Warren Buffett’s provocative proposition from over a decade ago—tying members of Congress’ re-election eligibility to the achievement of a sustainable national deficit—remains a striking illustration of how incentive design can be used to reshape public finance. In a candid, often folksy, interview, Buffett argued that a straightforward legal trigger could reorient the political calculus around fiscal responsibility. He suggested that if the government ran deficits exceeding a small percentage of GDP, sitting lawmakers would become ineligible for re-election. The point was not merely punitive; it was about aligning political career incentives with the nation’s longer-term economic health. Buffett’s broader argument extended beyond a single law: he urged business leaders and the corporate sector to demand greater discipline from policymakers, underscoring the shared stake of private capital and public credit in maintaining a country’s financial credibility.

Beyond the political gambit, Buffett’s commentary translated into a broader critique of Washington’s relationship with the country’s fiscal destiny. He warned that a nation’s creditworthiness is not a private asset that can be gambled with, but a public good that underpins borrowing costs, investment, and long-term prosperity. His metaphor drew a parallel between personal finances and national finances, emphasizing that missed payments or chronic deficits can erode both individual credit scores and a country’s standing in global capital markets. The implication was clear: if the nation refuses to confront structural deficits, the consequences will be felt through higher borrowing costs, weaker investment signals, and a gradual erosion of economic competitiveness.

The moment Buffett spoke also touched on a broader tension between corporate responsibility and public policy. He challenged business leaders to press for fiscal restraint, arguing that safeguarding the country’s long-run creditworthiness is not only the government’s duty but a prerequisite for a healthy operating environment for corporations. This interdependence—between the integrity of the national balance sheet and the health of private enterprise—has long been a theme in economic thought. Buffett’s stance suggested that when the public sector falters, the private sector bears the risk of higher financing costs, diminished demand, and a less predictable macro environment. In short, the proposed mechanism was designed to transfer some of the pain of fiscal correction away from future generations and onto the political class that shapes budget choices today.

The commentary resonated with many Americans precisely because it reframed the deficit debate as a matter of accountability and systemic risk, rather than abstract macroeconomic arithmetic. It pointed to a moment when the nation’s finances were framed as a delicate balance between sustaining credible obligations and maintaining room for investment in growth. The core idea—that deficits matter not only in the present but in their capacity to shape debt service costs and the affordability of government programs—was a call to reexamine priorities. Buffett’s blend of humor, bluntness, and technical insight underscored a widely shared worry: the habitual accumulation of debt without a commensurate plan to stabilize or reduce it threatens both immediate stability and future opportunities.

As the discussion broadened, Buffett’s critique shifted from fiscal policy to the behavior of the broader economy. He drew an analogy between personal credit discipline and the nation’s ability to manage its debt, highlighting that the consequences of fiscal mismanagement can extend well beyond the United States’ borders. In his view, the global financial system is tethered to the United States’ creditworthiness, and a sustained loss of confidence could ripple through capital markets, exchange rates, and international trade. The emphasis was on credibility—an intangible yet pivotal asset that sustains low borrowing costs when it is well maintained and fragile when it is not. His comments blurred the line between policy tools and moral suasion, suggesting that reputational capital matters as much as mechanical policy levers.

Yet Buffett himself acknowledged an irony at the heart of his suggestion. The very people who would be charged with passing a deficit-reducing law—the incumbents facing re-election—would bear political risk if they enacted measures that constrained deficits. The potential conflict of interest was stark: lawmakers might veto reforms that could jeopardize their own political futures, creating inertia that was hard to overcome. This paradox highlighted a fundamental dilemma in democratic governance: how to structure incentives so that immediate political incentives align with the longer arc of national solvency. In Buffett’s telling, such misalignment is precisely what makes bold, rational policy actions so difficult to achieve without clever design.

A longer view of history makes Buffett’s argument more compelling, even for critics who prefer incremental reform. If you map the course of public spending as a share of GDP over extended periods, you often see cycles of expansion followed by periods of retrenchment, tempered by political constraints and the prevailing economic climate. Buffett’s call to action sought to inject a mechanism that would break the cycles of delay, forcing accountability through a tangible consequence. The idea was not to demonize political actors but to reframe deficits as a structural, solvable problem—one that requires serious incentives, credible constraints, and a coalition of public and private stakeholders willing to pursue disciplined budgeting.

What this discourse reveals about the modern financial system is that fiscal health is a public good that protects private wealth and investment capacity. The incentive structure that governs lawmakers matters because it determines the likelihood of timely reform, prudent budgeting, and credible policy commitments. Buffett’s proposal is a provocative reminder that the federal budget is more than a ledger; it is a living signal about the country’s willingness to honor commitments, risk tolerance, and future opportunities for citizens and businesses alike. In that sense, the debate around deficit reduction is as much about the psychology of policy as it is about arithmetic.

In summation, Buffett’s alternative legal design aimed at aligning political incentives with fiscal responsibility underscores a central truth: debt dynamics are a shared risk that crosses partisan lines and economic sectors. The underlying message is not merely about cutting the deficit for its own sake, but about preserving the nation’s financial credibility, ensuring sustainable access to capital, and safeguarding the conditions that enable enterprise to thrive. Whether one agrees with the specifics of his proposal or prefers a more gradual approach, the underlying concerns—credibility, accountability, and the long-run health of the economy—remain central to any meaningful discussion of U.S. fiscal policy.

Section 1: Buffett’s Deficit Fix and the Political Economy of Incentives

Warren Buffett’s deficit cure, though couched in a provocative, almost blunt format, invites a deeper exploration of how incentive design can influence public finance. The central premise rests on the idea that political self-interest, when aligned with macroeconomic objectives, can be redirected toward disciplined budgeting. By linking re-election eligibility to the threshold of deficits relative to GDP, Buffett effectively proposed a rule intended to rewire the cost–benefit analysis that lawmakers perform when they cast votes on spending, tax policy, and debt issuance. The logic is straightforward: if government leaders know that persistent overspending could jeopardize their political survival, they might be more inclined to pursue reforms that bring deficits down and restore confidence in the nation’s fiscal trajectory.

This proposition sits at the intersection of public policy and behavioral economics. It recognizes that human beings do not act as abstract fiscal agents; they operate within incentives, reputations, and electoral incentives that can either accelerate or hinder reform. The suggestion presumes that the political system rewards long-term stability and credible commitments, or that at least it can be reframed to do so through institutional design. The potential benefit, in Buffett’s framing, is a more predictable and sustainable fiscal path—one that reduces the risk of sudden, disruptive debt shocks that could degrade the economy’s long-run growth prospects and undermine private investment.

Yet the irony of the idea lies in its very premise: the same set of actors who would be charged with enforcing such a law would be the ones most exposed to the political risk of doing so. In other words, the policy tool is elegant, but its effectiveness depends on a deep, structural willingness to accept electoral consequences for collective national health. The conflict of interest is not inconsequential; it is a fundamental barrier to reform that has persisted in various guises for generations. Even so, Buffett’s argument spotlights the critical role of political accountability as a lever for fiscal discipline.

From a policy design standpoint, the concept invites a broader question: what other incentive-compatible mechanisms could be deployed to reduce deficits without imposing abrupt political costs? One avenue could be performance-based budgeting, where departments demonstrate measurable efficiency gains and productivity improvements tied to funding levels. Another approach might be to tie debt reduction targets to explicit policy reforms, such as entitlement reform, tax code simplification, or changes in mandatory spending. The underlying aim would be to create a clear, externally verifiable link between policy choices and their long-term consequences on debt and creditworthiness. Buffett’s proposal, in its stark simplicity, underscores the value of thinking creatively about how to structure incentives so that political behavior is nudged toward sustainability rather than short-term expediency.

The broader public finance literature already contains several varieties of incentive-based reforms, each with its own strengths and trade-offs. Some models emphasize automatic stabilizers that kick in during downturns to prevent deeper recessions, while others advocate for rules-based frameworks that commit policymakers to future fiscal targets independent of political pressure. Buffett’s framing belongs to this family of rules-based thinking, albeit with a distinctive political twist: a direct consequence for incumbents if deficits exceed a predetermined benchmark. The debate around such rules is not purely academic. It matters for households facing higher borrowing costs, for businesses deciding whether to invest domestically, and for international partners assessing the reliability of the U.S. debt contract.

An essential dimension of the discussion concerns the nature of the deficit itself. Some observers view deficits through a lens of investment in future productivity—spending on infrastructure, education, and technological innovation as a means to lift long-run growth. Others see deficits as moral and economic hazards that accumulate compounding interest, crowding out essential public goods and eroding trust in the government’s ability to meet its obligations. Buffett’s argument leans toward the latter: deficits are not inevitable or purely mechanical; they reflect choices about priorities, governance, and the durability of institutions that stand behind the promise to repay debt. The policy implication is that if deficits persist, a credible and enforceable framework is required to restore fiscal balance and protect the country’s standing in global markets.

A sometimes-overlooked facet of Buffett’s critique is its appeal to business leaders as co-stakeholders in national solvency. If the private sector holds substantial claims on government debt—either directly through bonds or indirectly via financial institutions and pension funds—then the health of the corporate economy is inseparable from the health of the public sector’s finances. The expectation is that corporate governance and investor stewardship would push for political reforms that maintain the country’s credit rating and debt affordability. In this sense, Buffett’s stance is not a critique of capitalism; it is a plea for a more disciplined alignment between the incentives that govern markets and those that shape public policy.

The discourse around deficits also invites consideration of time horizons. Short-run political cycles reward immediate outcomes, while the costs of mismanaged debt accumulate over decades. Buffett’s proposal reframes the debate by insisting that the political system must internalize these longer horizons. If lawmakers cannot or will not consider the long-run consequences of continued deficits, then a mechanism—whether the proposed re-election constraint or another instrument—must be found to ensure the country does not drift into a scenario where debt service crowds out essential public goods. The logic is not about punitive governance; it is about safeguarding a durable, credible framework within which families, businesses, and communities can plan with greater confidence.

Another layer to Buffett’s argument concerns the credibility of the government’s fiscal commitments. In a world of global capital markets, credibility translates into lower interest rates, steadier exchange rates, and predictable macroeconomic conditions. A deficit that becomes chronic can threaten this credibility, leading to higher borrowing costs and greater volatility. Buffett’s emphasis on accountability aligns with the broader literature that ties policy credibility to macroeconomic stability. While the specific mechanism he proposed may face practical challenges in a complex political landscape, the underlying sentiment—America must protect its creditworthiness by constraining deficit growth through credible, enforceable rules—resonates with a deep-seated concern about long-run economic resilience.

In the end, Buffett’s deficit fix serves as a thought experiment with enduring relevance. It reframes the deficit narrative from a partisan battleground into a question of institutional design and shared responsibility. Whether one endorses the exact policy proposal or favors alternative incentive structures, the core message remains: fiscal health is inseparable from political accountability, market confidence, and the capacity of institutions to act in ways that safeguard the nation’s future. The discussion invites a broader contemplation of how best to align incentives, reap the benefits of disciplined budgeting, and sustain the U.S. economy’s productive potential for generations to come.

Section 2: The Debt Trajectory, Spending, Revenue, and Consequences

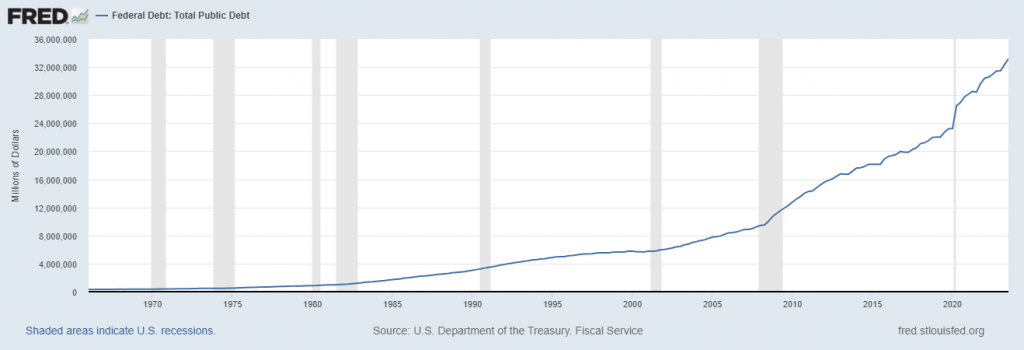

The United States has witnessed a long-running divergence between spending outlays and tax receipts, a gap that has grown larger over time and assumed new dimensions as policymakers grapple with demographic shifts, technological changes, and geopolitical pressures. The macro story is one of rising outlays—especially in mandatory programs, interest on debt, and recent emergency expenditures—versus revenue streams that, while substantial, have not kept pace with the increasing cost of obligations. When this gap remains persistent, it culminates in deficits that must be financed through new borrowing, creating a feedback loop in which debt service grows as a share of the budget, crowding out other important priorities and injecting greater volatility into the economy.

To understand the magnitude of the challenge, one must look at the latest data on federal outlays and revenue. Government spending has hovered at historically elevated levels relative to the size of the economy, underscoring the sheer scale of the commitment required to sustain public programs. Revenue, primarily sourced from individual income taxes, payroll taxes funding Social Security and Medicare, and corporate taxes, provides the core funding stream for these activities. Yet the structural trajectory suggests that even with revenue near peak levels, the growth of outlays—particularly interest payments on debt and large entitlement commitments—could outpace revenue growth, leaving policymakers with a difficult balance to strike.

In this environment, the federal budget has repeatedly shown a gap between what the government takes in and what it spends. When expenditures exceed revenue by a wide margin, the government must borrow to fill the void, which in turn compounds the national debt. This debt growth is not merely a numerical scorecard; it has real implications for households, businesses, and the broader economy. Higher debt service costs can divert resources away from productive investments such as infrastructure, education, and innovation, which are central to long-run growth. Over time, the compounding effect of interest payments can become a material constraint on fiscal flexibility, limiting policymakers’ ability to respond to future shocks or to fund capital projects that support competitiveness.

Holders of U.S. government debt are diverse, reflecting a broad base of domestic and international investors. The debt is held by foreign governments, central banks, private-sector financial institutions, pension funds, corporations, wealth holders, and individuals. Each category of holder has its own implications for risk, diversification of demand, and the transmission of policy changes. The breadth of ownership helps cushion the system against sudden shifts, but it also introduces a level of complexity in assessing vulnerability to shifts in global sentiment, currency movements, and monetary policy.

An important structural feature of the debt landscape is the relationship between debt issuance and the demand for Treasuries in the market. In recent periods, there have been episodes where primary dealers and even the Federal Reserve have purchased portions of Treasury auctions beyond what traditional market participants would have absorbed. These outcomes can signal various dynamics: evolving investor risk appetites, changes in foreign exchange reserves, or strategic posture from monetary authorities. When government financing relies on a larger share of non-traditional buyers or on central bank balance sheets, there are concerns about how sustainable the debt path is and what it means for price discovery in bond markets, as well as for the trajectory of interest rates and inflation.

The numbers at the heart of the current debate are stark. In a given fiscal year, the government can collect trillions in revenue, but outlays may exceed this intake by nearly one or two trillion dollars. The deficit thus represents the amount that must be borrowed to close the gap, and the appetite for debt issuance depends on a variety of factors, including interest rates, inflation expectations, and global demand for dollar-denominated assets. When deficits remain persistent, debt as a share of GDP tends to rise, and this relationship can become self-reinforcing. The higher the debt burden, the more pressure there is for higher interest rates, inflation expectations, and a potential reassessment of the dollar’s role in global finance.

The macroeconomic implications of a rising debt load extend beyond the numbers on a balance sheet. A higher debt service bite can crowd out key priorities, reducing funds available for long-term investments in areas like science, education, and infrastructure. This effect can dampen potential productivity gains and weigh on future growth potential. In scenarios where debt levels become unsustainable, the economy faces the risk of lower confidence, more volatile markets, and tighter credit conditions, particularly for sectors requiring substantial capital investment. These dynamics are especially acute during periods of economic weakness, when deficits may widen just as tax revenue falters, potentially creating a downward spiral that policymakers must actively manage.

From a practical perspective, the interplay between spending and revenue underscores several critical policy questions. How should the government prioritize mandatory spending versus discretionary programs? What is the appropriate balance between social insurance programs and other government functions? How should tax policy be designed to maximize revenue without unduly burdening economic activity, while ensuring that capital markets remain solvent and efficient? Each question has political, social, and economic dimensions that must be weighed carefully, transparently, and with a recognition of the long-run implications for growth, competitiveness, and resilience.

One of the enduring debates among economists and policymakers concerns the distributional consequences of debt-driven policy choices. When deficits are financed by debt rather than by higher taxes or spending cuts, there can be a shift in the burden across generations. Future taxpayers may bear the cost of today’s borrowing through higher taxes, reduced services, or both. The social contract embedded in the federal budget thus comes into focus: how do we preserve intergenerational equity while ensuring that present needs are adequately addressed? The answer is not simple, and it requires a careful blending of stabilization policies, structural reforms, and credible commitments to reduce deficits over time.

The trajectory of debt also has important implications for financial markets and investment. If markets begin to price in a higher risk of fiscal unsustainability, borrowing costs could rise, which would in turn affect consumer and business spending. The chain reaction could lead to slower growth, lower investment, and a less dynamic economy. Conversely, credible steps toward reducing the deficit and stabilizing debt could restore confidence, steady interest rates, and support for long-term investments. The challenge is to identify and implement policy measures that maintain security and predictability in a way that preserves both the ability to fund current needs and the potential for future growth.

A practical takeaway for readers is that the debt narrative is not merely an abstract policy issue; it directly touches households through taxes, inflation, interest payments, and the availability of government services. The choices policymakers make today about spending restraint, revenue generation, and debt management shape the economic environment in which families save, borrow, and invest. In this sense, the deficit story is, at its core, a story about priorities, governance, and the courage to pursue a sustainable path even when the politics of reform are difficult. It is a reminder that the integrity of the budget is a public currency that underpins financial stability, and that maintaining it requires ongoing vigilance, transparency, and accountability from both policymakers and the communities they serve.

As we assess the current moment, the debt trajectory remains a central test for economic governance. The path forward will require balancing the imperative of funding critical public goods with the discipline needed to prevent debt from exceeding the capacity of the economy to sustain it. Whether through reforms, targeted spending adjustments, or revenue enhancements, the goal remains the same: to preserve the country’s creditworthiness, protect savers and investors, and ensure that the United States maintains a robust foundation for growth and opportunity.

Section 3: Debt Funding, Market Dynamics, and Currency Implications

The mechanics of how the U.S. government finances its debt illuminate a complex ecosystem in which the political, financial, and monetary institutions intersect. Debt issuance, the behavior of primary dealers, the role of the Federal Reserve, and the broader demand for Treasuries collectively determine the cost and availability of financing for government operations. In recent periods, there have been episodes where traditional buyers did not fully absorb the debt offered in auctions. In several instances, the remaining pieces have been taken up by primary dealers or by the Federal Reserve itself, representing a sizable portion of the total offering. This pattern raises important concerns about the depth and resilience of regular market demand for government securities, and what it implies for interest rates, inflation, and the stability of funding.

The market dynamics surrounding Treasury auctions are a barometer of investor sentiment toward risk, inflation expectations, and the perceived credibility of fiscal policy. When demand from conventional market participants appears to wane, the government may rely more heavily on the central bank or on specialized financial institutions to complete the debt issuance. The implication is not simply a technical imbalance; it signaling a potential shift in the transmission mechanism through which monetary policy influences the broader economy. If the central bank becomes a more active or persistent buyer of government securities, questions arise about the independence of monetary policy, the inflation outlook, and the potential for moral hazard in debt markets. Market participants watch these dynamics closely because they color expectations for future inflation, the path of interest rates, and the degree of volatility that investors must endure.

Beyond the mechanics of auctions, the broader reality is that the debt burden interacts with exchange rates and global capital flows. A government that relies on weaker currency dynamics to manage debt obligations introduces a set of winners and losers across sectors. On the one hand, a depreciating currency can make exports more competitive and improve the current account balance, at least in the short run. On the other, a weaker currency erodes the purchasing power of domestic consumers, raises the cost of imported goods, and fuels inflationary pressures that can undermine household welfare and business investment. The policy challenge is to balance these competing effects in a way that protects the real incomes of citizens while preserving the country’s economic standing in the global arena. The outcome depends on a delicate mix of fiscal discipline, monetary policy, and market confidence.

The interconnection between debt sustainability and currency strength is not incidental. When a country accumulates large amounts of debt, investors scrutinize the capacity of the domestic economy to generate growth, maintain fiscal credibility, and foreign exchange resilience. If confidence erodes, flows of capital may slow, the currency may weaken, and the cost of servicing debt in domestic currency could rise in a way that compounds the problem. This cardio of policy signals—fiscal discipline, monetary credibility, and currency stability—forms a triad that investors use to calibrate risk. The synergy among these tools can either stabilize the macro environment or amplify imbalances if one leg of the triad weakens.

The debt story has broader implications for savers and households. Rising debt service costs can tilt the allocation of resources away from productive investments toward interest payments, a shift that can dampen long-term wealth creation and the ability to finance education, housing, and retirement security. Households with variable-rate debt or with exposure to inflation-sensitive assets may experience more pronounced effects as policy responses evolve. In this context, prudent savers and investors seek strategies that mitigate risk while preserving the capacity to participate in growth opportunities. This involves a careful assessment of asset allocations, inflation hedges, and risk management approaches that align with a rising debt burden and an uncertain interest rate environment.

From the policy perspective, the funding mechanism for debt raises questions about the most effective role for the Federal Reserve in managing the economy. The question is whether the central bank should operate as a passive balancer of liquidity or take a more active stance to anchor inflation expectations and support debt financing. The line between monetary policy and fiscal policy can become blurred when large-scale debt issuance interacts with the central bank’s balance sheet. The challenge is to maintain a clear mandate and avoid unintended consequences that could destabilize markets or undermine confidence in the currency. A coherent strategy requires careful coordination between fiscal planning and monetary stewardship to preserve price stability, financial market integrity, and sustainable growth.

The broader lesson for investors is that debt management is not a purely political exercise; it is a complex financial ecosystem with real implications for returns, risk, and financial planning. The health of the bond market, the behavior of key institutions, and the trajectory of macroeconomic policy all feed into investment decisions. A disciplined approach to risk—one that acknowledges the possibility of evolving debt dynamics, potential shifts in demand for Treasuries, and the prospect of currency depreciation—is essential for any strategy seeking to protect and grow wealth over time. In an environment where debt levels are rising and some market participants appear to be stepping in to absorb issuance, the prudent course is to remain vigilant about the structural drivers of inflation, the credibility of fiscal commitments, and the long-run consequences of debt accumulation for financial stability and economic opportunity.

In practical terms, this means monitoring signals from policy institutions, assessing the sustainability of debt trajectories, and evaluating the risks and rewards of different asset classes under various macro scenarios. It also means recognizing that the currency implications of debt policy matter to ordinary households—import prices, energy bills, and the cost of living are all tethered to the strength and reliability of the currency. The interplay of debt, market demand, and currency stability is therefore not an abstract debate; it is a lived experience for millions of people who rely on predictable prices, stable employment, and a sound financial system to secure a future for themselves and their families.

Toward a more sustainable path, policymakers must balance the imperative to fund essential programs with the need to sustain a credible and resilient debt trajectory. The question is not simply whether deficits will shrink in the near term but whether the framework guiding fiscal decisions will be capable of delivering long-run stability without undermining economic growth or market confidence. As markets absorb and respond to new information, the consistency and clarity of policy commitments will play a crucial role in shaping outcomes and in guiding households, firms, and investors through a period of transition that could define the country’s economic course for years to come.

Section 4: Inflation, Deflation, and Policy Trade-offs: Projections and Scenarios

The current macro landscape is characterized by a tug-of-war between inflation pressures, the pursuit of stable growth, and the fiscal realities of mounting debt. Tax revenue remains the primary source of government income, yet it is inadequate to fully cover the rising costs of spending, especially as the debt service burden grows. The tension between preserving purchasing power for households and maintaining incentives for investment under a high debt load creates a delicate policy balance. In this context, inflation and policy choices become central to the story of how the United States navigates its fiscal path.

A key driver behind these dynamics is the structure of federal revenue. Individual income taxes constitute a substantial portion of the tax base, followed by payroll taxes financing Social Security and Medicare, with corporate taxes contributing a smaller share. The larger the deficit, the more dependence on future revenues becomes essential for financing the ongoing functions of government. When the economy slows, tax receipts may decline, exacerbating the deficit and prompting policymakers to consider inflationary or monetary remedies to bridge the gap. This is where the policy dilemma becomes acute: inflation can erode household purchasing power but may also reduce the real value of debt, a dynamic that complicates the moral calculus of debt management.

From a historical vantage point, inflationary policy has often served as a double-edged sword. Moderate inflation can reduce the real burden of debt and support nominal economic activity, yet it also erodes the real incomes of savers and retirees, distorts price signals, and complicates long-run planning for households and businesses. The risk of deflation, while less likely in many scenarios, remains a dangerous possibility if demand collapses and debt burdens become unmanageable in real terms. The policy challenge is thus to maintain price stability and credible growth, while ensuring debt dynamics do not overwhelm fiscal space or distort investment incentives.

The fiscal year 2024 provided a concrete snapshot of the mismatch between revenue and spending. Revenue hovered around the mid-trillions, with expenditures pushing beyond that level, creating a multi-trillion-dollar deficit that must be financed. The scale of the gap underscores the need for a disciplined approach to budgeting, as well as thoughtful consideration of revenue reforms, efficiency improvements, and strategic reductions in nonessential or less productive spending. In this context, debt sustainability emerges as a core objective, not only for macroeconomic stability but also for preserving social programs, infrastructure investment, and the essential services that underpin citizen welfare.

Interest payments on the national debt present a growing constraint on fiscal policy. As the debt burden expands, the share of the budget devoted to servicing that debt grows, diminishing the capacity to fund other priorities. Historically, the trajectory of interest costs has been a reliable predictor of future fiscal pressure. If interest rates rise or if the debt continues to expand, the cost of financing could escalate even in periods of moderate economic growth. The risk is that high interest payments crowd out critical investments in areas such as education, research and development, and infrastructure, eroding the economy’s long-term potential and reducing competitiveness on the global stage.

Given these dynamics, the policy conversation naturally gravitates toward a range of scenarios, each with distinct implications for inflation, unemployment, and growth. A baseline scenario might assume continued moderate growth, persistent but manageable inflation, and gradual progress toward deficit reduction through a combination of spending discipline and revenue enhancements. A more cautionary scenario could envision slower growth, higher inflation expectations, and a more aggressive stance from policymakers aimed at restoring balance, possibly including structural reforms to entitlement programs, changes in tax policy, or targeted spending cuts. A worst-case scenario would consider a sustained deterioration in confidence, a loss of demand, and a debt trajectory that requires abrupt adjustments to avoid a destabilizing collapse in the credit markets or currency value. Each scenario carries different risk profiles and different implications for households, businesses, and global investors.

What remains central across all scenarios is the centrality of credibility and the durability of policy commitments. Without a credible plan to stabilize debt, control inflation, and support sustainable growth, the economy could drift toward a path of higher volatility, weaker investor confidence, and a more unpredictable macro environment. The credibility of the currency and the willingness of markets to absorb new debt at reasonable costs depend on transparent policy choices, consistent implementation, and a credible commitment to fiscal reform. In this sense, the long-run health of the economy hinges on a careful balancing act—one that honors the needs of today’s citizens while preserving the conditions for future generations to prosper.

For households and investors, the implications of inflation, deflation, and policy choices are tangible. Prices for everyday goods and services, mortgage costs, and long-term savings all respond to shifts in inflation expectations and the real return on investments. A disciplined approach to asset allocation that hedges against inflation risk while maintaining exposure to growth opportunities can help preserve purchasing power over time. Investors may look to diversified portfolios, inflation-linked instruments, and strategies designed to navigate volatility, while policymakers work to maintain the delicate balance between stabilizing prices and supporting productive investment.

The overarching takeaway is that there is no one-size-fits-all solution to the inflation–growth–debt trilemma. Instead, policymakers must pursue a coherent, multi-faceted strategy that blends prudent spending decisions, credible tax policy, and thoughtful reforms aimed at increasing productive capacity. The long-run outcome will depend on the ability of leaders to translate complex macroeconomic dynamics into concrete policies that preserve the stability and vitality of the economy, while protecting households from the worst effects of inflation and debt.

Section 5: Artificial Intelligence in Trading: A New Paradigm for Navigating Turbulent Markets

In the modern financial landscape, the role of artificial intelligence (AI), machine learning, and neural networks has evolved from novelty to necessity for a large segment of traders. Rather than relying on gut instinct or traditional rule-based heuristics, sophisticated AI systems process vast streams of market data in real time, identify subtle patterns, and translate them into actionable trading signals. The importance of this shift lies not in the idea that human judgment becomes obsolete, but in the enhanced ability to detect and react to market dynamics with speed, consistency, and a level of breadth that humans alone cannot achieve.

Advanced AI trading systems work by learning from historical data, continuously updating their internal models as new information arrives, and adapting to regime changes in the market. By building a feedback loop—where every trade, win or loss, is used to refine future decisions—AI can work toward reducing errors and capitalizing on persistent trends. In an environment characterized by noise, complexity, and rapid shifts in sentiment, AI offers a path to more repeatable and disciplined decision-making. Traders can leverage AI to filter out distractions, identify robust opportunities, and implement systematic strategies that align with measurable risk controls and defined performance targets.

One of the key advantages of AI-driven trading is its capacity to quantify and manage risk through precise, data-driven methods. Unlike human decision-makers who may be influenced by cognitive biases or emotional reactions, AI systems apply statistical and probabilistic frameworks to estimate the likelihood of different outcomes. This enables traders to calibrate exposure, optimize position sizing, and adhere to predefined risk limits even in highly volatile markets. The disciplined risk management enabled by AI can reduce the incidence of outsized losses and improve the consistency of returns across cycles.

Beyond risk management, AI can enhance the ability to recognize market structure and trend dynamics that can be difficult to discern through traditional analysis. By processing multiple data streams—price, volume, order flow, macro indicators, news sentiment, and more—AI systems can detect converging signals that suggest favorable opportunities. This multi-dimensional view helps traders avoid overreliance on any single factor and supports a more robust decision-making framework. The result is a more resilient approach to navigate the complexities of modern markets, where correlations shift, and information asymmetry can be pronounced.

The integration of AI into trading does not come without risks or caveats. The performance of AI systems is contingent on the quality of data, the design of the models, and the assumptions embedded in their training. There is also the potential for model overfitting, where a system performs well on historical data but struggles in real-time conditions. Therefore, risk controls, ongoing validation, and governance are essential components of any AI-driven trading program. Traders must be vigilant about data integrity, model drift, and the possibility of unprecedented market events that fall outside the historical distribution.

From a practical perspective, AI is transforming how traders think about opportunity and risk. It shifts the emphasis from chasing a single, perfect forecast to building adaptable systems that can identify and exploit favorable patterns across different market regimes. This approach aligns with the reality that markets are dynamic, with periods of trending behavior interspersed with sudden reversals and regime changes. AI can help traders remain responsive to these shifts, recalibrate expectations, and adjust strategies accordingly, rather than clinging to outdated paradigms.

The appeal of AI in trading also intersects with broader technological advances, including the application of reinforcement learning, which enables models to learn optimal actions through trial and error in simulated environments. This technique can help traders explore a wider array of strategies and refine their approach without exposing capital to unnecessary risk. Complementary methods, such as neural networks and ensemble learning, can provide more robust predictions by aggregating insights from multiple models, smoothing out volatility in any single approach. Taken together, these tools offer a powerful framework for navigating markets that are increasingly influenced by rapid information flow, complex interactions, and evolving macroeconomic drivers.

For readers seeking to understand the practical implications, the takeaway is that AI is shifting the baseline expectations for trading performance. It is not a guarantee of profits, nor is it a ticket to effortless wealth. Rather, it represents a sophisticated, data-driven approach that can improve the odds of success when combined with prudent risk management, sound capital allocation, and a clear understanding of market dynamics. The reality is that the markets remain a zero-sum game where discipline and information advantage matter; AI offers a new and highly effective way to cultivate those advantages in a structured, repeatable manner.

Investors may consider incorporating AI-enabled tools into their own decision-making processes, while also maintaining a robust framework for evaluating the quality and resilience of these systems. The most successful practitioners blend human judgment with machine intelligence, ensuring that the algorithms inform, rather than replace, critical assessment and strategic planning. In a world where information is abundant and speed matters, AI can be a meaningful catalyst for achieving more consistent performance, aligning with a core objective of preserving capital and pursuing sustainable gains in the face of uncertainty.

In summary, artificial intelligence is not a speculative add-on to trading—it is a foundational capability that enables a more disciplined, data-driven approach to navigating complex markets. The combination of real-time analysis, pattern recognition, risk management, and adaptive learning positions AI as a transformative force in modern finance. For those willing to adopt a thoughtful, well-governed implementation, AI can help traders stay ahead of the curve, capitalize on meaningful trends, and reduce the likelihood of catastrophic mistakes in a volatile, rapidly evolving environment.

Note: This section discusses techniques and concepts associated with AI-based trading. It is essential to understand that trading involves substantial risk, including the potential loss of capital. Potential participants should engage in due diligence, only deploy capital they can afford to lose, and seek professional guidance where appropriate. Historical performance is not indicative of future results, and there is no guarantee of profits from any trading strategy, automated or otherwise.

Section 6: Conclusion

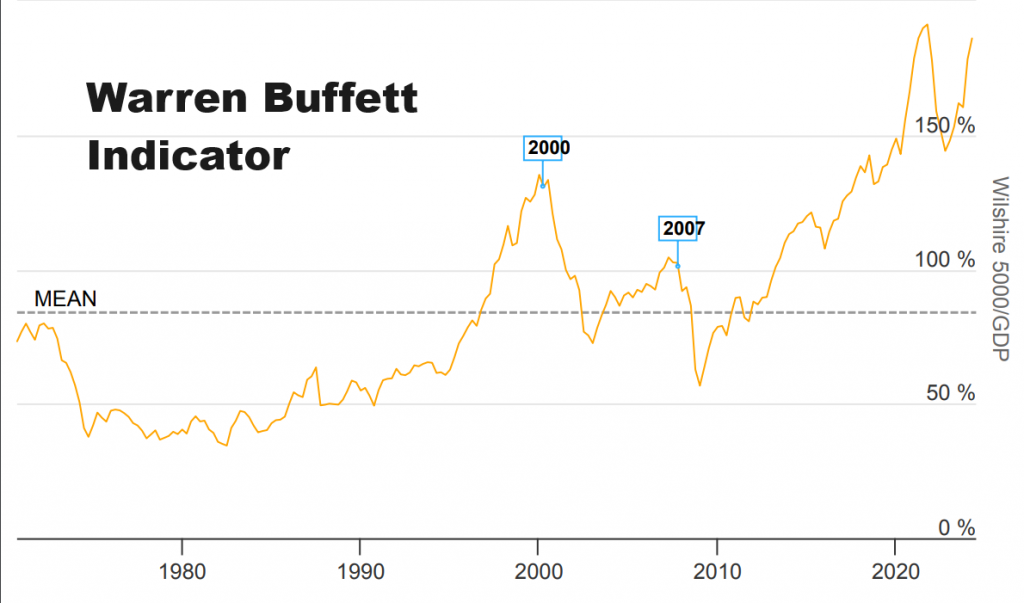

The threads woven through Buffett’s deficit proposal, the trajectory of federal debt, the mechanics of debt funding, the inflation–deflation trade-offs, and the emergence of AI-driven trading together illuminate a complex tapestry of fiscal policy, market dynamics, and investment strategy. The central insight is that debt sustainability is not a peripheral issue; it is a core determinant of economic stability, public trust, and the environment in which households and businesses operate. The effectiveness of policy choices depends on a combination of credible commitments, disciplined budgeting, and a willingness to address structural drivers of spending and revenue. When deficits persist and debt service climbs, the entire economy bears the burden through higher financing costs, reduced investment capacity, and greater exposure to macro shocks. The challenge is to reconcile the immediate needs of governance with the long-run imperative of maintaining fiscal credibility and macroeconomic stability.

From Buffett’s provocative call to action to the sober evaluation of debt indicators and market dynamics, the overarching message is one of accountability and strategic foresight. The health of the public balance sheet matters because it underpins the confidence that households, businesses, and international partners place in the U.S. economy. A credible plan to manage deficits, reduce the cost of debt, and maintain a resilient currency is essential to ensuring that capital markets function smoothly, that inflation remains contained, and that the path toward sustainable growth remains available. The policy conversation should be anchored in transparency, evidence, and a shared commitment to safeguarding the country’s economic future for generations to come.

In a world of rising debt and evolving financial technology, investors, policymakers, and citizens alike are called to engage with sophistication, discipline, and prudence. The instincts that drive speculative bets must be balanced with risk-aware strategies and robust risk management frameworks. The future of fiscal sustainability depends on choices made today—between spending priorities, revenue reforms, and the design of incentives that encourage prudent behavior in both public and private sectors. The lesson is not that debt is inherently dangerous, but that the path toward manageable debt requires deliberate policy design, credible commitments, and a steadfast focus on the long-term health of the economy.

Ultimately, the road ahead will test the collective ability to align political incentives with economic realities, to balance the impulse to promote growth with the imperative to maintain fiscal discipline, and to harness new tools—such as AI—without losing sight of the fundamental need for prudent risk management and human judgment. The goal remains clear: protect the integrity of the currency, preserve investor confidence, and create conditions under which innovation, opportunity, and prosperity can flourish for all Americans. The story is ongoing, and its outcome will hinge on the steady, informed actions of leaders, communities, and markets working in concert toward a more stable and prosperous economic future.