Amid a challenging domestic climate for Thailand, Meemitmak Co Ltd signals resilience and a clear strategic push toward international markets. The company behind Mith, Proad, and Prann perfume brands remains confident that consumer attention to personal appearance will sustain demand for fragrance products even as the local economy encounters headwinds. Meemitmak’s leadership emphasizes a proactive expansion plan intended to diversify revenue streams beyond a domestic base that is currently weighed down by slower growth and cautious consumer spending. At the same time, management acknowledges ongoing macro uncertainties linked to the pandemic’s lingering effects and shifting global demand patterns. This dual focus—strengthening domestic performance while accelerating cross-border sales—frames Meemitmak’s trajectory for the year ahead as it seeks to capitalize on international opportunities while addressing domestic market dynamics. The broader Thai economic backdrop—marked by slower growth, cautious household spending, and a tourism sector grappling with safety and perception concerns—forms an important context for the company’s long-term planning and market prioritization.

Economic backdrop and company outlook

Thailand’s economy this year is navigating a slower trajectory, influenced by a combination of domestic challenges and external pressures. The persistence of the pandemic’s aftereffects continues to weigh on real incomes and consumer confidence, and households are tightening budgets amid rising living costs and cautious credit conditions. In parallel, the tourism sector—the backbone of Thailand’s growth engine in many recent years—faces headwinds from safety concerns and occasional disruption in international travel flows. The kidnapping incident involving a prominent Chinese actor has added to a sense of unease among potential visitors, prompting the government to accelerate reassurance measures and elevate safety assurances for travelers. Against this backdrop, Meemitmak’s founder and chief executive, Juthinat Piyaweerawong, stresses that the company will not be deterred. Rather, he frames the year ahead as a critical juncture to widen international exposure while maintaining a strong foothold in the domestic market. The goal of attracting 35 to 40 million foreign visitors this year remains a bold target that may require a more robust safety and marketing framework to sustain momentum, he notes, but it does not negate the firm’s plan to expand beyond Thailand.

Within this broad context, Meemitmak is pursuing a deliberate expansion into overseas markets this year to diversify revenue streams and reduce dependency on domestic cycles. The company’s portfolio—anchored by Mith, Proad, and Prann perfume lines—serves as a vehicle to broaden its scent profile and capture a wider segment of fragrance enthusiasts across regions. Juthinat has emphasized that consumer demand for perfume products remains strong, driven by the enduring priority that people place on personal grooming and appearance. He argues that, even as the number of foreign tourists fluctuates, demand will respond to tailored distribution strategies and targeted marketing approaches in attractive markets. This stance reflects a belief that the global fragrance market can absorb incremental volumes from Meemitmak, particularly if the company can secure reliable international distribution channels and adequately adapt to local preferences. The management’s stance also highlights a willingness to absorb near-term volatility if it translates into longer-term market share expansion and a more balanced revenue mix.

In parallel with this optimism, Meemitmak’s business model remains anchored in a strong domestic base. The company reports that domestic sales account for about 80% of total revenue, with the remaining share attributed to exports. Of particular note is the reliance on foreign tourists to underpin the domestic revenues: roughly 60% of domestic sales are generated by visitors from overseas markets. This indicates a nuanced domestic dynamic where tourism-driven consumer spending—rather than purely resident demand—plays a significant role in the perfumes category. The geographic composition of domestic demand highlights principal markets in China, Singapore, Malaysia, and countries in the Middle East, underscoring the brand’s resonance with international travelers who shop for fragrance during their Thailand visits. The company’s strategy is therefore twofold: maintain and strengthen appeal to international tourists while growing formal export volumes to new overseas markets. The emphasis on both axes helps cushion Meemitmak against domestic slowdowns and aligns with the brand’s objective of becoming more globally visible.

From a strategic perspective, Juthinat is clear about the company’s posture toward foreign markets. He suggests that a temporary decline in foreign tourist numbers should not derail expansion plans; rather, it should be viewed as a transitional phase that demands sharper distribution reach and more resilient partnerships abroad. The company’s approach to market entry is to actively seek distributors in international markets rather than relying solely on direct-to-consumer channels in new geographies. This distributor-centric model is designed to accelerate market penetration, leverage local expertise, and adapt product offerings to regional preferences. It also aims to create a more predictable revenue pattern by leveraging existing and new partners who can navigate regulatory and logistical complexities in different regions. The emphasis on distribution partnerships fits a broader trend in the fragrance sector where brand-building in new markets often hinges on strong wholesale relationships and reliable supply chains. It also offers Meemitmak flexibility to scale operations in line with market demand and to manage currency and freight risk more effectively by engaging partners with established market networks.

In sum, the Thai economic environment presents both risks and opportunities for Meemitmak. The company’s leadership frames 2025-2026 as a dual-track year: safeguard and optimize domestic performance while laying the groundwork for a substantive international push. This dual focus is designed to preserve the core income from the domestic business, which benefits from high tourist footfall at premium retail sites, while creating a broader global footprint that can absorb fluctuations in tourism demand. The broader macroeconomic ecosystem—where consumer confidence remains a pivotal driver, tourism fluctuations can swiftly alter local demand, and global distribution networks increasingly determine market access—meaningfully informs Meemitmak’s planning horizon. The management’s narrative centers on resilience, adaptability, and a disciplined, market-driven expansion that mirrors the fragrance industry’s realities: slow but steady growth in mature markets, paired with targeted, high-potential entry in fast-growing economies. The aspiration to diversify revenue sources through international markets aligns with both a risk-management framework and a long-term growth ambition that seeks to secure a stable earnings trajectory beyond the domestic cycle.

Domestic portfolio, performance, and store footprint

Meemitmak’s domestic portfolio remains anchored by its Mith, Proad, and Prann perfume lines, which together form the backbone of revenue in Thailand. The domestic market performance reflects a strong preference for fragrance products among consumers who prioritize personal appearance and grooming. Despite the macroeconomic headwinds, the company’s domestic operations display a persistent willingness among Thai buyers to invest in premium and mid-tier fragrance offerings, underscoring the resilience of the category even during cyclical slowdowns. The management stresses that domestic sales represent the majority of total revenue, with 80% of sales generated domestically and 20% from exports. This composition demonstrates a heavy reliance on local demand but also confirms a stable base that Meemitmak can leverage as it scales international outreach. The emphasis on domestic performance does not obscure the strategic importance of foreign tourists in sustaining a meaningful portion of the company’s Thai turnover. Approximately 60% of domestic revenue results from purchases by foreign visitors, a dynamic that illustrates the close linkage between tourism activity and fragrance consumer behavior within the country. The company attributes this pattern to the fact that major tourist hubs attract shoppers who seek premium scents as souvenirs or personal items, thereby reinforcing the synergy between Thailand’s tourism product and Meemitmak’s brand lineup.

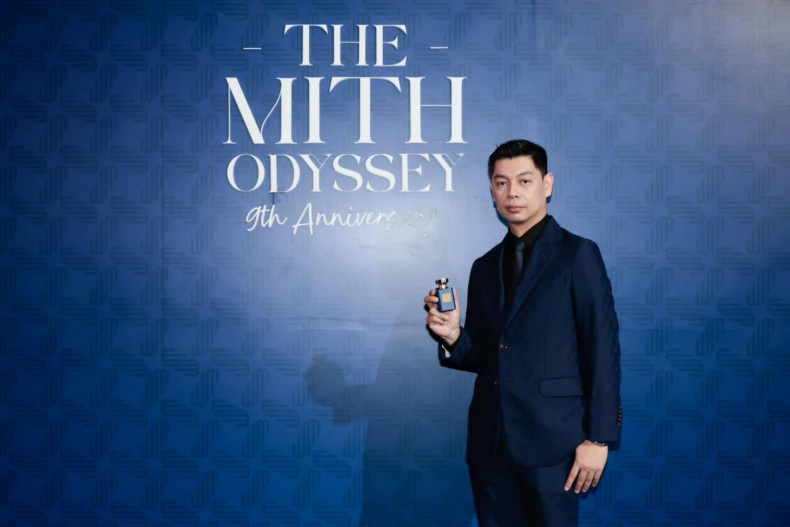

Within the domestic landscape, Mith stores have become a familiar presence in key tourist and retail destinations. Currently, Meemitmak operates 11 Mith stores across the country, with a strategic concentration in high-visibility venues that attract large foot traffic and international visitors. Notably, flagship locations include prominent Bangkok shopping complexes such as Iconsiam and CentralWorld, which are known for drawing both local residents and international travelers. In Chiang Mai, the Maya Shopping Center serves as another important retail anchor, complementing the Bangkok footprint and providing access to a broader regional audience. The store network is designed to maximize exposure in consumer-rich environments, leveraging the appeal of mith-branded fragrances to capture impulse purchases from visitors seeking memorable Thai-made scents. The store portfolio also supports a coherent brand message that aligns with Meemitmak’s international expansion objectives by reinforcing product familiarity among Thai shoppers and foreign tourists alike.

Looking ahead, Meemitmak plans to add one more Mith store within the current year, focusing on Pattaya as a strategic next location. The management’s rationale for Pattaya centers on the city’s unique draw as a tourist magnet with a high incidence of foreign visitors, both domestic and international. The expectation is that the Pattaya store will capture significant domestic demand generated by foreign tourists, complementing the company’s existing coastal and city centers. As part of this expansion, Meemitmak emphasizes a consumer-centric approach, leveraging in-store experiences, personalized fragrance consultations, and exclusive product bundles that appeal to tourists and residents alike. The Pattaya addition is intended to broaden the geographic reach of Mith’s retail network, ensuring that key tourist zones contribute meaningfully to domestic revenue and enhance brand visibility among international visitors who are often on short shopping itineraries but seek unique Thai fragrance products. The strategic rationale for Pattaya also reflects a recognition that tourism patterns can shift with seasonality and global travel trends, hence ensuring that the retail footprint remains adaptable and well-positioned to capture both peak-season surges and steady off-season demand.

In parallel with the store expansion, Meemitmak’s domestic team is intensifying efforts to optimize in-store merchandising, enhance consumer education on fragrance notes and brand heritage, and strengthen loyalty programs that reward repeat visits from both locals and tourists. This approach aims to convert high footfall into higher average basket size, encouraging cross-selling across the Mith, Proad, and Prann ranges. The company’s domestic retail strategy is also complemented by ongoing efforts to curate seasonal collections, limited-edition scents, and co-branded promotions tied to major festival periods and shopping events that attract large crowds. By focusing on a seamless customer experience—from scent discovery to purchase—Meemitmak seeks to foster stronger brand recall and repeated visits, thereby supporting sustained domestic revenue even as the international expansion unfolds. The domestic operations act as a stable anchor for the brand while the expansion into overseas markets fills the growth pipeline with new revenue opportunities. While the domestic footprint is robust, the company remains mindful of the need to balance store openings with profitability, ensuring that each new location contributes meaningfully to overall margins and cash flow.

Overall, Meemitmak’s domestic performance remains solid, underpinned by a well-located retail network, strong tourist footfall in flagship venues, and a steadily growing lineup of fragrance offerings that resonate with a broad audience. The store strategy—especially the planned Pattaya addition—signals a deliberate approach to capturing tourist-driven demand at scale while maintaining a strong presence in Bangkok and other regional hubs. The company’s retail architecture appears designed to optimize visibility, foot traffic, and cross-promotional opportunities across its fragrance lines, positioning Mith as a flagship brand within Meemitmak’s portfolio and laying a robust groundwork for successful international expansion in the coming years.

International expansion plan and target markets

Expanding beyond the home market, Meemitmak has laid out a clear roadmap to penetrate new international markets during the current year. The company’s leadership emphasizes that while the number of foreign tourists may be fluctuating, the core objective remains to extend the brand’s reach into additional geographies and to diversify revenue streams through outbound sales. The expansion strategy centers on establishing partnerships with distributors in strategic markets, enabling the brand to leverage local networks, regulatory understandings, and consumer purchasing behavior to drive growth. By focusing on distributor-led market entry, Meemitmak aims to accelerate access to retailers, e-commerce platforms, and independent stores, thereby unlocking a broader set of channels through which Mith, Proad, and Prann fragrances can reach consumers in different cultural and economic contexts.

A core component of the international push is to raise export sales as a share of total revenue. The company is targeting export sales to rise to 30% of total sales by 2026, up from roughly 20% in the previous year. This trajectory implies a significant shift in the company’s revenue mix and underscores the importance of scalable international demand. To achieve this goal, Meemitmak is concentrating on expanding its export footprint to markets that show early appetite for Thai fragrance products and that offer favorable distribution dynamics. The organization has already established a presence in the United States and Vietnam through dedicated distributors, with the US market currently served by a partner that handles distribution via Glindee.com. This e-commerce and wholesale pathway illustrates the company’s willingness to leverage digital platforms in tandem with traditional wholesale distribution to optimize reach and accessibility in the US market.

In addition to the United States, Meemitmak is actively pursuing opportunities in China, with plans to penetrate the Chinese market within the year. The company is exploring various entry points, including partnerships with regional distributors and potential collaborations with local retailers and online platforms that cater to fragrance enthusiasts in China. The Chinese market represents a large-scale opportunity given the country’s expanding consumer base for premium scent products, albeit accompanied by regulatory and market-specific considerations that require careful navigation. Beyond China, Meemitmak intends to explore potential for entry into the Malaysian and Singaporean markets, assessing the regulatory environment, consumer preferences, and competitive landscape to tailor its approach accordingly. Malaysia and Singapore are viewed as attractive stepping-stones to broader Southeast Asian growth, given their consumer sophistication, strong retail ecosystems, and proximity to flagship markets in the region.

In terms of channel strategy, Meemitmak is deploying a multi-faceted approach that combines traditional distribution partnerships with e-commerce capability. The presence in the US via a distributor that ships through Glindee.com demonstrates the company’s willingness to integrate online marketplaces into its go-to-market model. In addition, the company’s strategy includes leveraging in-market distributors to expand retail presence in other geographies, ensuring that product availability aligns with consumer demand and seasonal purchase patterns. The leadership emphasizes the importance of a reliable and diverse network of distributors to mitigate risks associated with single-channel dependence and to support more sustainable revenue growth over the medium to long term. By prioritizing distributors with established track records in fragrance or cosmetics, Meemitmak seeks to accelerate localization efforts, including adaptions in packaging, marketing messaging, and consumer education that resonate with regional preferences while maintaining the integrity of Mith, Proad, and Prann brand identities.

The expansion into international markets also has implications for the brand’s marketing approach. Meemitmak plans to enrich its global storytelling around Thai fragrance heritage, ensuring that Mith, Proad, and Prann carry a distinctive narrative that appeals to cosmopolitan consumers in new markets. The marketing strategy will likely emphasize the craftsmanship behind Thai perfumery, high-quality ingredients, and the brand’s commitment to delivering perfume experiences that blend tradition with contemporary style. In addition, product assortments may be tuned to local tastes, potentially including limited-edition releases or exclusive packaging that complements regional consumer preferences and gift-giving traditions. The company is investigating opportunities to collaborate with local retailers on in-store events, scent workshops, and experiential marketing campaigns to build brand awareness more effectively and to drive trial among new consumers.

Overall, Meemitmak’s international expansion plan reflects a deliberate, staged approach designed to balance risk with opportunity. The strategy prioritizes the build-out of a robust distribution network across select markets, the optimization of export volumes to achieve the 2026 target, and the integration of e-commerce channels to broaden access points for customers worldwide. The plan also recognizes the importance of tailoring the brand experience to local contexts, including packaging, messaging, and product lineups, while preserving the core identity of Mith, Proad, and Prann as hallmark Thai fragrance brands. While the path to a global footprint will require investments in market studies, regulatory compliance, logistics, and partner management, Meemitmak’s leadership remains confident that an expanded international footprint will yield meaningful long-term earnings growth and greater resilience against domestic economic cycles.

Distributors, channels, and regional opportunities

A central pillar of Meemitmak’s international strategy is the development and diversification of its distribution network across targeted regions. The company already maintains active distributor relationships in the United States and Vietnam, forming the backbone of its early international footprint. In the United States, the company’s distributor channels its products through Glindee.com, an e-commerce and wholesale platform that provides a streamlined route to US-based consumers and retailers. This arrangement illustrates Meemitmak’s willingness to leverage online distribution to maximize reach, particularly in a market where online fragrance sales have grown steadily as consumer shopping habits shift toward digital platforms. The Vietnamese market represents another important foothold, given the growth of e-commerce and the country’s expanding middle class, which is increasingly receptive to premium fragrance offerings. The continued presence in Vietnam signals a strategic test case for distribution efficiency, brand localization, and pricing strategies in a market that sits on the cusp of more accelerated perfume category growth.

Beyond the United States and Vietnam, Meemitmak is actively exploring opportunities in the Chinese market, while also evaluating potential entry points in Malaysia and Singapore. The company’s approach to China focuses on establishing partnerships with regional distributors and identifying opportunities to place Mith, Proad, and Prann within mainland marketplaces that cater to fragrance lovers. Given China’s vast consumer base and rising demand for premium cosmetics and fragrance products, success in China could significantly amplify Meemitmak’s overall export volumes and brand visibility. However, the company recognizes that China’s regulatory environment, consumer preferences, and competition require carefully calibrated market entry strategies and ongoing partnerships that can navigate local channels effectively.

In addition to China, Malaysia and Singapore present attractive expansion opportunities for Meemitmak. Malaysia offers a dynamic retail landscape with a mix of modern trade and e-commerce platforms, while Singapore’s sophisticated consumer base provides a gateway to Southeast Asia’s broader regional markets. Both markets also provide opportunities to test product variations, packaging formats, and marketing messages that resonate with more affluent and educated consumer segments. Entering these markets would involve negotiating distributor agreements capable of delivering consistent product availability, managing inventory across multiple channels, and implementing localized marketing campaigns that highlight Meemitmak’s Thai fragrance heritage and the premium positioning of Mith, Proad, and Prann.

The distributor network strategy is complemented by a focus on direct-to-retail partnerships in strategic markets where Meemitmak can leverage boutique perfumeries, department stores, and specialized beauty retailers. Establishing relationships with retailers that value unique scent experiences and limited-edition releases can help strengthen brand awareness and create high-value touchpoints for customers. The distribution strategy also contemplates collaboration with online marketplaces that suit each target region, ensuring that the brand can meet shoppers wherever they prefer to buy fragrance products. The overarching objective is to build a multi-channel, regionally tailored distribution framework that reduces reliance on any single channel and optimizes product availability, pricing, and promotional activities across varied consumer landscapes.

Meemitmak’s approach to channels includes a balanced mix of traditional wholesale, exclusive in-store experiences, and digital commerce to reach new consumer bases. The company intends to capitalize on the e-commerce economy by leveraging online storefronts, social commerce platforms, and retailer-powered online catalogs to maximize product visibility and accessibility. In parallel, the company plans to deploy targeted marketing campaigns that align with the consumer expectations of each market segment—whether it is a cosmopolitan urban demographic in the United States, a fast-growing middle class in Vietnam, or a discerning fragrance connoisseur in China, Malaysia, or Singapore. By integrating distributor partnerships with a strong e-commerce presence and local marketing efforts, Meemitmak seeks to optimize conversion rates, improve customer retention, and build a sustainable pipeline of export sales that helps achieve the goal of 30% export revenue by 2026.

The regional opportunities for Meemitmak also include the potential for co-branded promotions and strategic collaborations with retailers that align with the Mith, Proad, and Prann fragrance portfolios. Such partnerships could involve exclusive scent launches, limited-edition packaging, or in-store events designed to drive trial and awareness, while also providing retailers with compelling reasons to feature Meemitmak products prominently. Additionally, Meemitmak recognizes the value of compiling market intelligence through distributor feedback, customer surveys, and retail performance data to continuously refine product offerings, pricing, and promotional tactics. In essence, the company’s distributor-centric model is designed to build a resilient global network, enabling relatively rapid responses to changing demand patterns, seasonal fluctuations, and new competitive dynamics as Meemitmak expands its international footprint.

Marketing, branding, and in-market experience

As Meemitmak scales its international footprint, the marketing and branding strategy centers on maintaining the Mith, Proad, and Prann fragrance identities while tailoring messaging to resonate with diverse audiences in new markets. The brand narrative is anchored in Thai craftsmanship and the authenticity of Thai fragrance traditions, positioned to appeal to global consumers seeking premium scents with a distinct cultural story. Marketing campaigns are planned to highlight the brand’s heritage, the quality of ingredients, and the refined sensory experience of the products. By communicating a consistent brand story with localized appeal, Meemitmak aims to build lasting connections with customers who value both quality and cultural significance in their fragrance choices.

In-market experiences form a crucial part of the brand-building exercise. Meemitmak intends to curate experiential marketing activities that immerse customers in the scent journey—ranging from scent discovery sessions and in-store testers to guided experiences that showcase the perfume notes and the story behind Mith, Proad, and Prann. These experiences can be tailored to reflect local preferences, seasonal themes, and gifting occasions that are important in each market. Limited-edition releases, co-branded events with retailers, and partnerships with luxury retailers can amplify brand prestige and generate excitement around new launches. The experiential approach is designed to convert interest into trial, trial into purchase, and purchase into repeat engagement, while ensuring that brand messaging remains coherent across different regions.

From a digital marketing perspective, Meemitmak will likely deploy a mix of search engine optimization (SEO), content marketing, influencer partnerships, and social media activations to drive awareness and online sales. The objective is to create a robust online presence that complements in-store experiences and distributor channels. By optimizing online content for keywords related to Thai fragrance, Mith perfume, Proad perfume, Prann perfume, and Thai cosmetics, Meemitmak can improve visibility in global search results and attract fragrance enthusiasts who are exploring premium Thai fragrance labels. The brand’s digital strategy should also consider region-specific keyword optimization, local language content, and culturally resonant visuals that align with consumer expectations in the markets where Mith, Proad, and Prann will be sold. The ultimate goal is to create a cohesive digital ecosystem that supports brand discovery, product education, and e-commerce purchases across continents.

Co-branding and partnership strategy is another lever for expanding brand reach and credibility in new markets. Collaborations with local fashion houses, beauty retailers, or luxury lifestyle platforms can help Meemitmak position Mith, Proad, and Prann within a broader ecosystem of beauty and fashion, reinforcing the brand’s premium status. Co-branded gifts, exclusive packaging, and joint marketing campaigns could generate additional foot traffic and elevate the perceived value of the fragrance lines. In markets with a strong gifting culture, such collaborations can drive repeat purchases and word-of-mouth recommendations, contributing to sustainable growth. The brand’s affinity with Thai heritage and contemporary design can be leveraged in these partnerships to create a unique value proposition that differentiates Mith, Proad, and Prann from competing fragrance lines in international markets.

Meemitmak’s in-market execution will require close coordination with its distributors and retailers to ensure consistent brand representation, pricing integrity, and timely product availability. Training programs for retail staff, brand ambassadors, and sales teams can help ensure that in-market professionals convey product notes, usage recommendations, and the brand’s value proposition effectively. Education about the fragrance notes, the provenance of ingredients, and the artistry behind Mith, Proad, and Prann can equip sales personnel with the knowledge needed to engage customers and drive informed purchasing decisions. The marketing and branding strategy, thus, blends a global narrative with regionally tailored content and experiential marketing to create a compelling, differentiated fragrance brand that resonates with consumers across diverse markets.

In sum, Meemitmak’s marketing and branding play a pivotal role in its international expansion plan. By maintaining a consistent brand story rooted in Thai perfumery while adapting messaging to local markets, the company intends to build recognition, trust, and preference among fragrance shoppers worldwide. The emphasis on experiential retail, influencer and digital marketing, strategic co-branding, and strong distributor alignment is designed to elevate Mith, Proad, and Prann beyond national borders and into the repertoires of global perfume enthusiasts. The marketing strategy complements the expansion plan by supporting demand creation, channel development, and long-term brand equity in new markets, assisting Meemitmak in achieving its export growth targets and establishing a durable international platform for sustainable growth.

Logistics, risk management, and supply-chain considerations

A successful international expansion requires not only market access but also a robust supply chain capable of supporting multi-market demand. Meemitmak’s strategic planning includes attention to logistics, inventory control, regulatory compliance, and risk management to ensure that product availability aligns with the company’s sales ambitions. The planned growth in export sales to 30% of total revenue by 2026 implies the need for scalable production, accurate demand forecasting, and efficient distribution networks that can respond to fluctuations in order volumes across different markets. The company is assessing its supply chain readiness to ensure that bottlenecks are minimized and that lead times from production to distribution are kept within acceptable bounds. This is particularly important as Meemitmak expands into new markets with different regulatory environments, packaging requirements, and labeling standards that may require local adaptations.

Security of intellectual property and brand protection are also critical considerations in international markets. The company must ensure that Mith, Proad, and Prann branding and packaging remain consistent across channels while safeguarding packaging designs and scent formulations from misappropriation or counterfeit activities. This is especially relevant in markets with heavy perfume counterfeit ecosystems, where ensuring provenance and authenticity can influence consumer trust and willingness to pay a premium. Meemitmak’s risk management framework would likely encompass supplier qualification processes, quality assurance checks, and compliance with local regulatory norms related to cosmetics, fragrance ingredients, and labeling. The aim is to maintain product integrity and brand reputation while delivering a consistent customer experience in every market the company enters.

In terms of distribution logistics, Meemitmak’s approach emphasizes collaboration with established distributors who can handle regulatory clearance, warehousing, and timely delivery to retailers and, where appropriate, direct-to-consumer platforms. The arrangement with the US distributor via Glindee.com demonstrates a model where a third party manages a critical portion of the supply chain, enabling the brand to reach a broad customer base without needing to establish a direct regional arm immediately. Such partnerships require clear service-level agreements, transparent pricing, and reliable performance metrics to ensure that product availability, inventory turns, and order fulfillment meet the expectations of both retailers and consumers. The company’s logistics considerations also include currency risk management, as international sales expose the business to exchange rate fluctuations that could affect pricing and margins. A prudent approach would involve hedging strategies, regional pricing, and robust financial planning to protect profitability amid volatility.

Additionally, supply-chain resilience has emerged as a critical area of focus globally. Meemitmak’s expansion plan will benefit from diversifying suppliers and maintaining backup options for key inputs used in fragrance production, including aroma extracts, solvents, packaging materials, and caps or atomizers. By maintaining multiple sourcing options and monitoring supplier performance, the company can mitigate risks associated with supply disruptions, price spikes, or capacity constraints that could otherwise impact production schedules and delivery timelines. The organization’s risk management discipline encompasses contingency planning, such as maintaining safety stock at regional distribution centers, establishing alternate routes for shipping, and securing insurance coverage for cargo and transit. The goal is to ensure continuity of supply, especially during peak demand periods or when markets in new regions experience surges in orders.

From a regulatory standpoint, Meemitmak must remain compliant with the cosmetic and fragrance regulations in each market. This includes ensuring that product labeling and ingredient disclosures meet local requirements, as well as meeting any certifications that may be applicable to certain distribution channels or retailers. Compliance also extends to packaging and sustainability requirements, where consumers and retailers increasingly value eco-friendly packaging and transparent disclosure of product sourcing. The company’s internal processes should incorporate regular audits and reviews to confirm ongoing compliance and to address any changes in regulations that could affect product viability, labeling accuracy, or market access. Through proactive risk management and supply-chain optimization, Meemitmak aims to sustain smooth international operations, accommodate growth in export volumes, and preserve product quality and customer trust across its expanding global footprint.

People, culture, and governance implications

Meemitmak’s expansion into international markets has implications for governance, organizational structure, and culture. As the company scales, it will need to ensure alignment between its strategic objectives and operational execution across multiple markets, time zones, and regulatory regimes. Strengthening corporate governance and internal controls will be essential to maintaining accountability, transparency, and performance discipline across the expanding organization. The company’s leadership is likely to emphasize a culture of agility, collaboration, and accountability that can adapt to local market conditions while preserving the core values of the brand. A robust governance framework supports sound decision-making as the company enters new geographies and forges partnerships with distributors, retailers, and potential joint-venture allies.

Talent management and capability development will also play an important role in the company’s international journey. Meemitmak will need to attract, retain, and cultivate talent with regional expertise in markets such as the United States, China, Malaysia, Singapore, and Vietnam. This includes capabilities in sales and distribution management, marketing localization, regulatory compliance, and supply-chain operations. Training programs oriented toward product knowledge, customer service excellence, and brand storytelling will help ensure that in-market teams represent Mith, Proad, and Prann consistently across channels. The company’s culture could benefit from cross-border exchanges, with staff rotation or short-term assignments that facilitate knowledge sharing, build a unified brand culture, and strengthen relationships across the distributor network. A globally minded workforce can help Meemitmak achieve coherent customer experiences in varied markets while maintaining a consistent brand voice.

Corporate social responsibility and sustainability considerations are increasingly important in modern business, and Meemitmak’s international expansion plan offers opportunities to integrate responsible practices into operations. The company can pursue sustainable packaging initiatives, ethical sourcing of ingredients, and community engagement programs in key markets. Demonstrating a commitment to environmental and social stewardship can enhance brand reputation and appeal to consumers who value responsible business practices. In addition, Meemitmak can align its CSR initiatives with local community programs in target markets, supporting education, entrepreneurship, or cultural preservation efforts that resonate with regional stakeholders. Such activities can contribute to stronger relationships with retailers and distributors, build goodwill with local communities, and strengthen the brand’s overall value proposition.

Furthermore, financial governance is a critical factor as Meemitmak grows internationally. The company will need robust financial controls to manage cross-border transactions, taxation considerations, and transfer pricing in a way that remains compliant and efficient. Clear budgeting, forecasting, and performance metrics across regions will be essential to monitor profitability and ensure that resources are allocated to channels and markets with the strongest strategic returns. Transparency and accountability in financial reporting will be important to sustaining investor confidence, attracting potential partners, and enabling informed decision-making by management and stakeholders. The governance framework should also delineate clear roles and responsibilities for the leadership team, including oversight of regional managers, distributors, and key retailer partners, to ensure cohesive strategy execution while allowing for local flexibility.

In summary, Meemitmak’s international expansion is not only a business growth initiative but also a governance and people-centered undertaking. The company’s ability to align strategy with operations, develop a capable and culturally aware workforce, and embed sustainable practices into its international footprint will influence the success of its export ambitions. The governance approach will need to balance centralized brand stewardship with local execution, ensuring that the Mith, Proad, and Prann brands remain coherent across markets while adapting in ways that resonate with diverse consumer bases. By prioritizing strong governance, talent development, and responsible business practices, Meemitmak can reinforce its ability to scale globally while preserving the integrity of its brand promise and the quality that customers expect from Thai fragrance products.

Conclusion

Meemitmak Co Ltd enters a pivotal year with a clear dual focus: to maintain a robust domestic platform anchored by its Mith, Proad, and Prann fragrance lines, while actively expanding into international markets to diversify revenue and reduce reliance on Thailand’s domestic cycle. The company’s leadership emphasizes that perfume demand remains strong as consumers continue to prioritize personal grooming and scent experiences, even as macroeconomic pressures bear on the Thai economy. The strategic emphasis on international expansion, anchored by a distributive model and selective entry into key markets such as the United States, China, Malaysia, Singapore, and Vietnam, reflects a disciplined approach to growth that balances opportunity with risk management. Export sales target of 30% of total revenue by 2026, up from approximately 20% last year, demonstrates an ambitious but measured plan to broaden Meemitmak’s global footprint through a combination of established distributors and new partnerships, supported by e-commerce channels like Glindee.com in the US and a broader Southeast Asia strategy.

Within Thailand, Meemitmak’s domestic operations remain a strong foundation, with 80% of total sales generated domestically and roughly 60% of those domestic sales driven by foreign tourists. The current domestic store network of 11 Mith outlets—concentrated in high-traffic tourist areas such as Iconsiam and CentralWorld in Bangkok and Maya Shopping Center in Chiang Mai—will be complemented by a planned new location in Pattaya to capitalize on the influx of foreign visitors and to strengthen the brand’s regional presence. The Pattaya expansion aligns with the insight that foreign-tourist-driven demand contributes significantly to domestic sales, reinforcing the strategic logic of expanding the physical retail footprint in tourist hubs. The overall retail strategy integrates a strong brick-and-mortar presence with a growing emphasis on distributor partnerships and e-commerce to optimize market reach and consumer access.

On the international front, Meemitmak’s plan to broaden its distributor network and pursue entry opportunities in markets such as China, Malaysia, and Singapore reflects a forward-looking stance on global fragrance demand. The company’s relationship with its US distributor, channeling through Glindee.com, illustrates an adaptable distribution approach that blends online platforms with wholesale channels to extend reach and streamline logistics. The expansion into China and Southeast Asia is likely to involve regulatory navigation, packaging localization, and collaboration with local retailers and online marketplaces. These steps are designed to deliver a sustainable growth trajectory by widening the brand’s exposure to new consumer segments and creating a diversified revenue mix that is less susceptible to fluctuations in any single market.

As Meemitmak progresses with its growth agenda, governance and talent development will play a vital role in sustaining performance across multiple markets. The company recognizes the need for strong governance, robust risk management, and a culture capable of aligning global strategy with local execution. Investments in training, brand storytelling, and region-specific marketing are expected to support the successful launch of Mith, Proad, and Prann in new geographies, while maintaining brand integrity and consistent quality. Ultimately, Meemitmak’s international expansion reflects a strategic vision that seeks to augment Thailand’s fragrance industry footprint while delivering long-term value to customers, partners, and shareholders through thoughtful, well-managed growth. The path ahead requires disciplined execution, continuous learning, and a commitment to excellence that can turn Meemitmak’s Thai fragrance brands into enduring global favorites.