified effect of uncertainty when it persists across quarters underscores the importance of credible communications and clear policy direction. For markets, the findings emphasize the importance of anticipating uncertainty-driven volatility and incorporating uncertainty dynamics into pricing, risk management, and investment decisions. For forecasters, the results highlight the value of incorporating a structured uncertainty channel in macro models and the usefulness of scenario-based analyses to capture a range of plausible outcomes under different uncertainty regimes. These insights collectively contribute to a more nuanced understanding of how economic policy uncertainty shapes the near-term and intermediate-term path of real economic activity.

Conclusion

In summary, the latest examination of Economic Policy Uncertainty (EPU) and its relationship with Real GDP reveals a meaningful and interpretable dynamic. The log EPU has recently moved by roughly two standard deviations from February levels, signaling a notable shift in the policy uncertainty landscape during May through the 13th. When this uncertainty is modeled alongside Real GDP in a VAR framework, the key quantitative takeaway is that a one-standard-deviation shock to EPU tends to reduce Real GDP by about 0.2 percentage points, underscoring the macroeconomic significance of policy clarity and expectation management. The analysis also distinguishes between temporary and permanent uncertainty scenarios by outlining a four-standard-deviation shock in Q1 for temporary shocks and a staged sequence of shocks across Q1–Q4 for permanent shocks, illustrating how persistence in uncertainty can alter the GDP trajectory over multiple quarters.

The recession context, as indicated by shading of peak-to-trough periods, provides a macroeconomic backdrop that contextualizes the uncertainty dynamics. The interpretation of results rests on a robust data framework spanning 1985–2024, with attention to measurement choices, limitations, and the identification of shocks within the VAR structure. Although certain caveats apply—including the inherent measurement challenges of EPU indices, potential nonlinearities, and broader external influences—the findings offer meaningful guidance for policymakers, investors, and forecasters. The overarching message is clear: higher policy uncertainty has tangible adverse effects on output in the near term, and the persistence of uncertainty can amplify these effects across successive quarters. This recognition reinforces the importance of transparent policy signaling, credible policy design, and risk-management practices that account for uncertainty as a core driver of macroeconomic outcomes.